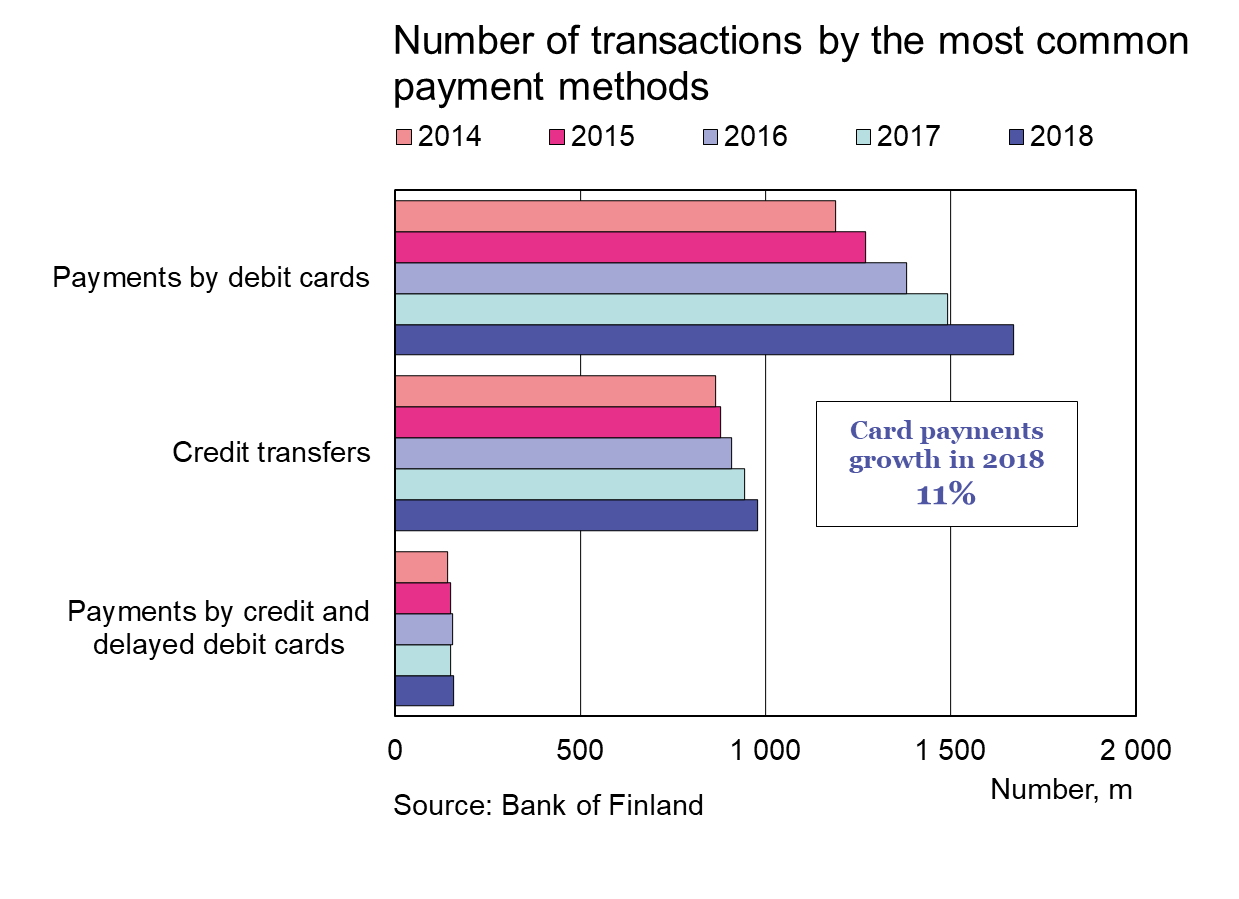

In 2018, a total of approximately 2.9 billion payments were made from Finnish bank accounts. The combined share of card payments and credit transfers was 96% of the total.1 The popularity of card payments continued strong growth, and the use of the contactless payment function in particular increased significantly during the year. In value terms, however, most of the money moved in credit transfers, which increased 9.8% in euros from the previous year. At the same time, the use of cash continued to fade, as reflected by a reduction in the number of cash withdrawals. In 2018, cash withdrawals from ATMs in Finland amounted to €11.4 billion. The amount of cash withdrawn from ATMs has decreased by more than a fifth between 2014 and 2018.

On average, a Finn used a card once a day in 2018.

The majority of purchases are paid with a debit function of a card

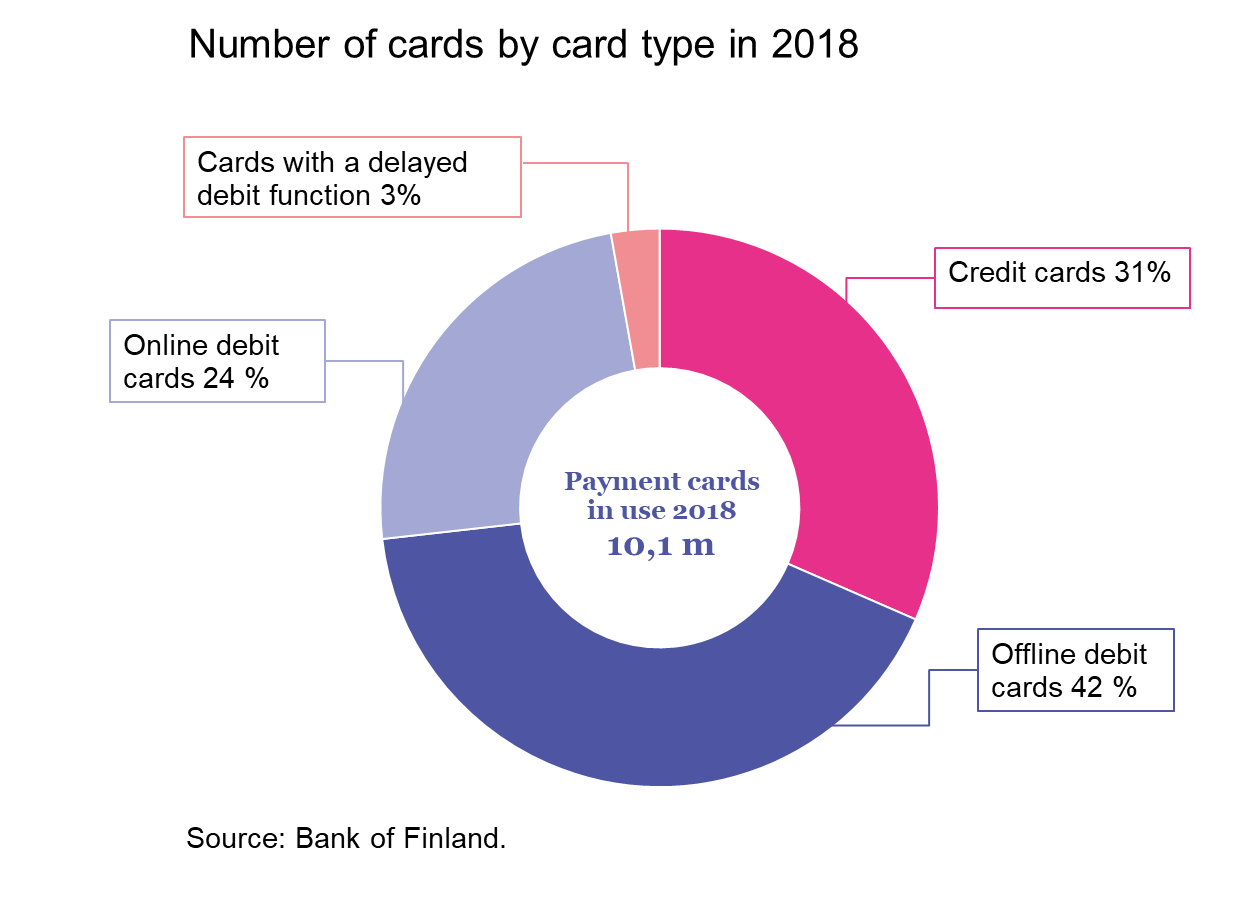

At the end of 2018, there were over 10 million payment cards in use in Finland. Slightly less than a third of them were combination cards including both a debit function and a credit or delayed debit function. The cards were used to pay 1.8 billion times during the year, which was 11% more than in 2017. On average a Finn used a card once a day in 2018. In value terms, card payments amounted to over €51 billion last year, and an average card payment was €28.

At the end of 2018, 80% of cards included the contactless payment function.

Debit card payments remained the most common payment method, accounting for 91% of all card payments in 2018. Although cards are the most popular payment method in Finland, paying with credit card has not increased to any significant degree in recent years. In terms of the number of payments, credit cards were used relatively little in comparison to debit cards, but the average value of a credit card payment was more than double the debit card payment.

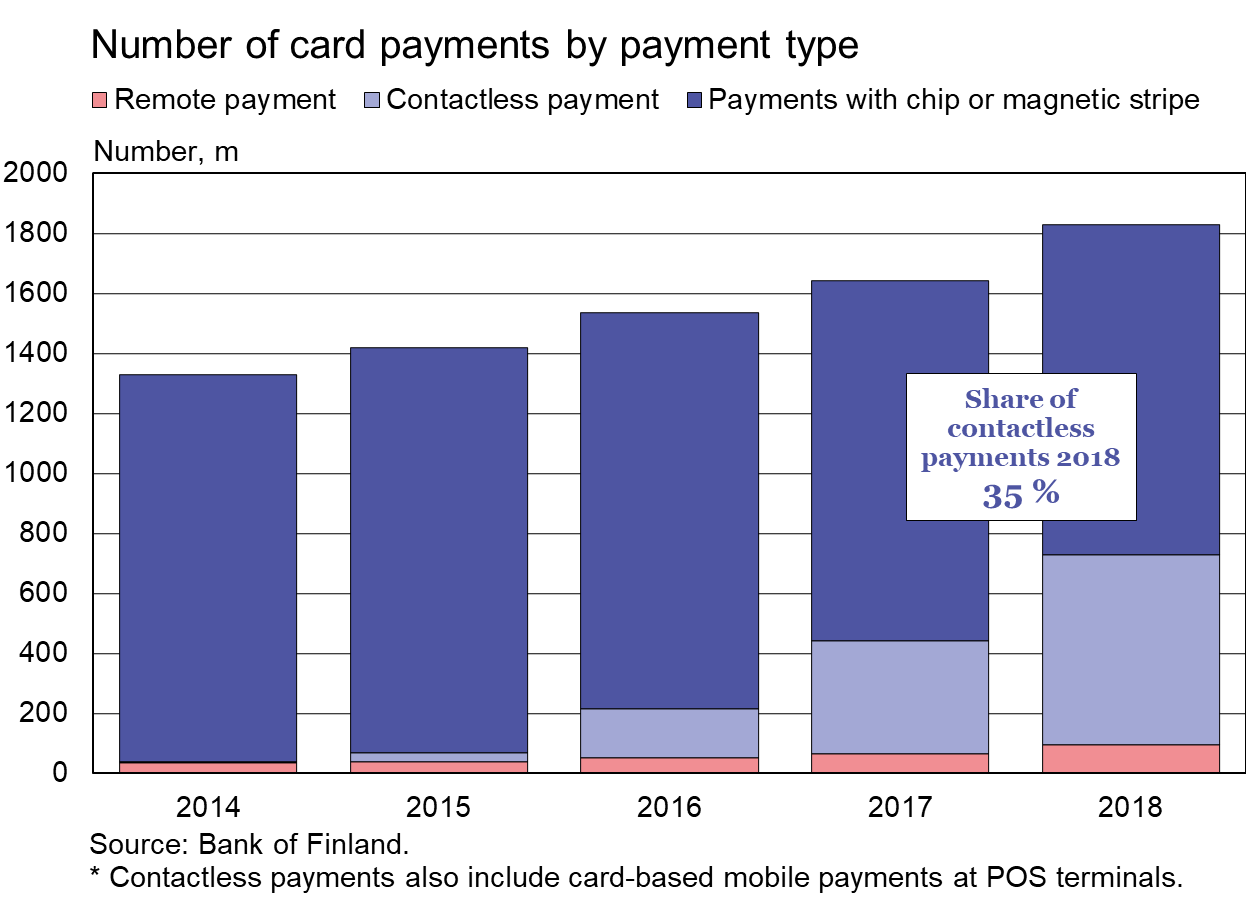

Over a third of card payments were contactless

At the end of 2018, 80% of payment cards already included the contactless payment function. The contactless payment function was used a record-high 632 million times during the year, which was 68% more than a year earlier. In 2018, the contactless payments accounted for 35% of all card payments, but traditional payments with a chip or magnetic stripe remained the most popular payment method by Finns. However, their share of all card payments has decreased from 97% to 60% between 2014 and 2018. The value of contactless payments almost doubled from the previous year, to stand at over €5.7 billion in 2018. The upper limit of contactless payments was raised to €50 in April 2019, which is likely to increase the popularity of contactless payments further.

The use of cards for online payments increases rapidly

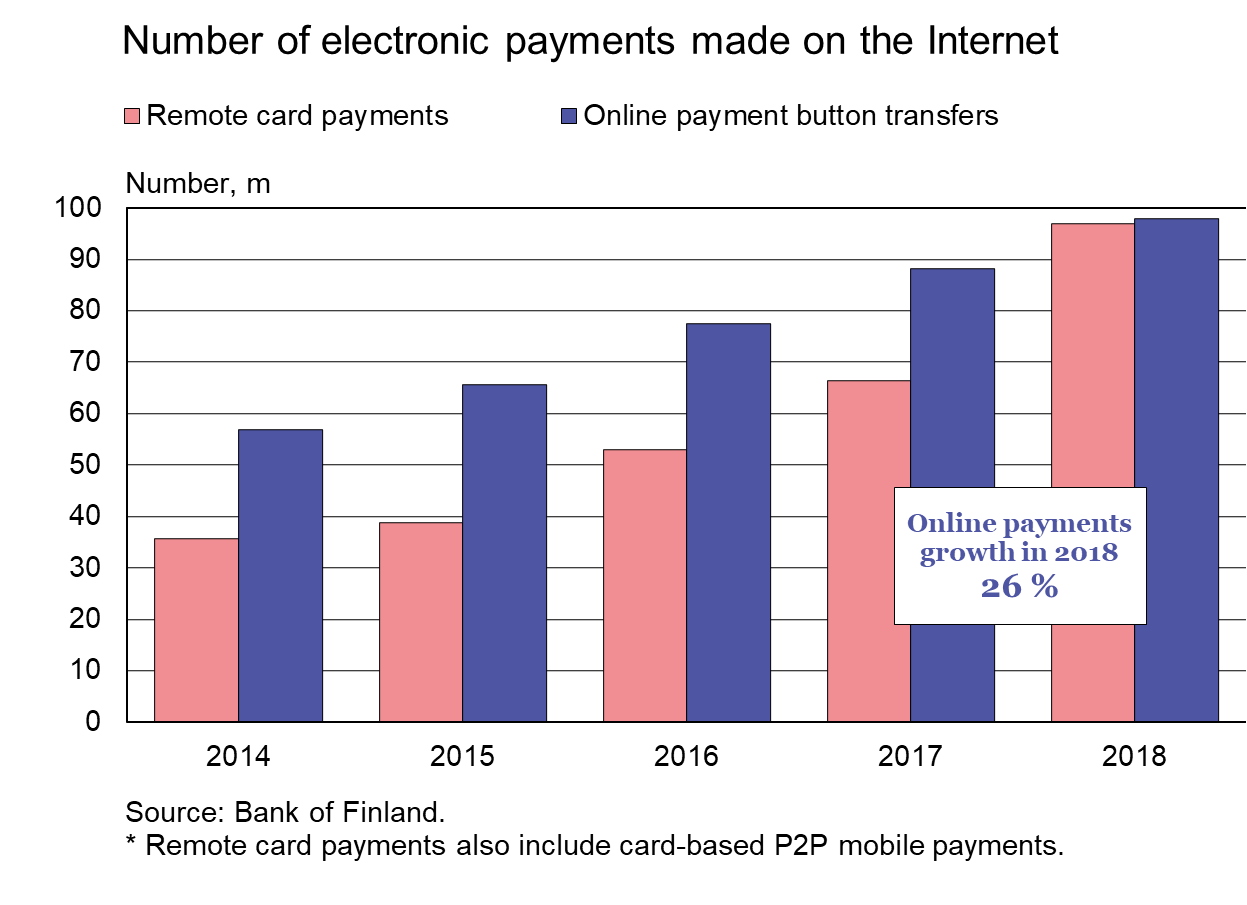

In addition to contactless payments, card payments initiated remotely2 increased significantly last year. Finnish cards were used to make 97 million remote card payments during the year, approximately 30 million more than in 2017. They accounted for slightly over 5% of all card payments in 2018. The number of card payments initiated remotely is also increased by person-to-person mobile payments.

The revised Payment Services Directive (PSD2) will change paying online next September.

Although paying by card on the Internet is becoming more common, the majority of online purchases in value terms are still paid with the online payment button, i.e. credit transfers authenticated with online banking IDs. These payments amounted to €7.8 billion in 2018, which was almost 70% of the total value of e-commerce payments.

The number of authentications using online banking IDs (Tupas) also continued to increase. The Tupas service was used to authenticate customers 125 million times in 2018, and the number has more than doubled over the last five years. The revised Payment Services Directive (PSD2) will change paying online from next September onwards. The Directive requires strong customer authentication in online purchases, and it remains to be seen how this will affect the development of means of payment and identification methods in the future.

For more information please contact:

Meri Sintonen, tel. +358 9 183 2247, meri.sintonen(at)bof.fi

1 The remainder of the payments consist of direct debits, debits from the accounts by simple book entry (such as banks’ service charges), money remittances, cheques and e-money transactions.

2 Remote payment refers to a payment transaction initiated via the Internet or a device used for distance communication.