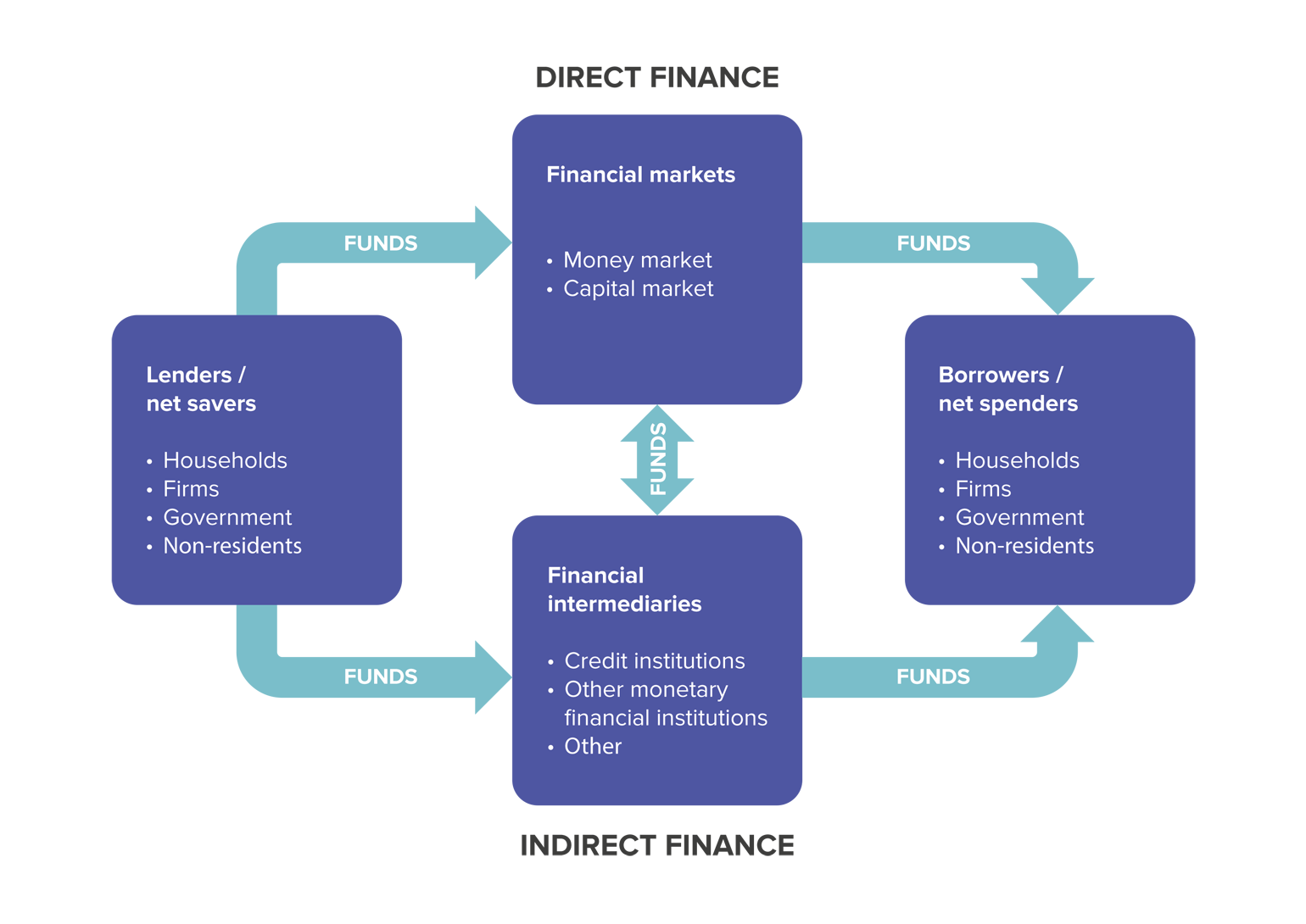

The financial system performs the essential economic function of channelling funds from those who are net savers (i.e. who spend less than their income) to those who are net spenders (i.e. who wish to spend or invest more than their income). In other words, the financial system allows net savers to lend funds to net spenders.

Funds are intermediated by banks and other credit institutions, and directly via financial markets through the issuance of securities. An efficient allocation of funds, together with financial stability, contribute to economic growth and prosperity.

The most important lenders are normally households, but firms, public entities and non-residents may also lend out excess funds. The principal borrowers are typically non-financial corporations and government, but households and non-residents also sometimes borrow to finance their purchases.

Funds flow from lenders to borrowers via two routes. In direct or market-based finance, debtors borrow funds directly from investors operating on the financial markets by selling them financial instruments, also called securities (such as debt securities and shares), which are claims on the borrower’s future income or assets. If financial intermediaries play an additional role in the channelling of funds, one refers to indirect finance. Financial intermediaries can be classified into credit institutions, other monetary financial institutions and other financial intermediaries, and they are part of the financial system.

One of the key features of a well-functioning financial system is that it fosters an allocation of capital that is most beneficial to economic growth. Well-functioning financial systems do not easily drift into financial crises and can perform their basic tasks even under difficult financial conditions.

The infrastructure of the financial system refers to payment and settlement systems, through which financial market operations are concretely carried out. A smooth and reliable functioning of payment and settlement systems promotes effective capital movements in the economy and thereby supports financial stability.

financial intermediation

THE Bank of finland's role

One of the Bank of Finland's statutory task is to act with a view to maintaining and developing stable, reliable and efficient financial and payment systems in Finland.

The Bank aims to identify risks to financial stability and contribute to the prevention of financial crises. As a means of achieving these objectives, the central bank conducts refinancing and payment operations, analyses threats to financial stability, including system weaknesses, and participates in systems development and the preparation of policy measures to prevent financial crises. The Bank of Finland cooperates closely with other supervisory and regulatory authorities. Safeguarding the stability of the financial system – macroprudential supervision – is thus a shared responsibility.