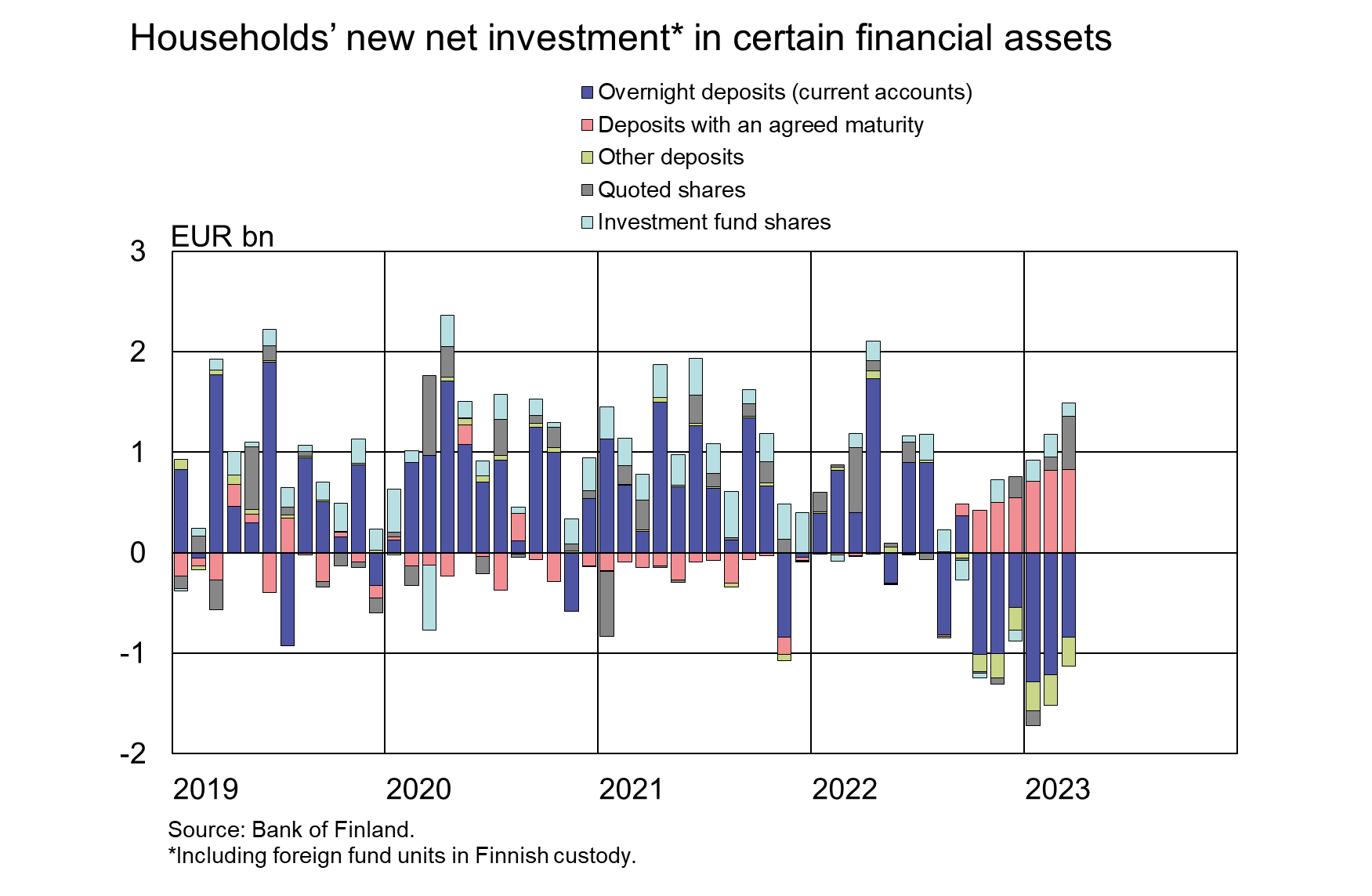

In the wake of rising interest rates, the popularity of deposits with an agreed maturity has grown among Finnish households. During the first quarter of 2023, households made new deposits with an agreed maturity totalling almost EUR 3 billion, as opposed to only EUR 165 million in the same period a year earlier. In March 2023, the average interest on households’ new deposits with an agreed maturity rose to 2.40%, having stood at 0.41% in the same period a year earlier.

The stock of households’ deposits with an agreed maturity (EUR 6 billion) has grown fast in recent months. In the first quarter of 2023, the stock grew by EUR 2.4 billion. At the end of March 2023, deposits with an agreed maturity accounted for 5.5% of the whole household deposit stock (EUR 109.9 billion). In March, most (90%) of households’ deposit assets was held on current accounts (overnight deposits), with an average interest of 0.39%.

Popularity of short-term funds has increased

As regards fund types, most (EUR 213 million) of Finnish households’ net subscriptions in the first quarter of 2023 was made in bond funds.[1] Within the bond fund category, net subscriptions in short-term funds[2] were EUR 211 million and in long-term funds EUR 2 million. In addition to new investments, the value of bond funds appreciated by EUR 143 million in the first quarter of 2023. In 2022, households’ redemptions from bond funds clearly exceeded the new subscriptions. In addition, bond funds’ value declined in 2022.

Bond funds are households’ second-most popular fund investment type after equity funds. At the end of March 2023, households had EUR 8.2 billion of investments in bond funds, EUR 1.1 billion of which in short-term funds. In total, household had investments worth EUR 31.2 billion in Finnish investment funds and an additional EUR 5.5 billion in foreign investment funds.

In the first quarter of 2023, households also invested a further EUR 101 million in bonds. During the period of low interest rates, households’ debt security holdings decreased significantly. At the end of the March 2023, households had EUR 1.3 billion of debt security holdings.

| Finnish deposits and investments (EUR million), 2023Q1 | ||||||

| All | Households | Employment pension schemes | ||||

| stock (flows) | change in valuation | stock (flows) | change in valuation | stock (flows) | change in valuation | |

| Finnish investments | ||||||

| Listed shares | 210 486 | 3 925 | 47 077 | 142 | 34 944 | 1 029 |

| (2 383) | (520) | (-586) | ||||

| - in domestic shares | 130 930 | -106 | 41 606 | -274 | 17 163 | -181 |

| (912) | (415) | (162) | ||||

| Bonds | 224 498 | 1 147 | 1 349 | 8 | 29 760 | 88 |

| (9 691) | (101) | (2 110) | ||||

| - in domestic bonds | 103 638 | 823 | 803 | 5 | 4 171 | 40 |

| (1 761) | (105) | (354) | ||||

| Fund shares | ||||||

| Domestic investment funds | 109 267 | 2 484 | 31 187 | 773 | 5 151 | 100 |

| (755) | (423) | (-12) | ||||

| Foreign funds | 166 411 | 1 074 | 5 503 | 185 | 123 836 | 179 |

| (3 470 ) | (141) | (2 125) | ||||

| Finnish bank deposits | ||||||

| Overnight deposits (transaction accounts) | 177 758 | -85 | 98 562 | -7 | 5 389 | -5 |

| (-9 590) | (-3 340) | (-1 682) | ||||

| Other deposits | 17 611 | -4 | 11 360 | 0 | -* | -* |

| (2 067) | (1 466) | -* | ||||

* confidential

For further information, please contact:

Markus Aaltonen, tel. +358 9 831 2395, email: markus.aaltonen(at)bof.fi,

Antti Hirvonen, tel. +358 9 183 2121, email: antti.hirvonen(at)bof.fi.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/statistics2/.

The next news release on saving and investing will be published at 10 am on 10 August 2023.

[1] Investment funds registered in Finland incl. money market funds.

[2] Incl. money market funds.