CARDS AND CREDIT TRANSFERS ARE THE MOST COMMON PAYMENT INSTRUMENTS

Payments by card and credit transfers, in particular, are the preferred electronic payment instruments in Finland.1 Most payments were executed by cards, which were used more than 1.4 bn times in 2015. Meanwhile, there were just under 880 m credit transfers. In value terms, however, the most popular payment instrument was the credit transfer. About EUR 2,700 bn worth of credit transfers were effected in 2015. The value of card payments was somewhat more than EUR 44 bn. Compared with 2014, the number of card payments increased by just under 7% and the total value of card payments by more than 3%. As for credit transfers, the development was more moderate in 2015, with no significant changes observed on the previousyear.2

The use of cheques and direct debits is very limited in Finland, and the use of cheques continued to decline significantly in 2015. National direct debits were eliminated by February 2014 in the context of SEPA migration. Cash withdrawals at ATMs totalled somewhat less than EUR 14 bn, and the average value of a cash withdrawal at ATMs was EUR 102. At the end of 2015, there were 1,525 ATMs with a cash withdrawal function and 515 ATMs with a credit transfer function in Finland.

CARDS WITH NFC FUNCTIONALITY ARE BECOMING INCREASINGLY POPULAR

In Finland, there were approximately 9.5 m cards in circulation at the end of 2015, and the cards often combine the cash withdrawal, debit and credit functions. The number of cards with Near Field Communication (NFC) functionality had more than doubled, year-on-year, to a total of about 3.8 m cards. Payments by cards with NFC functionality accounted for approximately 2% of the number of transactions in 2015. However, the number of transactions was more than eight times the 2014 figure.

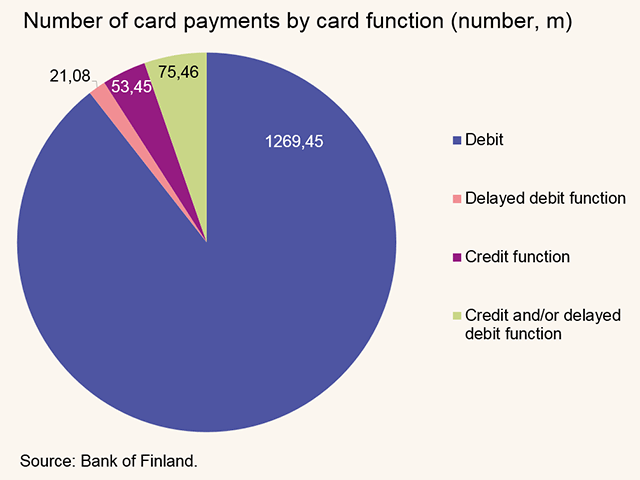

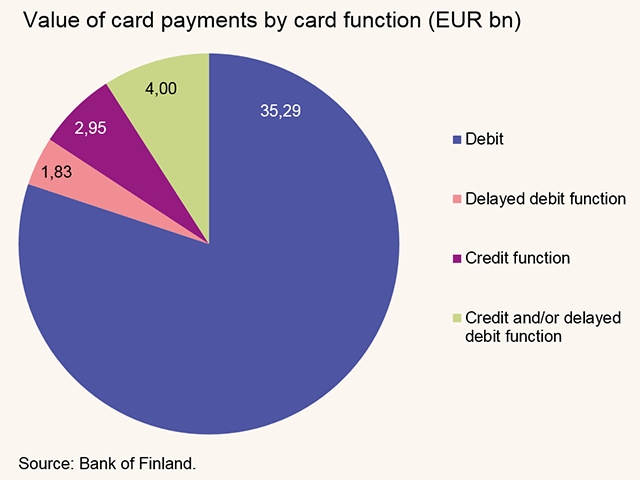

Nearly 90% of card payments were executed by debit card. At the same time, the value of credit card transactions accounted for about 20% of the total value of card payments. Consequently, the average value of payments made by credit card was significantly higher than that of payments made by debit card. The relative use of debit and credit cards remained almost unchanged compared with 2014.

Cards were used more than 85 m times to make or send payments abroad,3 and the value of these transactions was approximately EUR 4.2 bn. Card payments made abroad or sent abroad accounted for around 6% of the total number of card payments and around 10% of the total value of card payments. The total number and value of card payments made or sent abroad both increased by considerably more than for domestic card payments. Total card payments made abroad or sent abroad grew by more than 17% in number of transactions and by about 16% in value terms. The number of domestic card payments increased by about 6% and the corresponding value by more than 2%. The bulk of card payments made abroad or sent abroad focused on European Union countries.

DEVELOPMENT OF ONLINE SHOPPING IS REFLECTED IN PAYMENTS STATISTICS

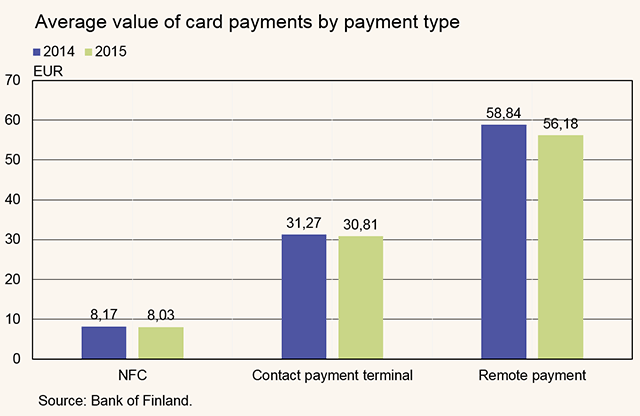

In 2015, nearly 39 m of card payment transactions were effected as remote payments, which is slightly less than 3% of all card payments. However, this represented growth of approximately 9% on the 2014 figure. Remote payments are card payments executed without the presence of a physical point-of-sale payment terminal, e.g. over the telephone or the Internet. The average value of remote payments was slightly over EUR 56, whereas the average value of card payments made via traditional point-of-sale payment terminals was about EUR 31.Online purchases can also be paid using, among other things, a website payment button (online banking). In 2015, more than 65 m payments were made using website payment buttons. This represented growth of approximately 15% on the 2014 figure. The value of a payment made using a website payment button was EUR 72, on average. The value of payments effected remotely and using website payment buttons totalled almost EUR 7 bn.

MOST CROSS-BORDER CREDIT TRANSFERS WERE SENT TO ESTONIA, GERMANY AND SWEDEN

The vast majority of credit transfers sent in Finland, 99%, were executed between domestic accounts. These comprised of about 871 m transactions.

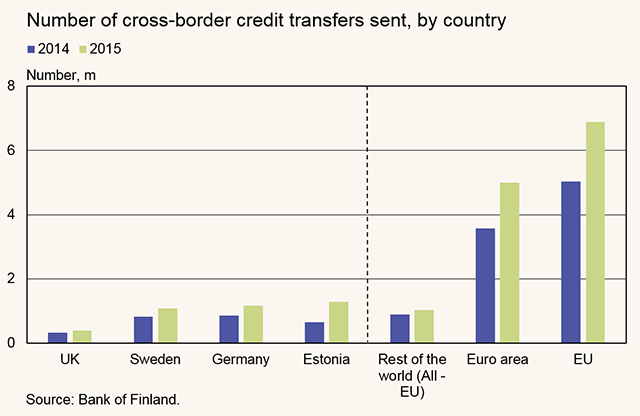

In 2015, slightly more than 7.9 m cross-border credit transfers were sent from Finland. Even though cross-border credit transfers sent from Finland accounted for just under 1% of the total number of credit transfers executed in Finland, the value of these credit transfers represented significantly larger share of the total value of credit transfers.

Most cross-border credit transfers in 2015 were sent to Estonia, Germany and Sweden. As regards SEPA credit transfers, cross-border payments were most frequently transmitted to Estonia, Germany and the Netherlands, whereas the bulk of payments via correspondent banks went to Sweden, the United Kingdom and Germany. Most payments via correspondent banks were denominated in the euro, the US dollar and the Swedish krona.

1The statistics comprise payment transactions related to customer business, as offered by credit and payment institutions. Therefore, they comprise of payment transactions initiated by companies and private persons. Payment transactions between financial institutions are not included.

2The revised reporting framework for payments statistics led to reporting problems in 2014 data in respect of the category non-SEPA credit transfers. Data reported for 2014 are lower for this category than actual figures.

3Card payments made abroad refer to transactions that the payer, while abroad, executes via a physical point-of-sale payment terminal. Card payments sent abroad refer, for example, to payments made at online shops by card and sent abroad.

For further information, please contact:

Timo Iivarinen, tel. +358 9 183 2275

Matti Hellqvist, tel. +358 9 183 2377

Heli Snellman, tel. +358 9 183 2183

E-mail: firstname.surname@bof.fi

Updated 28 July 2016 and 27 September 2016.