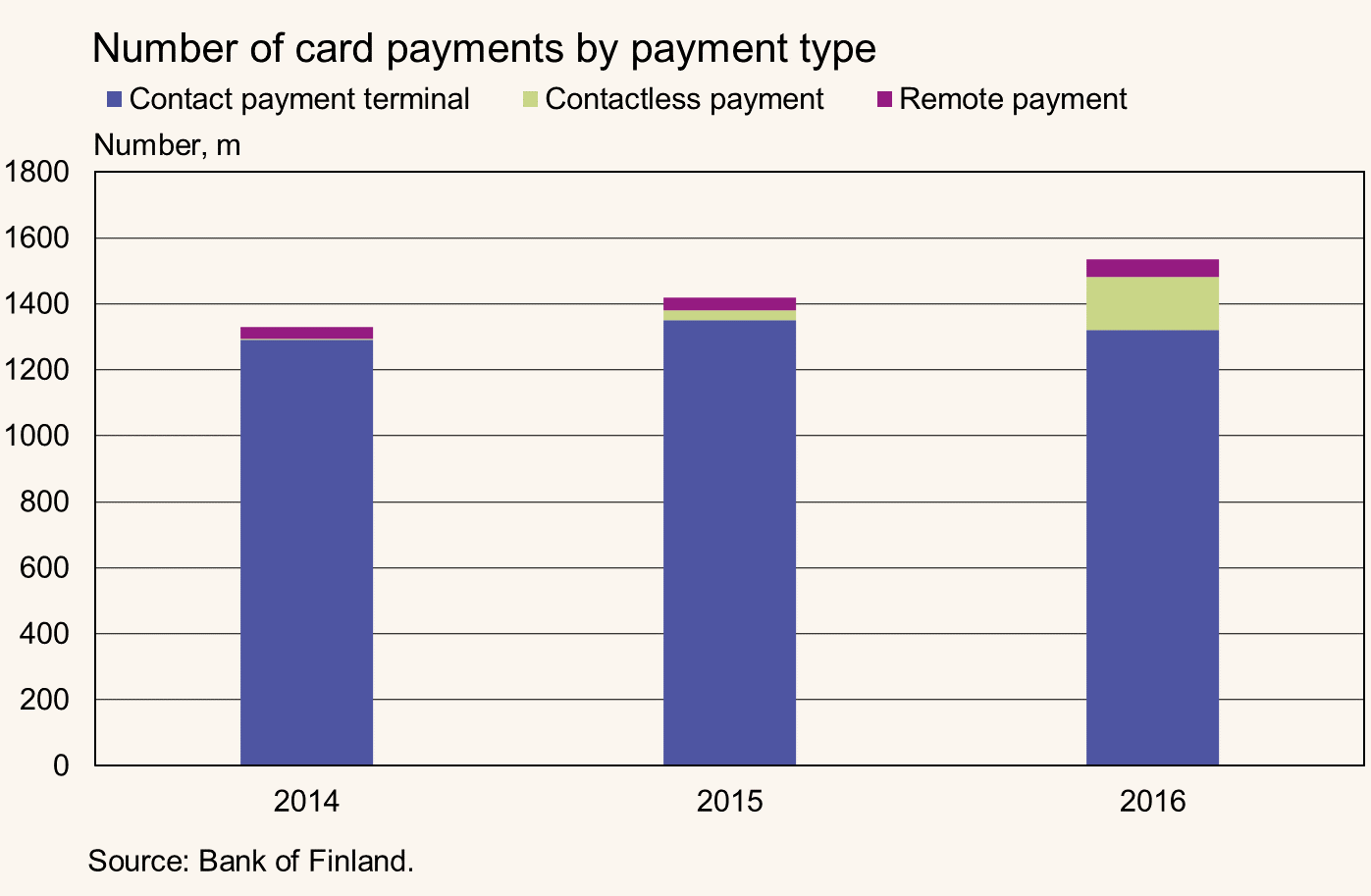

Payments by credit transfer and by card are becoming more popular, while cheque payments are declining in popularity. In 2016, cards issued in Finland were used as means of payment almost 1.54 billion times, an increase of 8.2% on 2015. At the same time, Finnish residents made 0.91 billion credit transfers, an increase of 3.4% on the previous year. Meanwhile, the number of cheques redeemed in Finland declined from 0.08 million to 0.07 million.

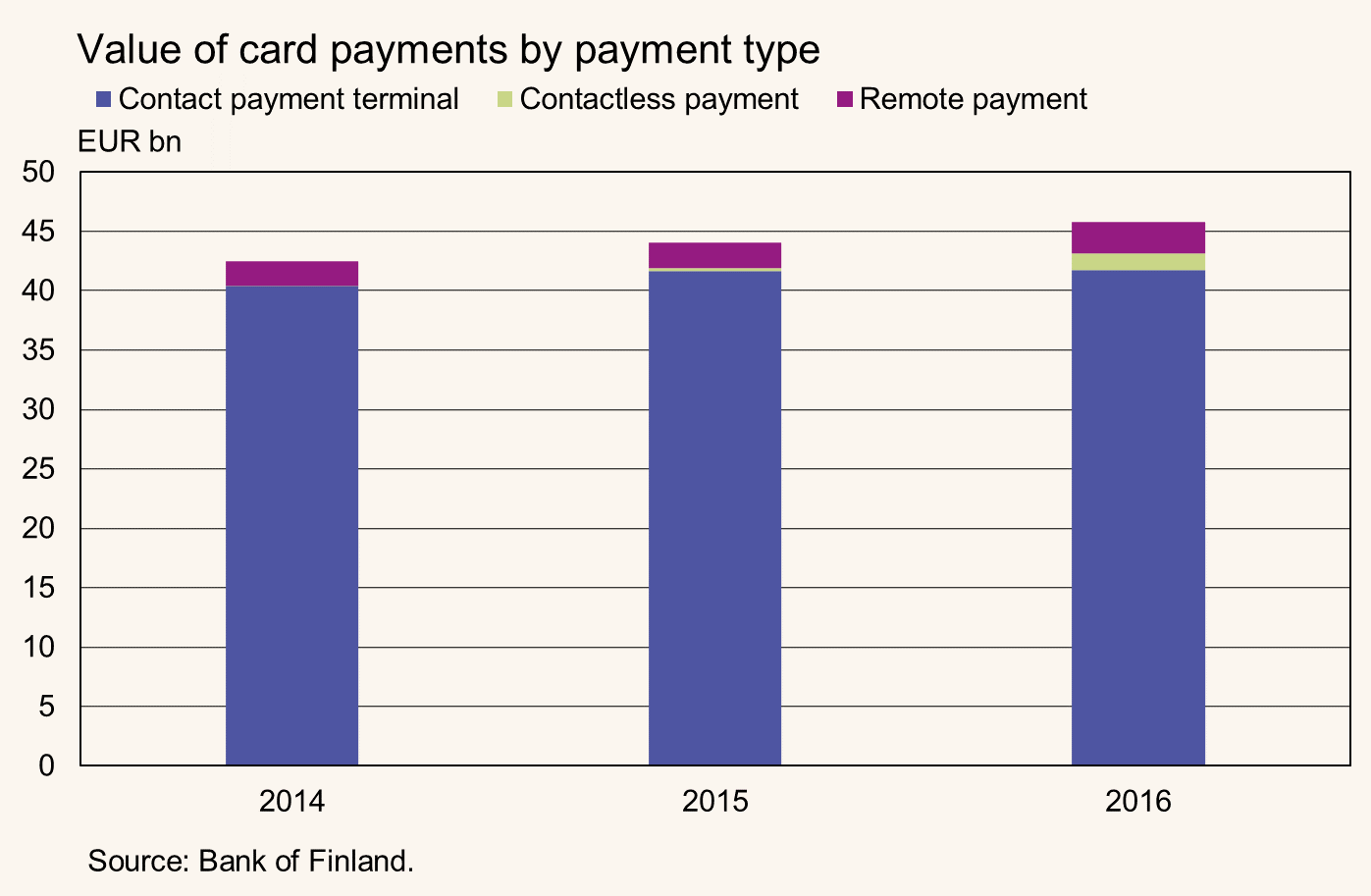

Measured by value, most money changes owner by credit transfer. In 2016, Finnish residents made credit transfers to the value of approximately EUR 2,732 billion, while card payments totalled EUR 45.8 billion. The value of credit transfers was virtually unchanged from the previous year, while the value of card payments grew by around 3.9%.

At the end of 2016, there were 1,457 cash withdrawal ATMs in Finland, and 466 credit transfer ATMs. During the course of the year, cash to the value of EUR 13 billion was withdrawn from ATMs.

Strong growth in the use of contactless card payments

In 2016, there were 9.8 million payment cards in use. As many as 5.2 million of these already had the capability for contactless payments. Such payments increased over five-fold on the previous year, with a total of 162 million transactions. In terms of value, the growth was similar: whereas in 2015 contactless card payments totalled just EUR 0.23 billion, in 2016 the total was EUR 1.36 billion.

As well as contactless card payments, there was also an increase in remote card payments in 2016. This refers to card payments not conducted at a retail checkout, but e.g. over the Internet or by telephone. In 2016, these types of card payment totalled almost 53 million. In value terms, remote card payments totalled EUR 2.7 billion. The average value of card payments made via contact payment terminals was a little over EUR 30, that of contactless card payments approximately EUR 8, and for remote card payments a little over EUR 50.

In addition to remote card payment, online purchases can also be made using an online (or Web) payment button. In 2016, there were almost 77.5 million such payments. This was 18% more than the previous year and much more than the number of remote card payments in 2016. The value of payments made using an online payment button was almost EUR 5.5 billion, approximately double the value of remote card payments.

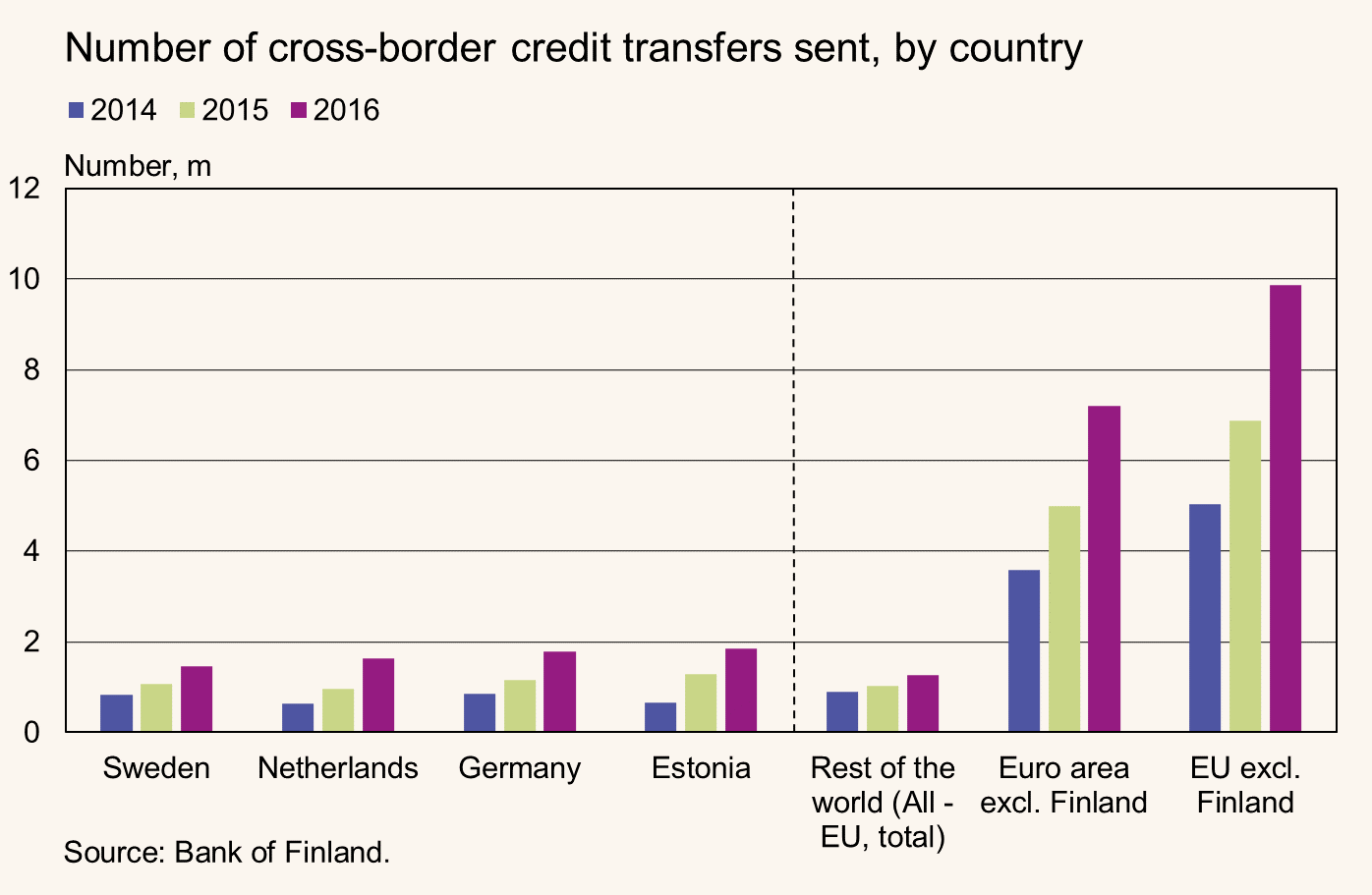

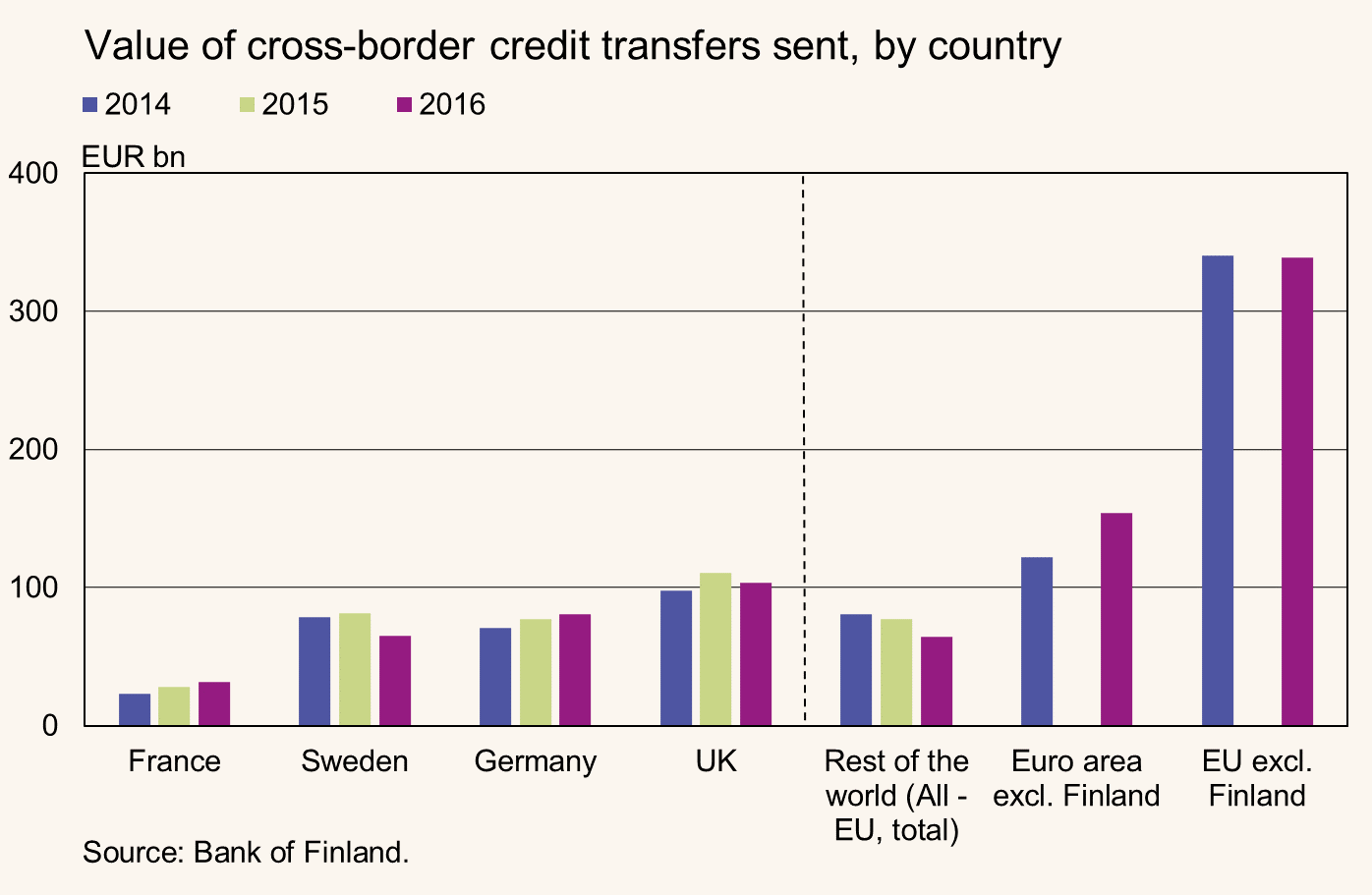

Of credit transfers abroad, highest number to Estonia, highest total value to United Kingdom

Of the credit transfers made in 2016, most, i.e. around 99%, were domestic. These amounted to a total of 898 transfers. In value terms, domestic credit transfers totalled approximately EUR 2,328 billion, or around 85% of the value of all credit transfers. In terms of the number of individual transactions, most credit transfers abroad went to Estonia, Germany, the Netherlands and Sweden. In terms of value, the most went to the United Kingdom, Germany, Sweden and France. In terms of individual transactions, credit transfers to outside the EU accounted for around 0.1% of all credit transfers, and by value, too, for only around 2.4%.

Of all credit transfers, approximately 890 million, or almost 98% were SEPA credit transfers, i.e. credit transfers within the parameters of the Single Euro Payment Area (SEPA) standard. In terms of value, SEPA credit transfers amounted to approximately EUR 1,961 billion, giving them a share of around 72% of all credit transfers. Payments can also be made via the correspondent bank network, without payment systems. In 2016, there were around 1.8 million such payments, accounting for a share of just 0.2% of all credit transfers. In terms of value, however, payments via correspondent banks amounted to EUR 393 billion, or over 14% of all credit transfers. A substantial proportion of correspondent bank payments, around 44% by volume and 16% by value, went outside the EU. By currency, most correspondent bank payments were in euro, US dollars and Swedish kronor.

Of all credit transfers, approximately 890 million, or almost 98% were SEPA credit transfers, i.e. credit transfers within the parameters of the Single Euro Payment Area (SEPA) standard. In terms of value, SEPA credit transfers amounted to approximately EUR 1,961 billion, giving them a share of around 72% of all credit transfers. Payments can also be made via the correspondent bank network, without payment systems. In 2016, there were around 1.8 million such payments, accounting for a share of just 0.2% of all credit transfers. In terms of value, however, payments via correspondent banks amounted to EUR 393 billion, or over 14% of all credit transfers. A substantial proportion of correspondent bank payments, around 44% by volume and 16% by value, went outside the EU. By currency, most correspondent bank payments were in euro, US dollars and Swedish kronor.

For further information, please contact::

Timo Iivarinen, tel. +358 9 183 2275, timo.iivarinen(at)bof.fi

Matti Hellqvist, tel. +358 9 183 2377, matti.hellqvist(at)bof.fi

Heli Snellman, tel. +358 9 183 2183, heli.snellman(at)bof.fi