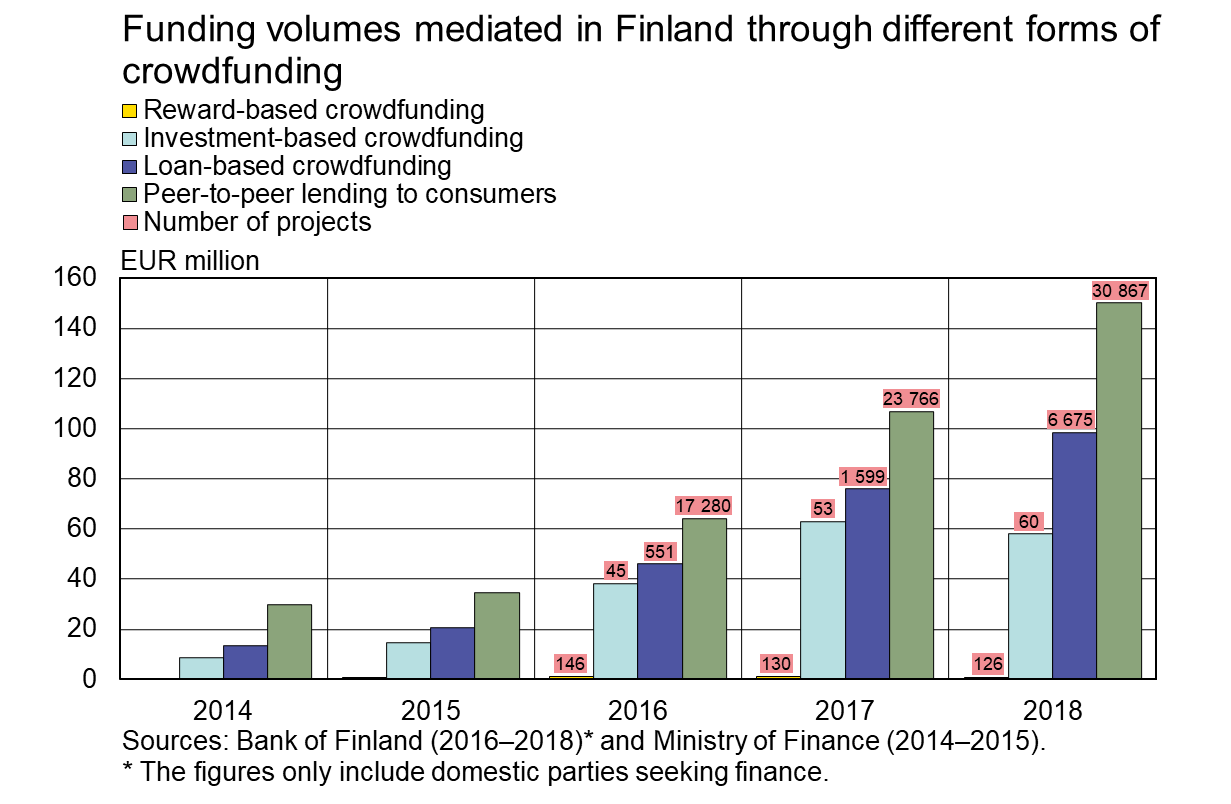

Peer-to-peer (P2P) lending to consumers grew further, albeit at a slower pace than a year earlier. In 2018, the volume of P2P lending mediated to Finnish consumers amounted to EUR 150.1 million, up by about 40% on the previous year. In 2017, P2P consumer lending had grown 67% year-on-year. Despite the strong growth in recent years, P2P loans still account for a minor share of the total stock of consumer credit to household, i.e. about 1%.

Consumers are increasingly taking out loans through P2P lending, which has been reflected as growth in the number of funding rounds on service platforms. A total of almost 31,000 successful funding rounds were recorded in 2018, which is over 7,000 rounds more than in the previous year.

Increase in the share of loan-based crowdfunding

For businesses, the most important forms of crowdfunding are loan-based crowdfunding and investment-based crowdfunding. In 2018, the volume of loan-based crowdfunding mediated to Finnish companies totalled EUR 98.3 million, up by about 29% on 2017. The growth rate has moderated, however, since in 2017 loan-based crowdfunding increased by 64% year-on-year. The average loan amount has contracted markedly. This is particularly explained by the increasing popularity of loans mediated through loan-based crowdfunding for paying invoices.

Investment-based crowdfunding, in turn, decreased in 2018 compared with 2017. The total volume mediated in 2018 amounted to EUR 58.0 million, down by almost 8% on the previous year. The decline is partly explained by the high risk level of investments and the difficulty to assess the value of the target company.

Of the different forms of crowdfunding, the lowest volume mediated was through reward-based crowdfunding, which totalled EUR 0.7 million in 2018. As was the case for investment-based crowdfunding, the volume of reward-based crowdfunding decreased, too, by 27% year-on-year.

Funding volumes mediated in Finland through different forms of crowdfunding

|

|

2016, EUR million |

2017, EUR million |

2018, EUR million (year-on-year change) |

|

Loan-based crowdfunding |

46.3 |

76.0 (64%) |

98.3 (29%) |

|

Investment-based crowdfunding |

38.2 |

62.8 (64%) |

58.0 (–8%) |

|

Reward-based crowdfunding |

1.0 |

1.0 (4%) |

0.7 (–27%) |

|

Peer-to-peer lending to consumers |

64.2 |

106.9 (67%) |

150.1 (40%) |

|

Total |

149.6 |

246.7 (65%) |

307.2 (24%) |

* The figures include domestic parties seeking finance.

For further information, please contact:

Johanna Honkanen, tel. +358 9 183 2992, email: johanna.honkanen(at)bof.fi,

Katja Haavanlammi, tel. +358 9 183 2415, email: katja.haavanlammi(at)bof.fi.

[1] Comprises investment-, loan- and reward-based crowdfunding as well as peer-to-peer lending to consumers. The figures only include successful projects of domestic parties seeking finance. The figures also include anchor investors and co-investors.