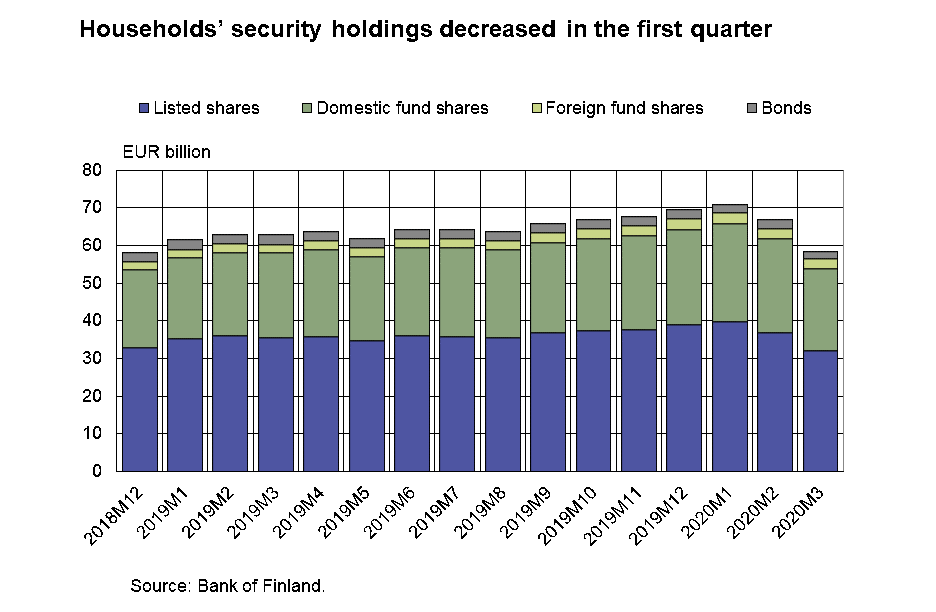

At the end of March 2020, Finnish households had security holdings[1] worth EUR 58.2 billion, which is EUR 12.8 billion less than in January 2020. The value of the holdings decreased in February and March by EUR 13.2 billion, mainly due to the decline of the equity markets. Over the same period of time, households made new investments of EUR 0.8 billion in net terms.

In addition to securities, deposits make up a significant proportion of Finnish households’ financial wealth.[2] At the end of March 2020, the aggregated household deposit stock amounted to EUR 96.9 billion, growing at an annual rate of 6.2%. Transaction accounts amount to 87% of the deposit stock.

At the end of March 2020, Finnish households held investments of EUR 21.9 billion in domestic investment funds, which is EUR 3.9 billion less than in January 2020. Already in February 2020, changes in valuation reduced households’ fund holdings by EUR 1 billion. However, a more significant change in the value took place in March, when changes in valuation reduced the holdings by EUR 2.3 billion. In addition, households redeemed fund units worth a total of EUR 0.5 billion in net terms in February and March.

In February–March, households redeemed their investments mostly from bond funds (EUR 0.4 billion) and mixed funds (EUR 0.2 billion). Changes in valuation reduced households’ holdings mostly in equity funds (EUR 1.9 billion), bond funds (EUR 0.7 billion) and mixed funds (EUR 0.7 billion). The value of holdings in real estate funds decreased in March primarily due to changes in the market value of funds investing in REIT corporations, and due to income distribution from some funds.

In addition to domestic investment funds, Finnish households own fund units in foreign investment funds. These holdings amounted to EUR 2.2 billion at the end of March 2020. Households’ holdings in foreign investment funds decreased by over 25% from the beginning of the year as a result of changes in valuation in February–March.[3]

At the end of March 2020, Finnish households held listed shares worth EUR 32 billion, which is EUR 7.9 billion less than in January 2020. Due to negative market performance, the value of households’ equity holdings decreased in February by EUR 3.6 billion and in March by EUR 5.7 billion. The value of shareholdings in financial sector[4] companies decreased by 27.7% from January. The value of equity holdings in other companies[5] decreased by 18.4%.

Although market performance reduced households’ equity holdings, households purchased equities worth EUR 1.3 billion in net terms in February and March. Over 95% of the purchases concerned domestic shares.

Finnish deposits and investments (EUR million), 2020Q1 |

||||||

| All | Households | Employment pension schemes | ||||

| stock (flows) | change in valuation | stock (flows) | change in valuation | stock (flows) | change in valuation | |

| Finnish investments | ||||||

| Listed shares | 150 019 | -39 286 | 31 995 | -8 362 | 22 967 | -6 041 |

| (3 017) | (1 387) | (725) | ||||

| - in domestic shares | 101 620 | -26 038 | 29 238 | -7 623 | 12 704 | -3 236 |

| (2 240) | (1 247) | (636) | ||||

| Bonds | 197 100 | -5 445 | 1 990 | -208 | 30 488 | -1 256 |

| (5 527) | (-91) | (-3 292) | ||||

| - in domestic bonds | 69 255 | -670 | 1 287 | -123 | 3 675 | -141 |

| (3 423) | (-41) | (195) | ||||

| Fund shares | ||||||

| Domestic investment funds | 86 794 | -11 819 | 21 935 | -3 193 | 5 040 | -784 |

| (-2 150) | (-203) | (-338) | ||||

| Foreign funds | 135 425 | -17 611 | 2 234 | -482 | 97 547 | -12 201 |

| (2 415) | (103) | (2 589) | ||||

| Finnish bank deposits | ||||||

| Transaction accounts | 162 402 | -52 | 84 281 | -4 | 7 761 | 0 |

| (9 515) | (1 985) | (1 996) | ||||

| Other deposits | 52 533 | 16 | 12 598 | 0 | -* | -* |

| (4 975) | (-232) | -* | ||||

| *confidential | ||||||

For further information, please contact:

Antti Alakiuttu, tel. + 358 9 183 2495, email: antti.alakiuttu(at)bof.fi,

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/saving-and-investing.

The next news release on saving and investing will be published at 1 pm on 13 August 2020.

[1] Listed shares, domestic investment fund units, foreign investment fund units, bonds.

[2] According to Statistics Finland’s financial accounts, households’ aggregate financial wealth totalled EUR 329 billion at the end of 2019.

[3] Households made net subscriptions in foreign investment funds’ units during the first part of the year, and there were no significant (net) redemptions in February or March, either.

[4] Sectors S.121–S.129

[5] S.11