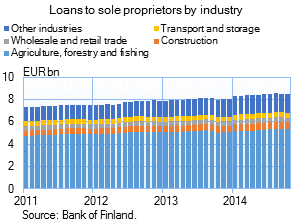

Sole proprietors include private persons who carry on business. Sole proprietors’ drawdowns of loans for business purposes were at moderate levels in the period January-October 2014, totalling EUR 1.7 bn. This is slightly more than in the same period a year ago, when sole proprietors’ drawdowns of loans totalled EUR 1.6 bn. During the course of 2014, however, the growth rate of loans raised for the conduct of business has picked up: in October the growth rate was 6.5%. At the end of October, the stock of loans granted to sole proprietors by Finnish MFIs amounted to EUR 8.5 bn, and the average interest rate on the stock was 2.39%. More than 60% of sole proprietors’ loans had been granted to households engaged in agriculture, forestry and fishing. |

|

The average interest rate on sole proprietors’ new drawdowns of loans was 3% at the end of October. Drawdowns of other small corporate loans below EUR 50,000 (excl. loans to sole proprietors) amounted to EUR 0,9 bn in January-October 2014, and the average interest rate on the loan stock was 3.48% in October.

In October 2014, households’ new drawdowns of housing loans amounted to EUR 1.4 bn. The average interest rate on new housing-loan drawdowns was 1.74%, down by 0.03 percentage point on September. The stock of euro-denominated housing loans totalled EUR 89.6 bn at the end of October, and the annual growth rate of the housing loan stock was 1.6%. At the end of October, household credit comprised EUR 13.6 bn in consumer credit and EUR 15.6 bn in other loans. New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted in October to EUR 1.7 bn, which is EUR 0.3 bn less than in October 2013. The average interest rate on new corporate-loan drawdowns increased slightly from September, to 2.44% in October. At the end of October, the stock of euro-denominated loans to non-financial corporations was EUR 67.6 bn, of which loans to housing corporations accounted for EUR 20.8 bn. | ||||||||||||||||||||||||||||||||||||||||||

Deposits At the end of October 2014, the stock of household deposits totalled EUR 80.4 bn, and the average interest rate on these deposits was 0.40%. Overnight deposits accounted for EUR 53.3 bn and deposits with agreed maturity for EUR 13.5 bn of the total deposit stock. In October, households concluded EUR 1.0 bn of new agreements on deposits with agreed maturity. The average interest rate on these was 1.07%. Notes: | ||||||||||||||||||||||||||||||||||||||||||

Key figures of Finnish MFIs' loans and deposits, preliminary data

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes. | ||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||

For further information, please contact: The next news release will be published at 1 pm on 2 January 2015. |