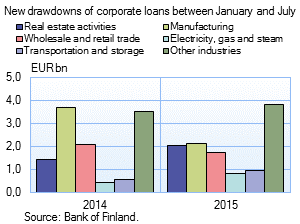

| In January-July 2015, new drawdowns of euro-dominated corporate loans by domestic non-financial corporations (excl. housing corporations) were modest, totalling EUR 11.5 bn. This was slightly less than in the corresponding period in 2014. A comparison of industries reveals that the demand for corporate loans was highest in manufacturing, particularly in the metal industry and the manufacture of machinery and equipment1. However, the loan amounts declined notably from the previous year. Loan drawdowns by manufacturing companies in January-July totalled EUR 2.1 bn, which was more than 40% less than in the year-earlier period.

|

|

Even though drawdowns of corporate loans have declined, the growth rate of the stock of domestic euro-denominated corporate loans (excl. loans to housing corporations) increased slightly in the early part of the year, from 3.9% at end-2014 to 4.8% in July 2015. With loans to housing corporations included, the corporate loan stock grew at a steady rate of around 7% in the early part of the year. Loans In July, households’ new drawdowns of housing loans amounted to EUR 1.3 bn, which was slightly more than a year earlier in July. The average interest rate on new housing-loan drawdowns was 1.5% in July 2015. The stock of euro-denominated housing loans totalled EUR 90.9 bn at the end of July, and the annual growth rate of the housing loan stock was 2.1%. At end-July, household credit comprised EUR 14.0 bn in consumer credit and EUR 15.8 bn in other loans. New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted in July to EUR 2.4 bn. The average interest rate on new corporate-loan drawdowns rose slightly from June, to 1.77%. The stock of euro-denominated loans to non-financial corporations at the end of July was EUR 71.1 bn, of which loans to housing corporations accounted for EUR 22.4 bn. | ||||||||||||||||||||||||||||||||||||

Deposits At the end of July, the stock of household deposits totalled EUR 81.8 bn, and the average interest rate on deposits was 0.32%. Overnight deposits accounted for EUR 57.1 bn of the total deposit stock and deposits with agreed maturity for EUR 11.4 bn. In July, households concluded EUR 0.7 bn of new agreements on deposits with agreed maturity. The average interest rate on these decreased from June, to 0.94% in July. 1 Manufacture of machinery and equipment comprises the manufacture of computer, electronic and optical products, electrical equipment and machinery and equipment not elsewhere classified. | ||||||||||||||||||||||||||||||||||||

Key figures of Finnish MFIs' loans and deposits, preliminary data

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes. | ||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||

For further information, please contact The next news release will be published at 1 pm on 30 September 2015. |