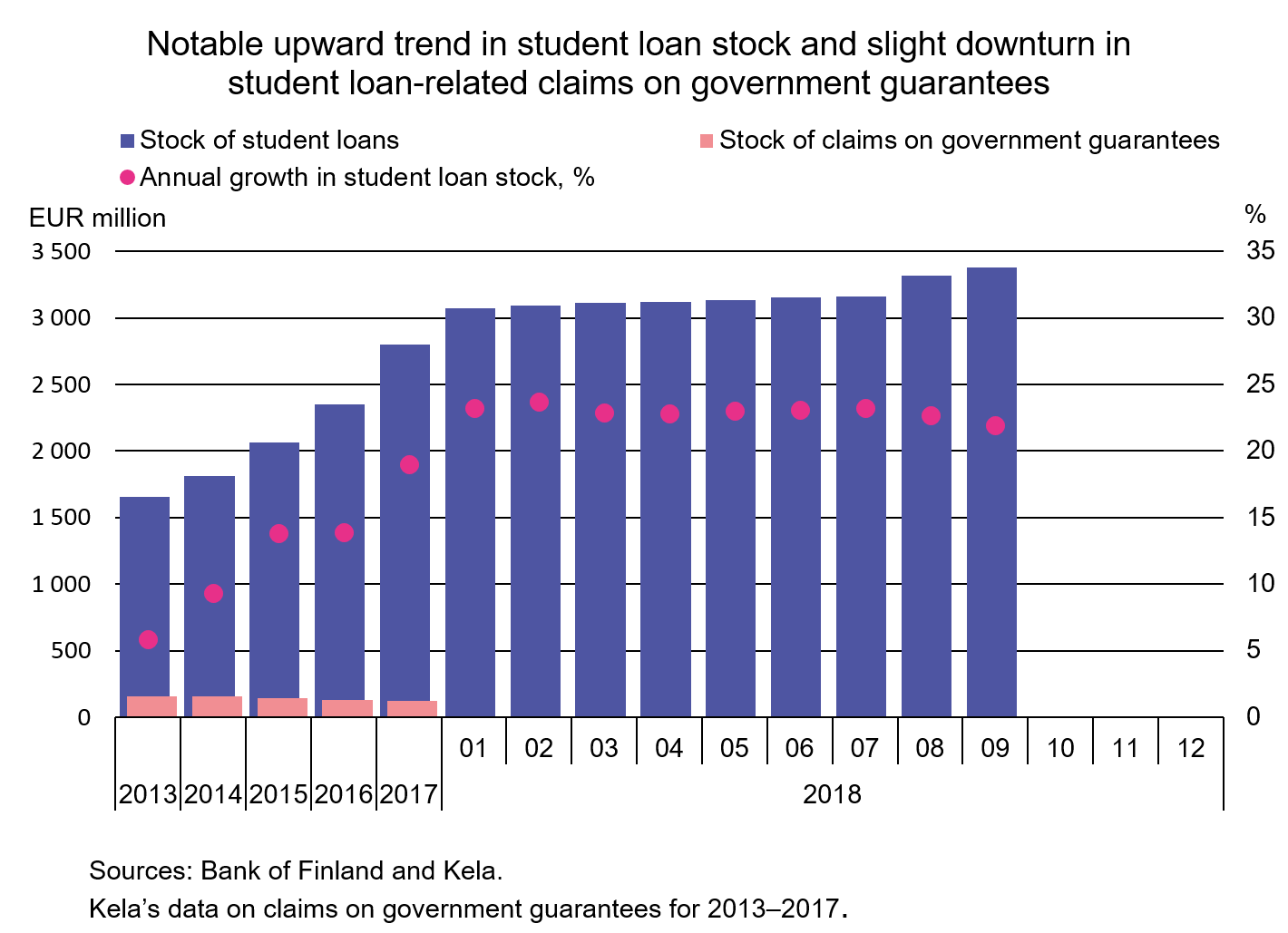

In August–September 2018, drawdowns of student loans amounted to EUR 230 million, which is 7% more than in the corresponding period in 2017. Student loans are typically drawn down at the beginning of the autumn semester in August–September and at the beginning of the spring semester in January.

Growth in the stock of student loans has picked up markedly since 2013. The annual growth rate of the stock was well over 20% in January 2018 and has remained almost unchanged throughout the year. The upward trend in student loan drawdowns reflects low interest rates and the reform of the student financial aid scheme. In September 2018, the interest rate on new student loan drawdown was exceptionally low (0.48%). The student financial aid scheme has also been adjusted with incentives for students to take out a loan and graduate faster. Namely, the maximum amount of government guarantee for student loan was raised in 2014 and 2017, and a student loan compensation system encouraging faster graduation was introduced in 2014.

Despite the brisk growth in the stock of student loans, the stock of claims on government guarantees has contracted slightly. Claims on government guarantees are amounts owed by students under the loan guarantee scheme, i.e. loan amounts which Kela (Social Insurance Institution of Finland) has repaid to banks in its capacity as the guarantor of student loans and which it later collects from students. The contraction in the stock of claims on government guarantees may also partly reflect the full capitalisation of the interest due on student loans during the financial aid term. Before the legislative amendment that took effect on 1 July 2014, a student loan could, due to unpaid interest payments, be recorded in Kela’s claims on government guarantees already during the financial aid term. Repayment of student loans usually begins after the finalisation of studies. The recent brisk growth in the student loan stock may therefore be reflected in claims on government guarantees after a time lag.

Loans

Households’ new drawdowns of housing loans amounted to EUR 1.5 bn in September 2018. The average interest rate on new housing-loan drawdowns was 0.88% and the imputed margin was 0.85%. At the end of September 2018, the stock of euro-denominated housing loans amounted to EUR 97.4 bn and the annual growth rate of the stock was 1.8%. Household credit at end-September comprised EUR 15.8 bn in consumer credit and EUR 17.3 bn in other loans.

New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted to EUR 1.8 bn in September. The average interest rate on new corporate-loan drawdowns rose from August, to 2.34%. At the end of September, the stock of euro-denominated loans to non-financial corporations was EUR 84.0 bn, of which loans to housing corporations accounted for EUR 30.9 bn.

Deposits

The stock of household deposits at end-September totalled EUR 87.6 bn and the average interest rate on the deposits was 0.12%. Overnight deposits accounted for EUR 74.2 bn and deposits with agreed maturity for EUR 5.6 bn of the deposit stock. In September, households concluded EUR 0.5 bn of new agreements on deposits with agreed maturity, at an average interest rate of 0.25%.

| Key figures of Finnish MFIs' loans and deposits, preliminary data | |||||

| July, EUR million | August, EUR million | September, EUR million | September, 12-month change1, % | Average interest rate, % | |

| Loans to households2, stock | 129,648 | 130,014 | 130,572 | 2,4 | 1,48 |

| - of which housing loans | 97,111 | 97,296 | 97,444 | 1,8 | 0,98 |

| Loans to non-financial corporations2, stock | 83,020 | 83,316 | 84,015 | 6,6 | 1,38 |

| Deposits by households2, stock | 90,554 | 90,765 | 91,553 | 4,7 | 0,12 |

| Households' new drawdowns of housing loans | 1,493 | 1,546 | 1,497 | 0,88 | |

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Households also include non-profit institutions serving households; non-financial corporations also include housing corporations

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Imputed interest rate margins on loans from MFIs

For further information, please contact:

Ville Tolkki, tel. +358 9 183 2420, email: ville.tolkki(at)bof.fi,

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi.

The next news release will be published at 1 pm on 30 November 2018.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.