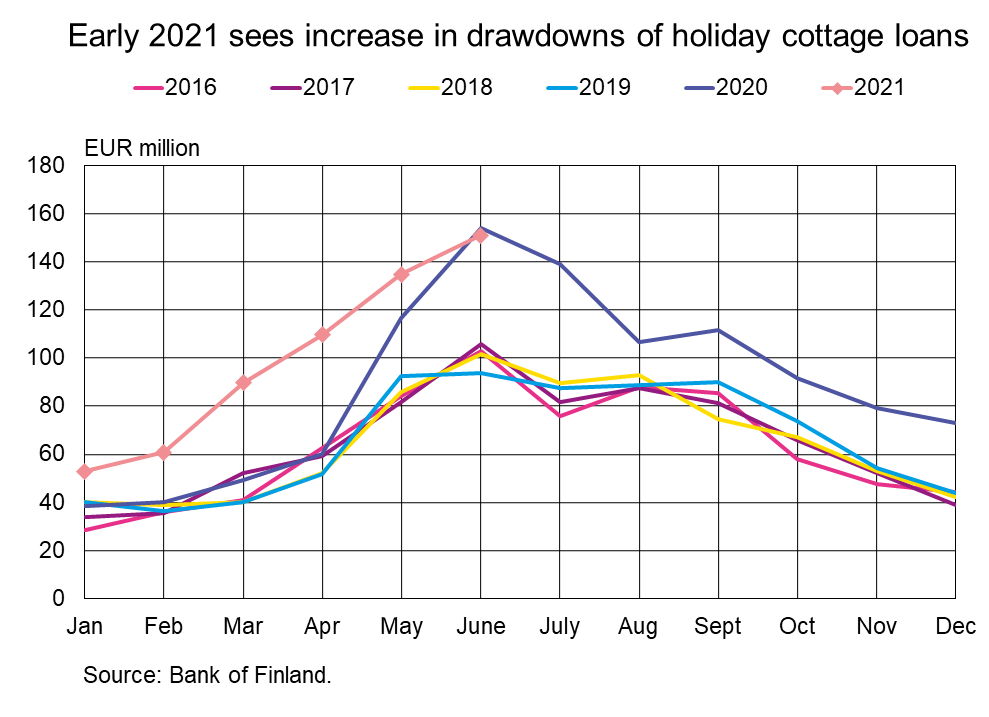

In June 2021, Finnish households drew down new housing loans for the purchase of holiday homes (holiday cottage loans) to the value of EUR 151 million. More has been drawn down in a single month for this purpose only once before, in June 2020, when new drawdowns were 1.9% higher. In June 2021, the average interest rate on new housing loans for purchase of a holiday home was 0.93%.

New holiday cottage loans have been drawn down at a record rate throughout the entire first half of 2021. During the second quarter of the year, drawdowns were 20% up on the second quarter of 2020. Overall, in the first half of 2021, a total of EUR 600 million in new housing loans for holiday residences was drawn down, which is as much as 31% more than in the same period in 2020.

The large number of drawdowns saw the stock of holiday cottage loans grow to EUR 4.3 billion in June 2021, an annual growth rate of 12.4%. Holiday cottage loans’ share of the overall stock of household loans has risen slightly from 2020, to stand at 3.1% in June 2021.

The repayment periods for new holiday cottage loans have been lengthening since the middle of 2014, and this trend has continued during the past year. The average repayment period on holiday cottage loans drawn down in June 2021 was 18 years and 8 months, 10 months longer than a year earlier.

Loans

In June 2021, Finnish households drew down new housing loans to a value of EUR 2.2 billion, or EUR 358 million more than a year earlier. Of the new housing loans, 8.5% were for investment. At the end of June 2021, the stock of housing loans stood at EUR 104.9 billion, representing annual growth of 4.3%. The share of the housing loan stock taken by housing for investment purposes was 7.9%. Of Finnish households’ loans at the end of June 2021, consumption loans totalled EUR 16.6 billion and other loans, EUR 17.7 billion.

In June, Finnish non-financial corporations took out new corporate loans (excl. overdrafts and card credit) in the amount of EUR 2.6 billion. The average interest rate on the new corporate loans was down from May, at 1.43%. At the end of June, the stock of loans granted to Finnish non-financial corporations stood at EUR 96.7 billion, of which EUR 38.0 billion was to housing corporations.

Deposits

At the end of June, the stock of deposits held by Finnish households stood at EUR 107.8 billion, and the average interest rate on the deposits was 0.03%. Overnight deposits accounted for EUR 98.2 billion and the stock of deposits with agreed maturity, EUR 2.9 billion of the stock of deposits. In June, Finnish households made new deposits with agreed maturity in the amount of EUR 53.0 million. The average interest rate on these new deposits was 0.19%.

LOANS AND DEPOSITS TO FINLAND, PRELIMINARY DATA |

|||||

| April, EUR million | May, EUR million | June, EUR million | June, 12-month change1, % | Average interest rate, % | |

| Loans to households, stock | 137,947 | 138,534 | 139,205 | 4,3 | 1,31 |

| - of which housing loans | 103,973 | 104,399 | 104,929 | 4,3 | 0,80 |

| - of which buy-to-let mortgages | 8,191 | 8,255 | 8,315 | 0,92 | |

| Loans to non-financial corporations2, stock | 96,847 | 97,158 | 96,725 | 0,2 | 1,28 |

| Deposits by households, stock | 106,233 | 106,631 | 107,833 | 7,4 | 0,03 |

| Households' new drawdowns of housing loans | 1,925 | 2,078 | 2,182 | 0,72 | |

| - of which buy-to-let mortgages | 174 | 192 | 186 | 0,88 | |

* Includes loans and deposits in all currencies to residents in Finland. The statistical releases of the Bank of Finland up to January 2021, as well as those of the ECB, present loans and deposits in euro to euro area residents and also include non-profit institutions serving households. For these reasons, the figures in this table differ from those in the aforementioned releases.

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Non-financial corporations also include housing corporations.

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Imputed interest rate margins on loans from MFIs

For further information, please contact:

Antti Hirvonen, tel. +358 9 183 2121, email: antti.hirvonen(at)bof.fi.

The next news release will be published at 10:00 on Tuesday 31 August 2021.

Related statistical data and graphs are also available on the Bank of Finland website at https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.