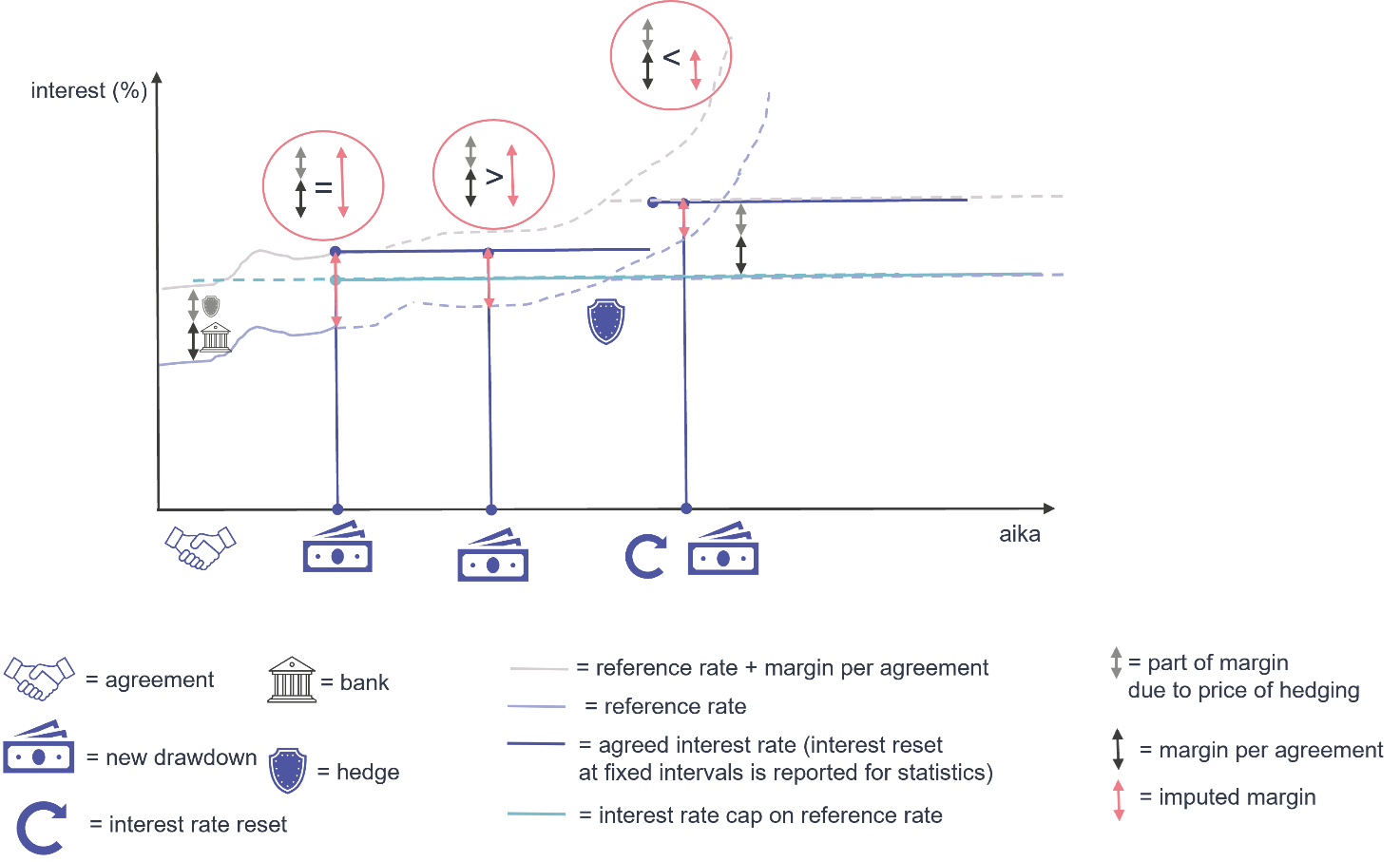

The Bank of Finland calculates an imputed interest margin on households’ new drawdowns of housing loans as well as on new loans drawn down by housing corporations and non-financial corporations. The imputed interest margin is the difference of the agreed annual interest rate and the monthly average of the reference interest rate. The agreed annual interest rate covers all interest payments, but no other charges that may apply. However, the agreed annual interest rate includes interest rate hedges purchased by households for their housing loans if they involve fees payable to the bank in connection with the interest rate payments. Interest rate hedges usually increase the interest rate agreed on by the credit institution and the household at the time of inception of the agreement.

In spring 2022, households purchased a large volume of interest rate hedges for their housing loans, which increased the agreed annual interest rate and the imputed interest margin. In autumn 2022, the typical reference rate on housing loans, the 12-month Euribor, rose steeply, which is assessed to have reduced the volume of interest rate hedges purchased since their prices increased. At the same time, the imputed interest margin on new housing loan drawdowns declined (Chart 1).

Chart 1. Imputed margins on housing loans

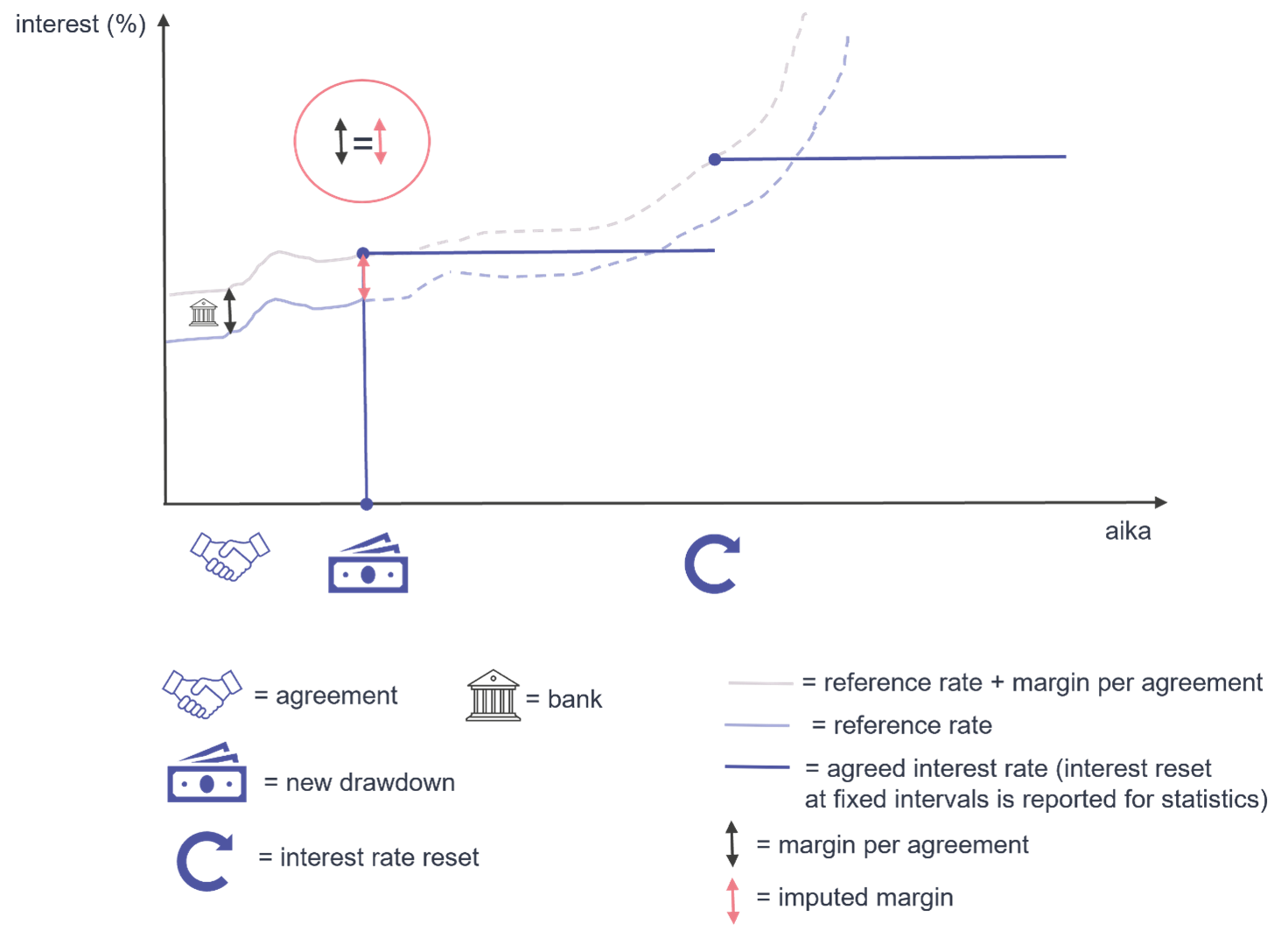

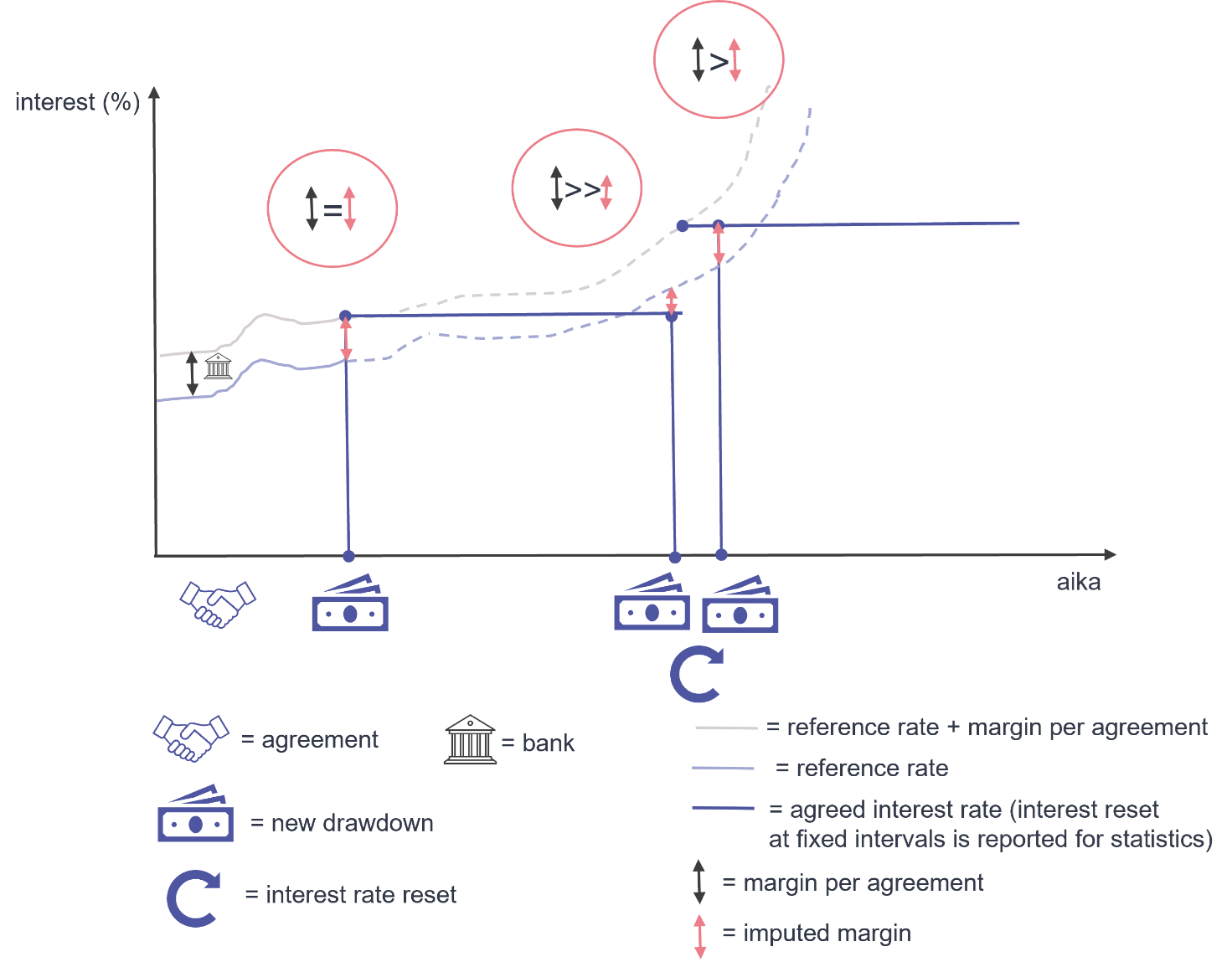

A part of housing loans is drawn down in instalments (Chart 3). For example, when constructing a house, several components affecting on the annual interest rate – such as the margin – are fixed at the inception of the agreement. However, drawdowns are made in instalments as the construction project proceeds. The interest rate of the loan changes on the rate reset date, based on the reference rate fixation period. If an interest rate hedge has been purchased for the loan, the hedge limits the rise of the interest rate in connection with subsequent drawdowns (Chart 4) even if the reference rate has been reset between the drawdowns. When the reference rate rises, the imputed margin is likely to underestimate the real margin in connection with subsequent drawdowns (Charts 3 and 4: two subsequent drawdowns illustrated). This timing issue weakens the ability of the imputed margin on new drawdowns to reflect the real margin in a rapidly evolving interest rate environment.

The timing issue related to new drawdowns can be adjusted for by using the imputed margin on real new agreements (illustrated in Chart 1). This way, the entire agreed loan amount is recorded at the time of inception of the agreement. From the beginning of 2022 onwards, the imputed interest margin calculated for new housing loan agreements decreases clearly more slowly than the imputed margin calculated for new drawdowns. Therefore, the imputed margin on real new agreements is currently a better indication of developments in the real housing loan margin.

However, the margin calculated based on new agreements does not eliminate the effect of interest rate hedges. Therefore, the rise of the margin on real new agreements in early 2022 is more indicative of households seeking protection from a rise in interest rates than growth of the margin itself. Towards the end of the year, as interest rates had already risen clearly higher, households’ appetite for hedging was lower. The decrease of the imputed margin on new agreement in the second half of the year was partly due to the reduced demand for hedging of housing loans.

The insights presented in this article are also partly applicable to the imputed margin on new loan drawdowns by housing corporations. Housing corporations include, in addition to housing companies, other housing corporations.

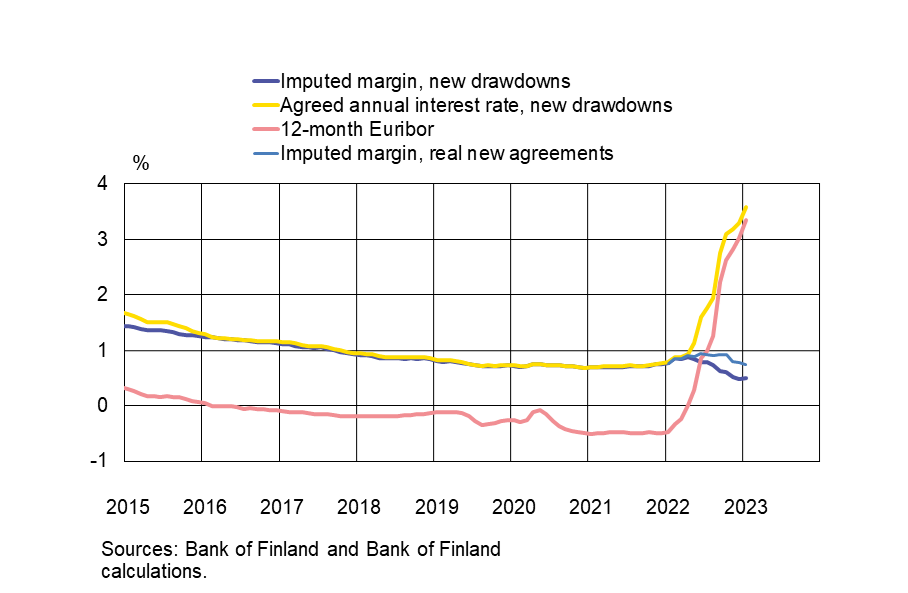

Chart 2. Imputed margin on new drawdowns without interest rate hedging and subsequent drawdowns

Chart 3. Effect of subsequent drawdowns on the imputed margin on new drawdowns

Chart 4. Effect of subsequent drawdowns on the imputed margin on new drawdowns, including an illustration of interest rate hedging