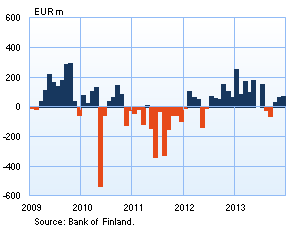

Finnish households’ net investments in investment funds registered in Finland were generally positive in 2013, except for a small dip in early autumn. Net inflows into investment funds from the household sector totalled slightly over EUR 1.0 bn in 2013, the largest inflow since 2009, when households invested EUR 1.4 bn in investment funds, on net. Due to the low level of deposit rates, households have turned to investment funds as a means of preserving asset value while seeking additional return. In the fourth quarter of 2013, net investments by households amounted to a modest EUR 0.2 bn.

Fund capital historically high At the end of 2013, the aggregate fund capital reached a historical high of EUR 75 bn. Fund capital increased during the fourth quarter of the year by EUR 2.4 bn, of which the bulk (EUR 1.7 bn) reflected positive market developments, particularly the rise in equity prices. A third of the increase was accounted for by new capital inflows. |

Finnish households’ net investment in investment funds registered in Finland |

|---|---|

Domestic insurance corporations made significant (EUR 0.5 bn) net invstments in investment funds in the last quarter of 2013. For the year as a whole, insurance corporations’ net investments in funds to-talled EUR 1.3 bn. Investments from abroad were negative (EUR −0.4 bn) in 2013 for the first time in four years..

Finnish fund market developments differed from the euro area AIn January-November, investment fund capital grew more in Finland than in the euro area on average: 12% in Finland, compared to 10% in the euro area. The difference in growth rates is partly explained by the relatively higher exposure of Finnish investment fund markets to equity market dynamics. Equity funds account for 41% of aggregate fund capital in Finland, compared to 27% in the euro area. Therefore, fluctuations in equity markets have a relatively stronger impact on Finnish-registered funds than euro area funds. Luxembourg has the largest investment fund markets in the euro area in terms of both the number of funds and the amount of capital managed. Looking at average fund volumes, however, investment funds registered in Luxemburg are only the fourth largest (EUR 175 m) in the euro area. On average, the largest funds are domiciled in the Netherlands, where the average fund size is almost EUR 315 m. In Spain, in turn, the number of funds is high, but average fund volume there is very small (EUR 33 m). In terms of average fund size, Finland ranks sixth (EUR 139 m). NOTE. Money market funds are excluded from euro area comparisons. Key statistical data on investment funds registered in Finland, preliminary data

For further information, please contact:

Johanna Honkanen, tel. +358 10 831 2992, email: johanna.honkanen(at)bof.fi, Jori Oksanen, tel. +358 10 831 2552, email: jori.oksanen(at)bof.fi. The next investment fund news release will be published on 30 April 2014 at 1.00 pm.

| |

Households’ fund investments highest in four years

Older news

Statistics

Friday 31 January 2014, 1:00 PM

Key figures on investment funds in the euro area, September 2013

Key figures on investment funds in the euro area, September 2013