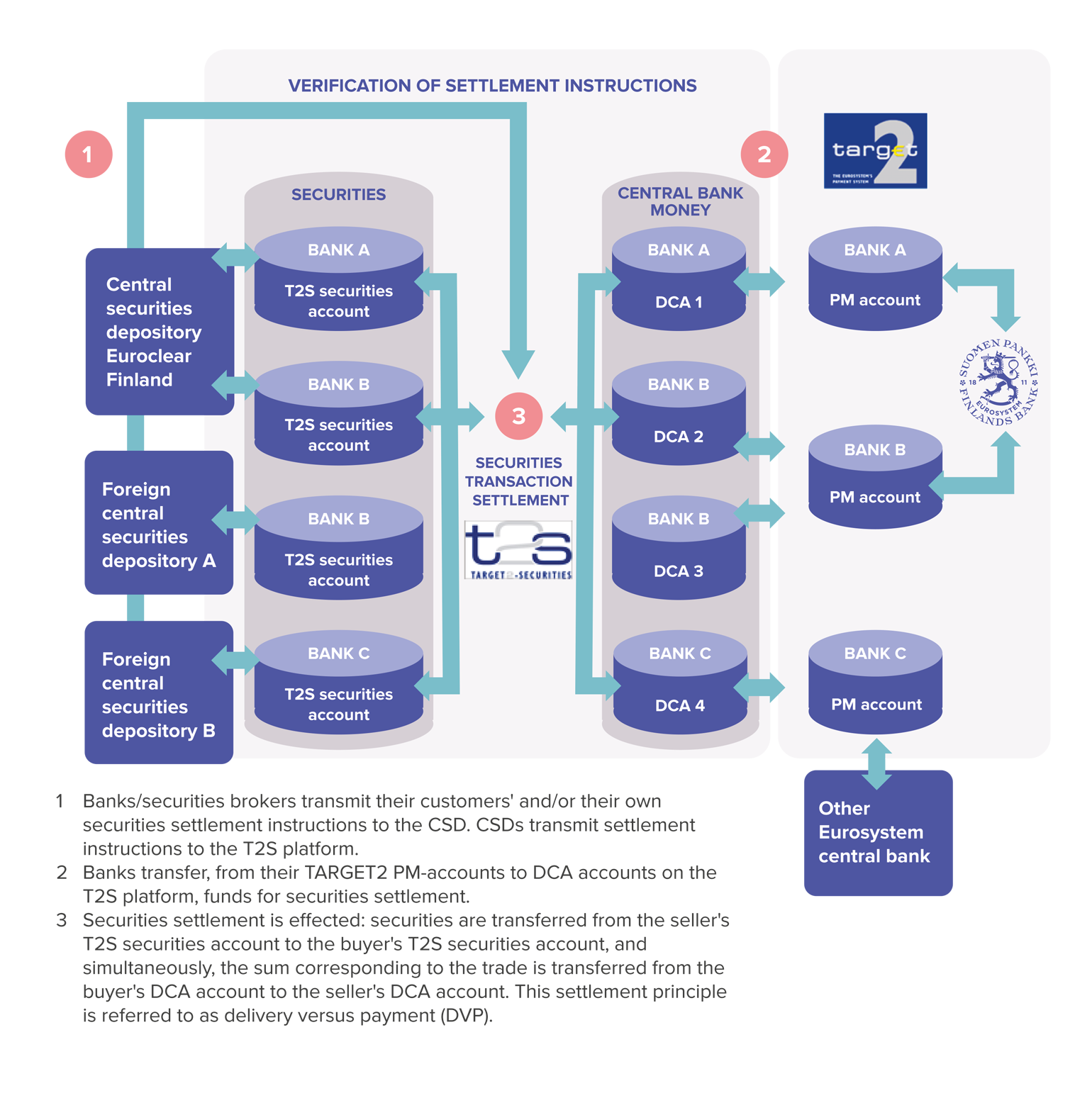

TARGET2-Securities, T2S, is a new European securities settlement platform which offers centralised delivery-versus-payment (DvP) settlement in central bank money. T2S covers almost the entire European securities market.

T2S was developed for central securities depositories – and not to compete with them. The objective is to reduce the costs of cross-border securities settlement and increase competition and choice among providers of post-trading services in Europe. The main objective of T2S is to integrate and harmonise the highly fragmented securities settlement infrastructure in Europe. It is a critical step towards the creation of a true single market for financial services in the EU. T2S enhances the collateral and liquidity management of market participants engaged in securities trading.

Following a decision by the Governing Council of the ECB, the T2S project was launched in 2008. The majority of European central securities depositories have migrated or will migrate to T2S. The settlement platform became operational in June 2015. Central securities depositories will migrate to the platform in several waves between 2015 and 2017.

The central banks of Germany, Italy, France and Spain were together responsible for the development of T2S. They are also responsible for the daily operation of the service platform. The Bank of Finland will open central bank money accounts for its customers and provide liquidity management services in T2S. As one of the owners of the settlement platform, the Bank of Finland participates, via Eurosystem working groups, in the development of T2S and other market infrastructures.

TARGET2-Securities (T2S)