Settlement systems – securities infrastructures – refer to multilateral arrangements and systems that are used for the clearing, settlement and recording of payments, securities, derivatives or other financial transactions. Securities settlement systems are used for post-trade processing.

Securities issued by a Finnish entity can be entered in the book entry system of a Finnish or foreign central securities depository. The issuer can be either a company or a government. Despite the issuer’s right to choose, securities issuance and securities in the EU are subject to national company law or other similar law. When the securities have been recorded in the book entry system, they can be traded publicly on a stock exchange or other trading venue. The instrument subject to trading can also include the various rights or obligations related to book-entries.

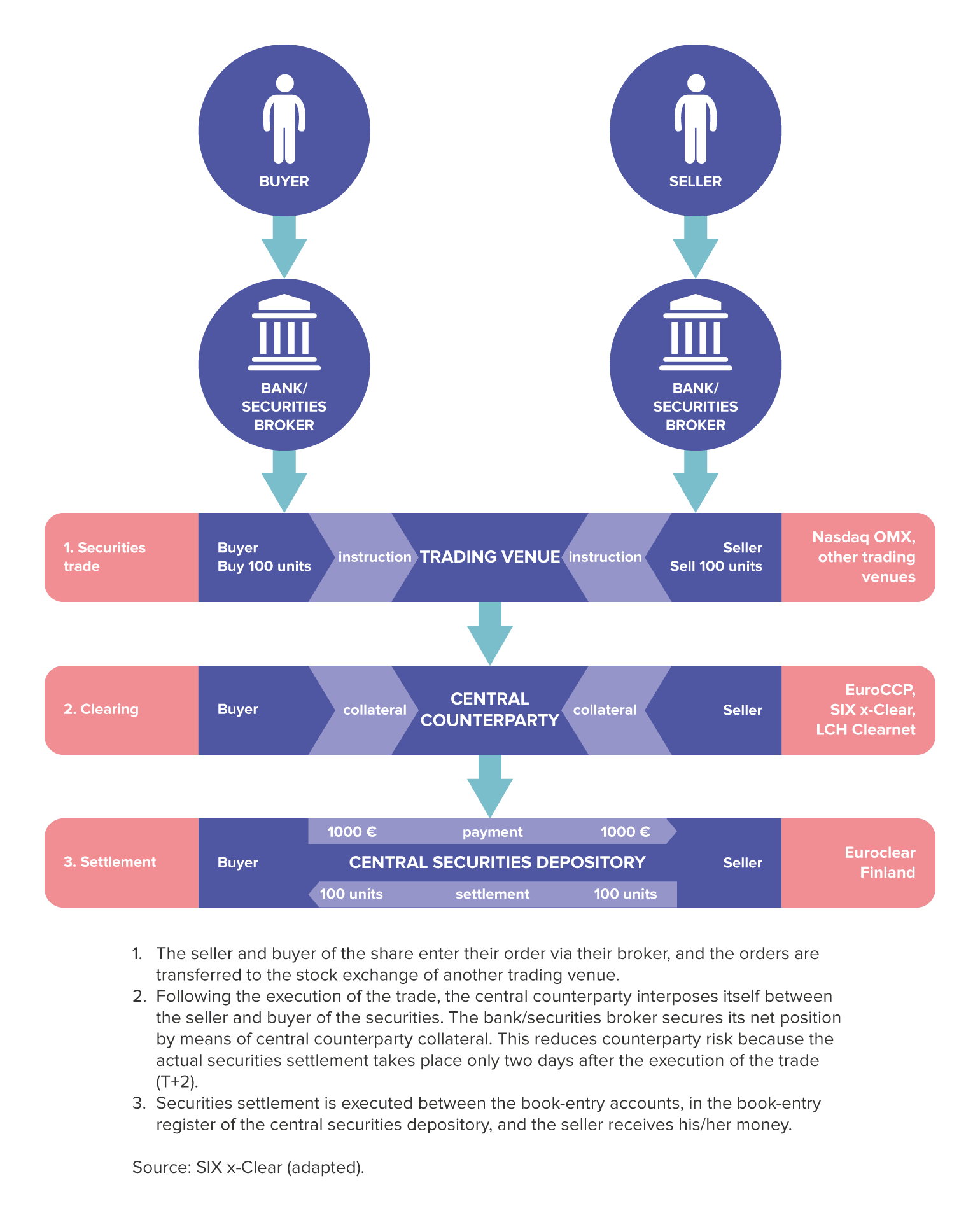

Clearing refers to the procedure by which a central counterparty interposes itself between the seller and the buyer of the securities traded. The central counterparty thus carries the risk related to the counterparties' ability to fulfil their obligations. It settles the net positions of the clearing parties per instrument. The net position per counterparty and instrument is transferred to the central securities depository's system for settlement. Central counterparty services in Finland cover currently only stock market instruments.

Securities settlement is executed between the book-entry accounts, in the book-entry register of the central securities depository, and the seller receives the cash. In Finland, the clearing party and the book-entry registrar are often one and the same entity that, based on transactions, records entries directly in the book-entry system of the central securities depository and records the cash amounts on his own behalf or on his customer’s behalf.

The chart gallery shows the development of the volume and value of trades settled by Euroclear Finland.

The operation of payment and settlement systems in the euro area is described in detail in the book The Payment System – Payments, Securities and Derivatives, and the Role of the Eurosystem.