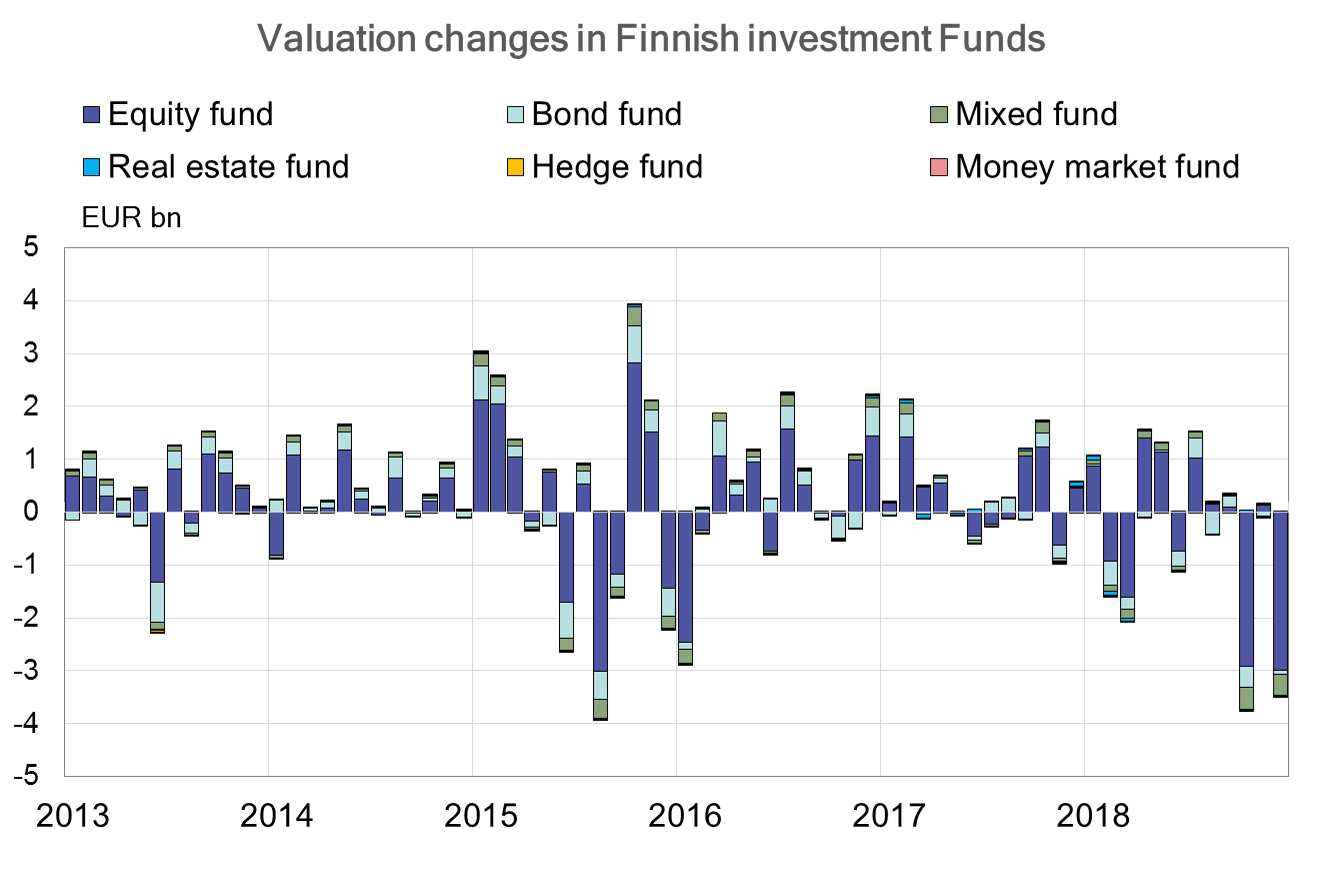

The fund capital of investment funds registered in Finland contracted by EUR 8.6 bn in the course of 2018. At the end of 2018, the fund capital totalled EUR 112.2 bn, the same level as at end-March 2017. The contraction was mainly due to negative valuation changes. Stock market fluctuations, in particular, were large in the first and fourth quarters of 2018. Valuation changes accounted for EUR 6.3 bn of the decline in the fund capital, of which EUR 4.4 bn was attributable to shares.

In the fourth quarter of 2018, the fund capital contracted more than in any quarter recorded so far. The largest negative valuation changes were registered in October (EUR 3.7 bn) and December (EUR 3.5 bn). Of this, shares accounted for EUR 2.9 bn on both occasions. Negative valuation changes have last been as considerable in August 2015. In the second and third quarters of 2018, however, valuation changes were positive.

Redemptions exceeded new investments

The contraction in the investment fund capital was also due to redemptions. Net investment flows were EUR 2.2 bn negative during the year. Bond funds saw net redemptions of EUR 2.5 bn. The largest redemptions were made by non-financial corporations (EUR 0.4 bn), insurance corporations (EUR 0.3 bn), households (EUR 0.4 bn) and other investment funds (EUR 1.3 bn). In addition to domestic investments, the redemptions concerned bond fund investments in e.g. the United Kingdom, Italy and France.

Equity funds experienced net redemptions of EUR 1.2 bn, of which the largest were by employment pension schemes (EUR 0.3 bn) and other investment funds (EUR 0.8 bn). Besides domestic shares, the redemptions concerned e.g. British, Irish and Swedish shares. Equity investments in e.g. the United States and Japan, in turn, increased in net terms in 2018. Short-term funds experienced net redemptions of EUR 0.4 bn.

Net investments in other funds were positive in 2018. New investment inflows in real estate funds totalled EUR 1.0 bn, on net, and went mainly to domestic investment vehicles. The largest investors were non-financial corporations, insurance corporations and households. Mixed funds attracted net inflows of EUR 0.8 bn, which were mostly channelled into the United States.

Households favoured real estate funds

Households’ net investments were modest (EUR 33 million) in 2018, and households shifted their holdings during the year. The largest investments by households were made in real estate funds (EUR 0.3 bn) and mixed funds (EUR 0.2 bn). Households’ investments in real estate funds accounted for about one-third of all investments in these funds. The largest redemptions by households were from bond funds (EUR 0.4 bn). The largest redemptions occurred in the last quarter of 2018 and totalled EUR 0.4 bn.

Key statistical data on investment funds registered in Finland, preliminary data

- Breakdown of investment funds’ fund-share liability by sector of holder

- Securities-based assets of investment funds by area

- Securities-based assets of investment funds by instrument, area and sector

For further information, please contact:

Anne Turkkila, tel. +358 9 183 2175, email: anne.turkkila@bof.fi

Juuso Koppanen, tel. +358 9 183 2257, email: juuso.koppanen@bof.fi

The next investment fund news release will be published at 1 pm on 3 May 2019.