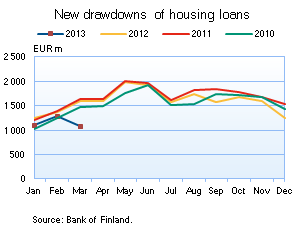

In March, new housing loans to a value of just under EUR 1.1 billion were drawn down in Finland, compared with almost EUR 1.6 billion a year earlier. The decline in new housing loan drawdowns observed already at the start of the year was further fed by the introduction of a higher rate of asset transfer tax in March. In addition, the imputed interest margin on housing loans broadened to 1.54% in March from the February figure of 1.48%.

In March, new housing loans to a value of just under EUR 1.1 billion were drawn down in Finland, compared with almost EUR 1.6 billion a year earlier. The decline in new housing loan drawdowns observed already at the start of the year was further fed by the introduction of a higher rate of asset transfer tax in March. In addition, the imputed interest margin on housing loans broadened to 1.54% in March from the February figure of 1.48%.

Loans

Deposits

The stock of household deposits at the end of March was EUR 82 billion. The average rate of interest was 0.61%. Of the total stock, overnight deposits accounted for EUR 49 billion, and fixed term deposits for EUR 18 billion. Households concluded new fixed-term deposit contracts in March in the amount of EUR 1.1 billion. The average interest on the new contracts rose slightly, from 1.12% in February to 1.14% in March.

Notes:

MFIs comprise all monetary financial institutions operating in Finland.

Loans and deposits comprise all euro-denominated loans and deposits vis-à-vis the euro area as a whole, with countries other than Finland accounting for a very small share of total volumes.

Key figures of Finnish MFIs' loans and deposits, preliminary data

| January, EUR million |

February, EUR million |

March, EUR million |

March, 12-month change1, % |

Average interest rate, % | |

| Loans to households2, stock | 114,718 | 114,835 | 115,057 | 4.2 | 1.92 |

| - of which housing loans | 86,364 | 86,535 | 86,709 | 5.1 | 1.53 |

| Loans to non-financial corporations2, stock | 63,370 | 63,973 | 64,010 | 3.7 | 1.90 |

| Deposits by households2, stock | 81,859 | 81,701 | 82,274 | 0.3 |

0.61 |

| Households' new drawdowns of housing loans | 1,108 | 1,282 | 1,090 | – | 2.03 |

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Households also include non-profit institutions serving households; non-financial corporations also include housing corporations.

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Analytical accounts of the banking sector (MFIs) in Finland

For further information, please contact:

Essi Tamminen, tel. +358 10 831 2395, email: essi.tamminen(at)bof.fi

Jaakko Suni, tel. +358 10 831 2454, email: jaakko.suni(at)bof.fi

The next news release will be published at 1 pm on 31 May 2013.

Related statistical data and graphs are also available on the Bank of Finland website:

http://www.suomenpankki.fi/link/2331b6266da3492f832ec75e0f654bd9.aspx?epslanguage=en.