BIS survey of foreign exchange and OTC derivatives markets 2025

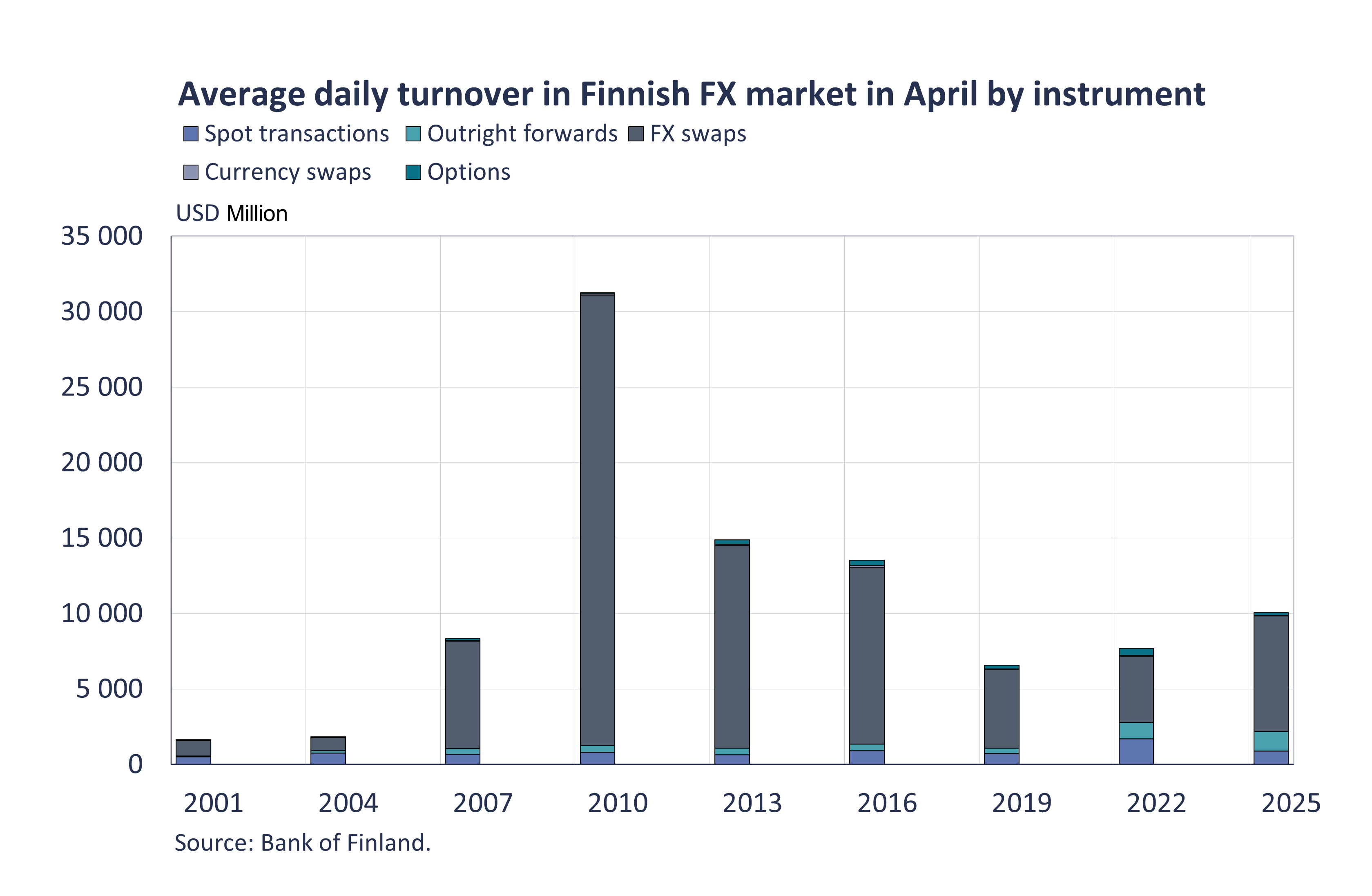

The average daily FX turnover for financial institutions operating in Finland rose in April 2025 compared with April 2022, though it remained lower than in 2010–2016.[1] The daily FX transaction volume in April 2025 totalled USD 10.1 billion, a 31% increase from April 2022. Global FX trade has followed a similar trend. The global FX transaction volume grew by 29% over the same period, reaching USD 9,600 billion per day in April 2025. This information comes from the triennial survey of foreign exchange and OTC[2] derivatives markets conducted by the Bank for International Settlements (BIS) and implemented in Finland by the Bank of Finland.

The growth in daily FX turnover in Finland is attributed to growth in FX swap and forward transaction volumes. The transaction volume in FX swaps rose by 75% and the volume in FX forwards by 20% since 2022. FX swaps continue to account for the majority of foreign exchange turnover. In 2025, FX swaps accounted for 76% of the daily foreign exchange turnover, while forwards, spot transactions and OTC FX options accounted for 13%, 9% and 2%, respectively. Globally, the share of FX swaps declined since 2022, yet remained the largest instrument category with a share of 41% of total FX turnover.

Global FX trade remained highly concentrated on the largest financial centres. Of the global FX transactions conducted in April 2025, the United Kingdom, United States, Singapore and Hong Kong accounted for 72%. The United Kingdom remained the largest market venue, with a share of 38%.

In the Finnish foreign exchange markets, the euro remained the most actively traded currency, used as one currency in 83% of all contracts. The currency with the second-highest turnover was the US dollar, appearing in 52% of all contracts. Globally, the share of the US dollar increased by one percentage point to 89%. The share of the second most traded currency, the euro, declined by 2 percentage points since 2022, to 29% in April 2025. The third most traded currency, the yen, maintained its share at 17%.

By volume, 40% of the FX transactions in Finland took place among the financial institutions reporting to the survey, down from 66% in 2022. The share of other financial institutions has grown significantly, accounting for 37% of Finnish FX transaction volume in April 2025. The share of non-financial counterparties amounted to 23%. The share of domestic counterparties declined slightly to 26%. Globally, the share of counterparties reporting to the survey was 47% and that of other financial institutions 48%. Local institutions’ share in global FX transaction volume remained at 38%.

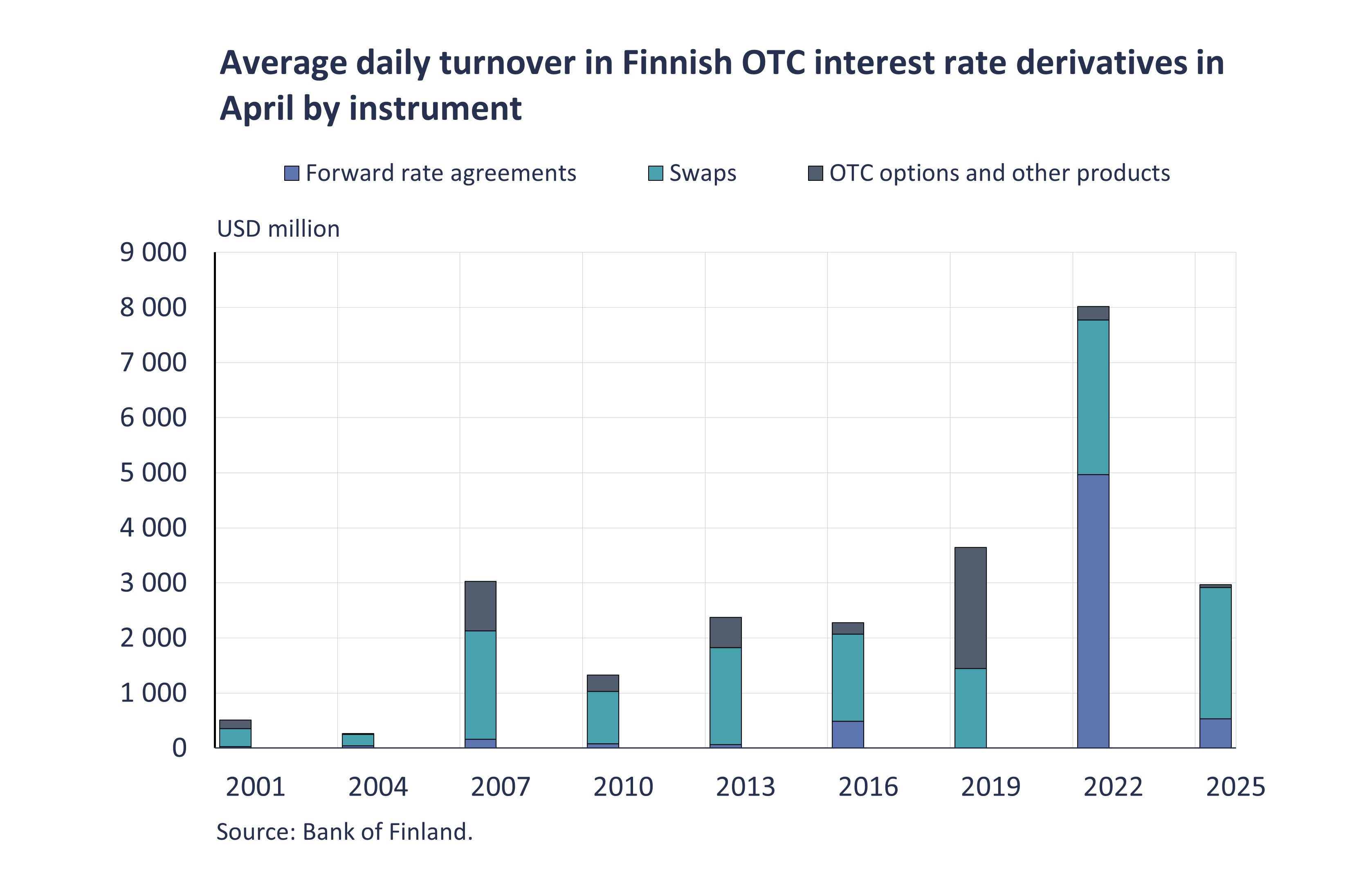

In the triennial BIS survey, data is also collected on the trading volume of OTC interest rate derivatives in USD terms in April. In April 2025, the average daily turnover in Finland was USD 3.0 billion. The transaction volume of OTC interest rates derivatives contracted significantly since 2022, when the average daily turnover amounted to USD 8.0 billion. The decrease in daily turnover is almost entirely attributed to a contraction in forward rate agreement volumes. In April 2025, FX swaps accounted for of 80%, forward rate agreements 18% and OTC options and other instruments 2%. Globally, the daily turnover of OTC FX derivatives increased by 58% since April 2022, to USD 7,900 billion.

The press release by the BIS and the results of the global survey can be accessed on the BIS website at https://www.bis.org/statistics/rpfx25.htm.

[1] The BIS survey of foreign exchange and OCT derivatives markets has been conducted in 2001, 2004, 2007, 2010, 2013, 2016, 2019, 2022 and 2025.

[2] Over-the-counter.