Card payments increasingly made via virtual terminals and mobile applications

Card payments initiated in mobile applications increased in the first half of 2025, reaching a total value of EUR 8.1 billion. A growing share of card payments is now made via virtual terminals, while the share of payments at physical terminals has declined.

Cards granted by Finnish banks and payment institutions were used in 1.2 billion card payments in the first half of 2025, with an aggregate value of EUR 36.9 billion. Private individuals accounted for almost 95% of the total value of the payments. Private individuals’ card payments are divided mainly into credit cards and debit cards. In the first half of 2025, 84% of the value of private individuals’ payments was made with debit cards, and this share has not changed significantly in recent years. Credit cards accounted for 15% of the value of private individuals’ payments. Corporate customers also commonly use delayed debit cards, which resemble credit cards but whose full balance must be paid at the end of a predefined period. In the first half of 2025, corporate customers made the largest share of the value of their card payments (49%) with delayed debit cards. Debit cards accounted for 46% of the value of corporate customers’ card payments.

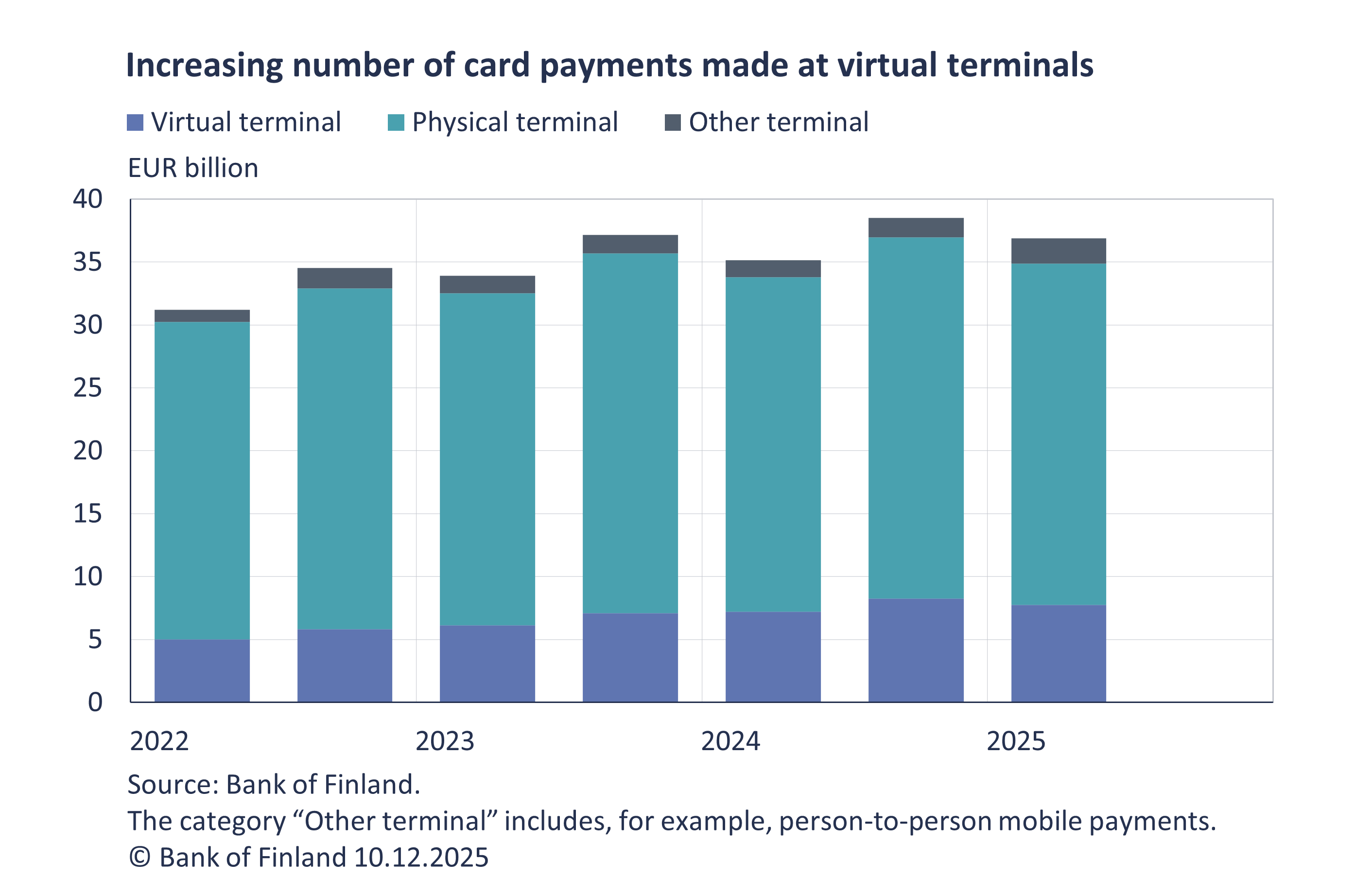

By value, 74% (EUR 27.1 billion) of card payments in the first half of 2025 were made at physical terminals (e.g. in-store checkouts). However, the share of physical terminals has declined in recent years as online payment methods have become more common. At the outset of the half-yearly statistics in the first half of 2022, the share of card payments made at physical terminals was still 81%. Over the same three-year period, the share of payments made at virtual terminals[1] has risen: in the first half of 2025 it was 21% (EUR 7.8 billion), compared with 16% just three years earlier.

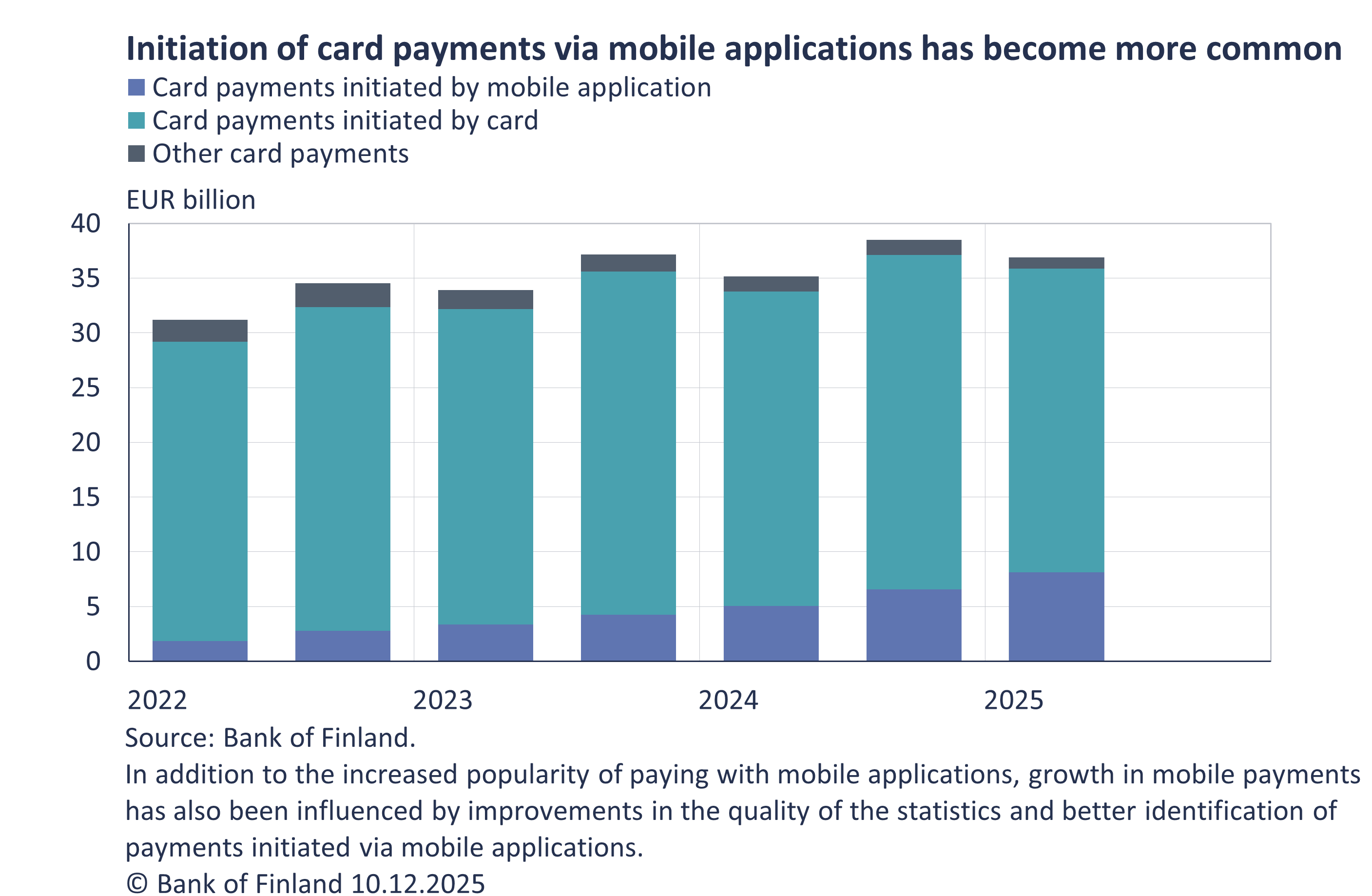

The shift in payment behaviour is also evident in how the card is used. By value, 75% of card payments in the first half of 2025 were initiated by the card[2] itself, compared with 88% three years earlier. Correspondingly, the share of payments initiated via a mobile application rose to 22% in the first half of 2025.

The number of card payments initiated via mobile applications has increased throughout the period covered by the statistics, which began in 2022. In the first half of 2025, a record number of such payments was again made, both in terms of transaction count and value. A total of 334 million payments were made, with an aggregate value of EUR 8.1 billion. Two factors lie behind the growth in mobile-app-initiated payments: first, paying via mobile applications has become more widespread in recent years. Second, improvements in the quality of the statistics have enabled better identification of payments initiated via mobile applications, which has increased the reported total value and refined the subclassification of these payments. The majority of mobile-app-initiated card payments were payments from private individuals to businesses, with a value of EUR 6.1 billion in the first half of 2025. Person-to-person (P2P) card-based mobile payments totalled EUR 1.2 billion.

Some of the figures discussed in this news release have been published in the half-yearly dashboard on payment statistics.

The next half-yearly news release on payment statistics will be published at 10 a.m. on 4 June 2026.

[1] Payments made at virtual terminals include e-commerce transactions made on the internet (using either a physical card or a mobile application) or inside a mobile application (in-app). Hence, in addition to online stores, payments made at virtual terminals may, for example, relate to the purchase of public transport tickets in a transport operator’s application.

[2] Card as the initiation method refers to situations in which the physical card is used at a physical terminal either with the chip or contactlessly, or where the card details are entered directly into an online merchant’s terminal.