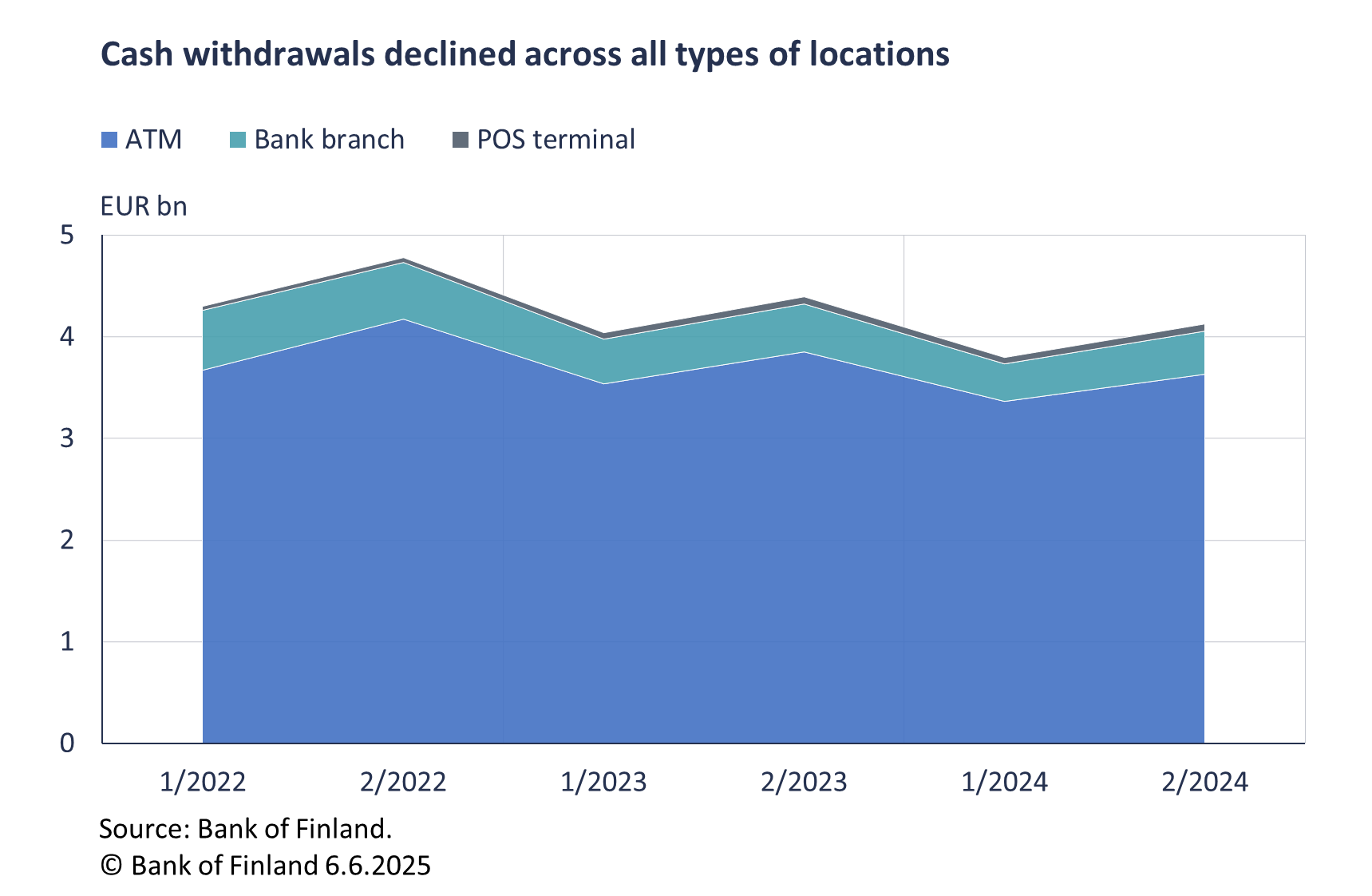

Cash withdrawal volumes declined in the second half of 2024 across all types of withdrawal locations

In H2/2024, Finnish payment service providers’ (PSP) customers withdrew 6.1% less cash in euro terms at automated teller machines (ATMs), bank branches and point-of-sale (POS) terminals, compared to the same period last year.

In the second half of 2024, Finnish PSPs’ customers made a total of 28.2 million cash withdrawals totalling EUR 4.1 billion at ATMs, bank branches and POS terminals. In comparison with the second half of 2023, this represented a year-on-year decrease of 7.8% in terms of the number of withdrawals and 6.1% in value.

In the second half of 2024, a total of 1.2 million cash withdrawals worth EUR 67.7 million were made at POS terminals. In contrast to the recent growth trend, withdrawals declined year-on-year both in terms of number (-1.9%) and value (-0.5%). In the second half of 2024, the value of cash withdrawals at ATMs amounted to EUR 3.6 billion (-5.7% year-on-year) and at bank branches EUR 0.4 billion (-10.2%).

Cash withdrawals from ATMs and POS terminals abroad amounted to EUR 135.9 million in the second half of 2024. The amount of cash withdrawn abroad decreased by nearly EUR 30 million, or 18.0%, year-on-year. In the second half of 2024, the largest volumes of cash were withdrawn in Estonia (EUR 18.2 million), Spain (EUR 17.3 million), and Thailand (EUR 12.8 million).

New data released

The figures in this news release are published in the new semi-annual dashboard of payment statistics, which now includes additional data on credit transfers sent and fraudulent payments[1].

For instance, the proportion of instant payments is now available. In the second half of 2024, a total of 59.8 million instant payments, worth EUR 72.1 billion, were made. The share of instant payments on the value of all credit transfers sent rose slightly year-on-year, reaching 3.9% in the second half of 2024.

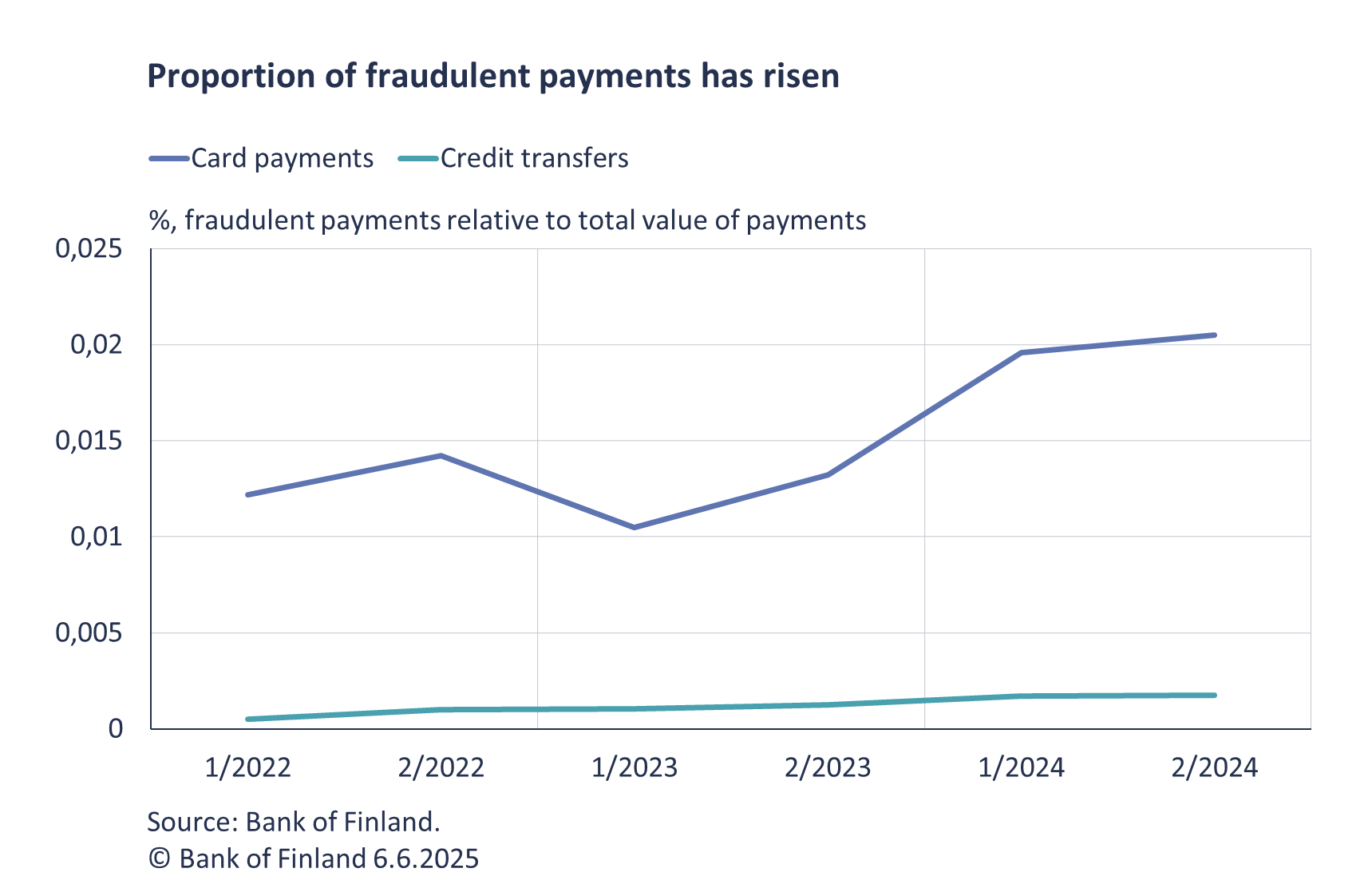

Cards issued by Finnish PSPs were used in 92 018 fraudulent card payments in the second half of 2024. During the same period, 12 727 fraudulent credit transfers were made. The value of the fraudulent card payments was EUR 7.9 million, and that of the credit transfers was EUR 32.4 million. The proportion of fraudulent card payments was 0.0205% (0.0132% a year earlier) of the total value of card payments, and the corresponding share for credit transfers was 0.0017% (0.0013% a year earlier). Fraudulent payments and losses resulting from fraud are also discussed in a recent Bank of Finland Bulletin (in Finnish).

In connection with this semi-annual release, data for 2024 was updated in the annual dashboard.

The next semi-annual news release on payment statistics will be published at 10 a.m. on 10 December 2025.

[1] Fraudulent payments are unauthorised payment transactions. These include, for example, transactions resulting from the loss, theft or misappropriation of sensitive payment data or a payment instrument, whether detectable or not to the payer prior to a payment and whether or not caused by gross negligence of the payer or executed without the payer's consent. In addition, the category includes payment transactions where the fraudster has manipulated the payer to initiate the payment transaction. Cases where the payee is fraudulent, for example selling a non-existent/counterfeit product or service, but the fraud is not directly involved with the payment transaction, are not included in fraudulent payment transactions.