Households' deposit stock at all-time high in November 2025

Households have increased their deposits in 2025 while interest rates on deposits have declined. Deposits have grown in all deposit categories. In addition, Finnish corporations concluded a high volume of new agreements on deposits with agreed maturity in November.

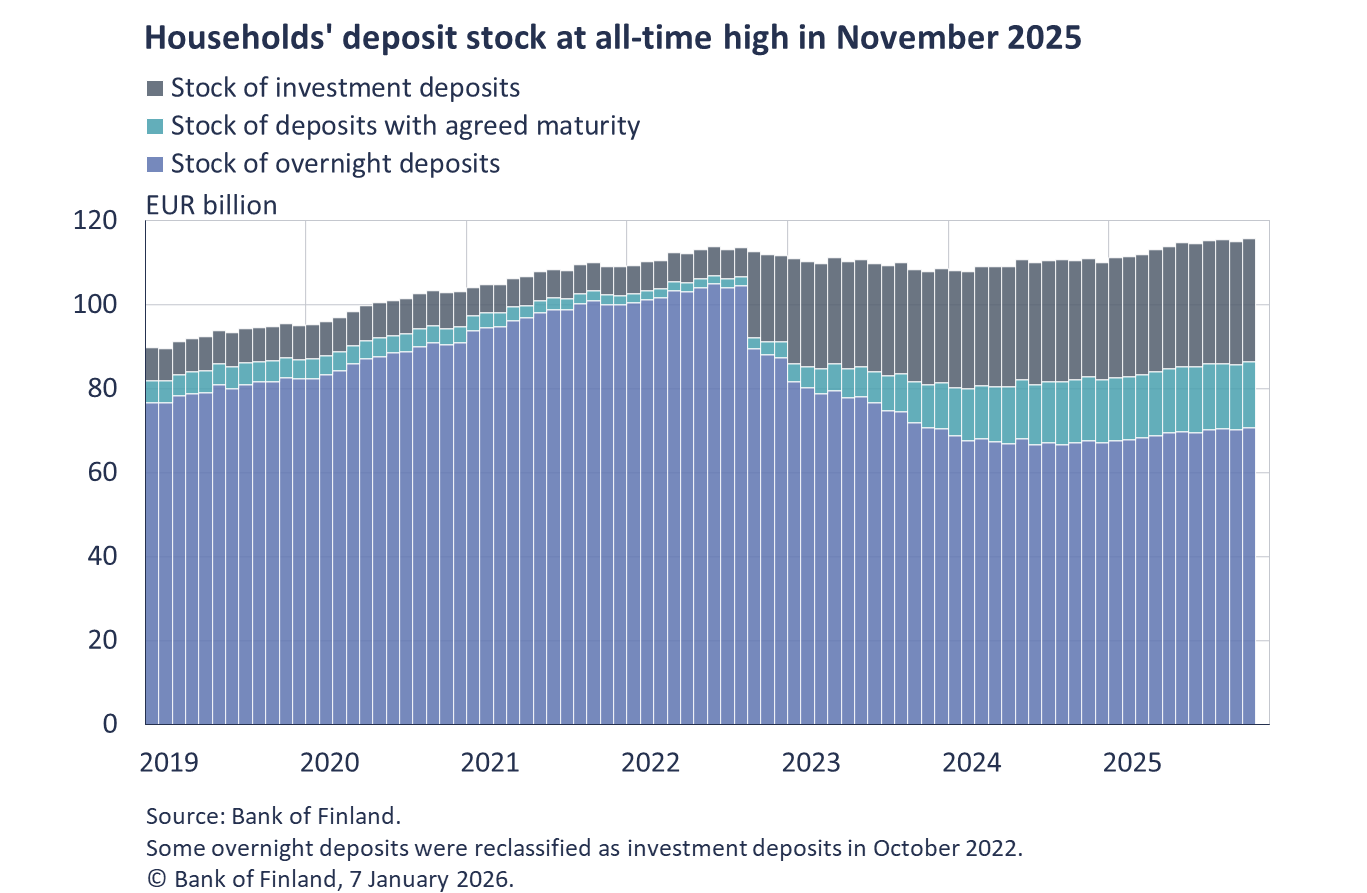

At the end of November 2025, Finnish households had deposits totalling EUR 115.7 billion, the highest nominal amount on record[1]. Of these deposits, EUR 70.7 billion (61%) were overnight deposits[2], EUR 29.4 billion (25%) investment deposits[3] and the remainder, EUR 15.7 billion (14%), deposits with agreed maturity.

The average interest rate on households' deposit stock at the end of November was 0.80%, which was 0.49 percentage points lower than in November 2024. Average interest rates on all deposit types declined compared to a year earlier. The average interest rate on the stock of overnight deposits was 0.38% at the end of November 2025 (0.52% in November 2024), on the stock of investment deposits 1.17% (2.14%) and on the stock of deposits with agreed maturity 1.98% (3.09%). The rates on investment deposits declined the most in relative terms from a year earlier. The average interest rate on new agreements on deposits with agreed maturity concluded in November 2025 fell by 0.79 percentage points year-on-year, from 2.98% to 2.19%.

Households' deposit stock grew by 4.3% in November 2025 year-on-year, compared with annual growth of 2.8% in November 2024. In January–November 2025, households increased their overnight deposits by the largest net amount, totalling EUR 3.5 billion. Over the same period, households placed a net EUR 1.4 billion in investment deposits and EUR 700 million in deposits with agreed maturity. Households concluded new agreements on deposits with agreed maturity amounting to EUR 1.2 billion in November 2025, which was nearly the same as in the corresponding period a year earlier despite the decline in interest rates. Of the new agreements on deposits with agreed maturity, 91% had a maturity of up to one year and the rest a longer maturity.

The deposit stock of Finnish non-financial corporations[4] and housing corporations has also grown. Corporations' deposit stock stood at EUR 46.7 billion at the end of November 2025 and its annual growth rate was 4.7%. Housing corporations' deposit stock stood at EUR 3.5 billion and its annual growth rate was 5.6%. The average interest rate on non-financial corporations' deposit stock was 0.99% (1.53% in November 2024) and on housing corporations' 0.23% (0.48%). Non-financial corporations concluded a high volume of new agreements on deposits with agreed maturity in November 2025, amounting to EUR 1.9 billion. The amount was 52%, or EUR 655 million, more than in November 2024. Over the same period, the average interest rate on corporations' new agreements on deposits with agreed maturity declined from 3.08% to 2.16%.

Loans

In November 2025, Finnish households drew down new housing loans amounting to EUR 1.20 billion, which was EUR 108 million less than a year earlier. Of the new housing loans drawn down, EUR 113 million were buy-to-let mortgage loans. The average interest rate on new housing loans rose slightly from October and stood at 2.85% in November. The stock of housing loans stood at EUR 105.9 billion at the end of November 2025 and annual growth in the housing loan stock was -0.1%. Buy-to-let mortgage loans accounted for EUR 9.1 billion of the housing loan stock. Of Finnish households' loans, consumer credit amounted to EUR 17.5 billion and other loans than housing loans or consumer credit to EUR 17.8 billion at the end of November.

In November, Finnish households drew down new loans[1] worth EUR 2.3 billion, including EUR 401 million of housing corporations’ loans. The average interest rate on new corporate-loan drawdowns rose from October by 0.15 percentage points to 3.47% November. At the end of November, the stock of loans granted to Finnish non-financial corporations stood at EUR 108.9 billion, including EUR 46.2 billion of loans to housing corporations.

| Loans and deposits to Finland, preliminary data | |||||

| September, EUR million | October, EUR million | November, EUR million | November, 12-month change1, % | Average interest rate, % | |

| Loans to households, stock | 141,073 | 141,094 | 141,174 | 0.1 | 3.32 |

| - of which housing loans | 105,720 | 105,780 | 105,867 | -0.1 | 2.78 |

| - of which buy-to-let mortgages | 8,998 | 9,033 | 9,063 | 2.88 | |

| Loans to non-financial corporations2, stock | 107,949 | 108,367 | 108,905 | 1.3 | 3.28 |

| Deposits by households, stock | 115,443 | 115,170 | 115,725 | 4.3 | 0.80 |

| Households' new drawdowns of housing loans | 1,270 | 1,354 | 1,205 | 2.85 | |

| - of which buy-to-let mortgages | 115 | 132 | 113 | 2.95 | |

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Imputed interest rate margins on loans from MFIs

Further information

Pauli Korhonen, tel. +358 9 183 2280, email: pauli.korhonen(at)bof.fi

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi.

The next news release on money and banking statistics will be published at 10:00 on 30 January 2026.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/statistics.

[1] The nominal amount includes deposits in all currencies with credit institutions operating in Finland.

[2] Overnight deposits include transaction accounts and other types of accounts from which funds may be withdrawn or transferred freely.

[3] Investment deposits are deposits redeemable at notice. They do not have a fixed maturity date (unlike deposits with agreed maturity), but they have a notice period during which the deposit cannot be converted into cash without consequences (unlike overnight deposits). This class also includes investment accounts without a period of notice or agreed maturity but which have restrictive drawing provisions.

[4] Non-financial corporations excluding housing corporations, sector S.111.