Drawdowns of vehicle loans declined in early 2025 year-on-year

The volume of new vehicle loans and other consumer credits granted by other financial institutions to Finnish households decreased year-on-year in the first quarter of 2025. The average interest rate on new consumer credits declined compared to the corresponding period in 2024.

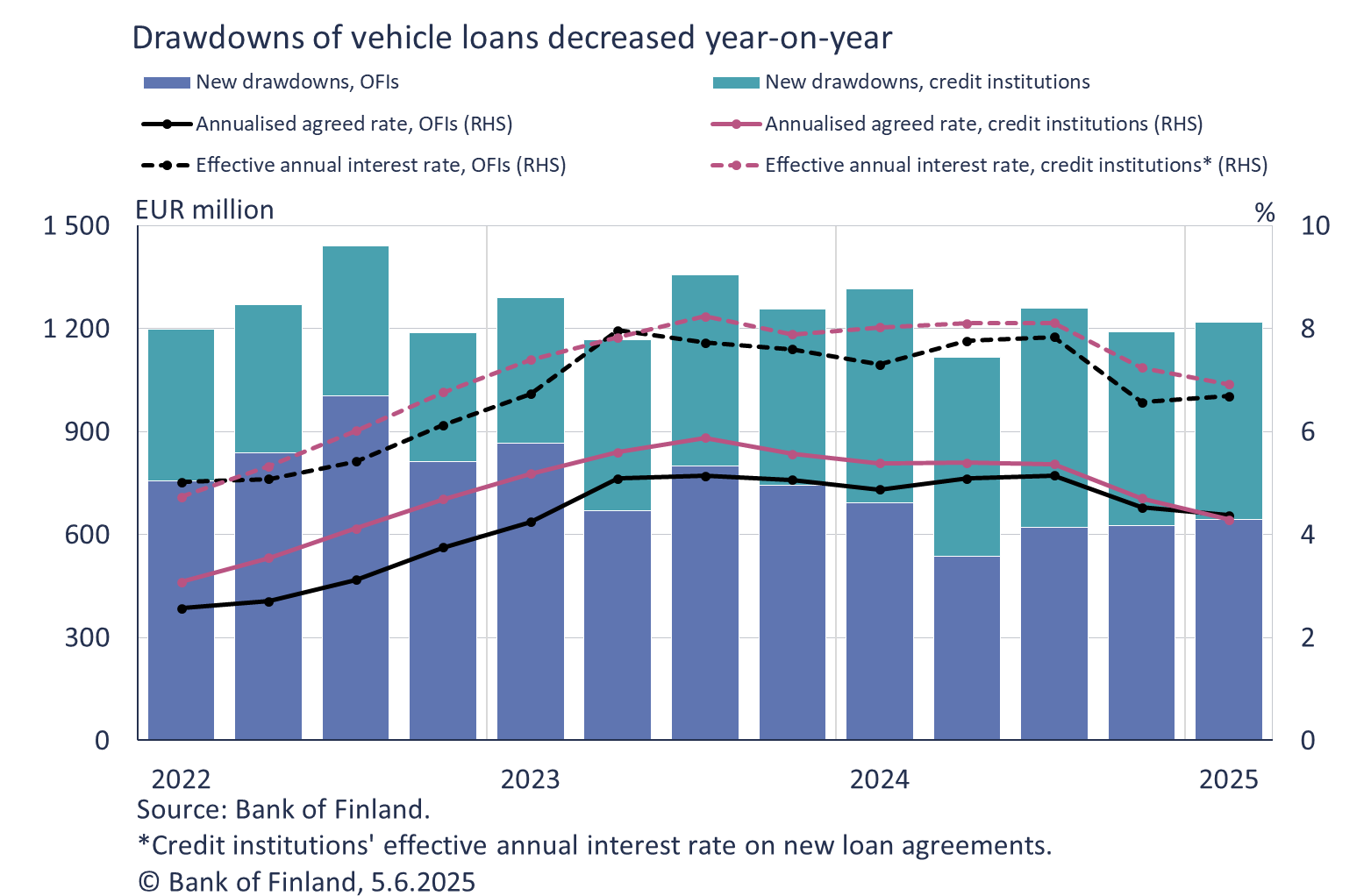

In the first quarter of 2025, other financial institutions (OFIs) granted a total of EUR 704 million in new consumer credits[1] to Finnish households. Consumer lending by OFIs concentrates on vehicle finance. EUR 644 million, or 91%, of the granted consumer credits were vehicle loans, with the remainder consisting of other consumer credits. The volume of vehicle loan drawdowns in the first quarter declined by 7% and that of other consumer credits by 5% compared to the corresponding period in 2024. The annualised agreed rate on new vehicle loans was 4.37%, which is 0.5 percentage points lower than a year earlier. In the first quarter of 2025, the average annualised agreed rate on other new consumer credits declined by over one percentage point year-on-year, from 9.85% to 8.69%. During the same period, the effective annual interest rate, which includes other expenses, on new vehicle loans fell from 7.30% to 6.69%, and that on other consumer credits declined from 13.43 percent to 12.67 percent

In addition to OFIs, consumer credits are granted by credit institutions operating in Finland (Finnish banks) and foreign credit institutions engaged in cross-border lending, which have increased their share of consumer lending in recent years. However, credit institutions lending across borders have a very low share of vehicle financing.[2] In the first quarter of 2025, banks operating in Finland granted new consumer credits1 in the amount of EUR 1.16 billion, almost 9% less than in the same period a year earlier. EUR 574 million, or roughly half of the total, consisted of vehicle loans. The volume of vehicle loan drawdowns declined by 8% year-on-year.

The stock of vehicle loans granted to Finnish households and held on OFIs’ balance sheets totalled EUR 3.3 billion at the end of the first quarter of 2025, with an average interest rate of 3.62%. Year-on-year, the stock contracted by 9.8%, and the average interest rate declined by 0.21 percentage points. However, not all vehicle loans granted by OFIs are held on their balance sheets. Securitised vehicle loans serviced by OFIs as off-balance-sheet items constitute a significant share of the total. At the end of the first quarter, the stock of Finnish banks’ vehicle loans was EUR 4.8 billion, with an average interest rate of 4.75%. The stock of vehicle loans granted by banks grew by 7.5%, and their average interest rate rose by 0.14 percentage points year-on-year. The combined stock of vehicle loans originated by OFIs and Finnish banks contracted by EUR 29 million year-on-year. Approximately two thirds of the stock of vehicle loans granted by OFIs and 90% of those granted by Finnish banks consist of fixed-rate loans.

The figures discussed in the release and their time series are available comprehensively in the dashboards for other financial institutions and banks.

The next news release on other financial institutions will be published on 4 September 2025.

VOLUME OF LOANS GRANTED BY OFIs TO FINNISH NFCs AND HOUSEHOLDS, 2025Q1:

|

|

Non-financial corporation loans (EUR million) |

Household loans (EUR million) |

|

Secured |

1,577 |

3,368 |

|

Unsecured and with collateral deficit |

3,478 |

474 |

|

Total |

5,055 |

3,842 |

[1] New loan drawdowns. New loan drawdowns and information on their interest rates do not include continuous overdrafts and credit card credits or non-recourse factoring.

[2] Sources: Positive Credit Register, Bank of Finland calculations.