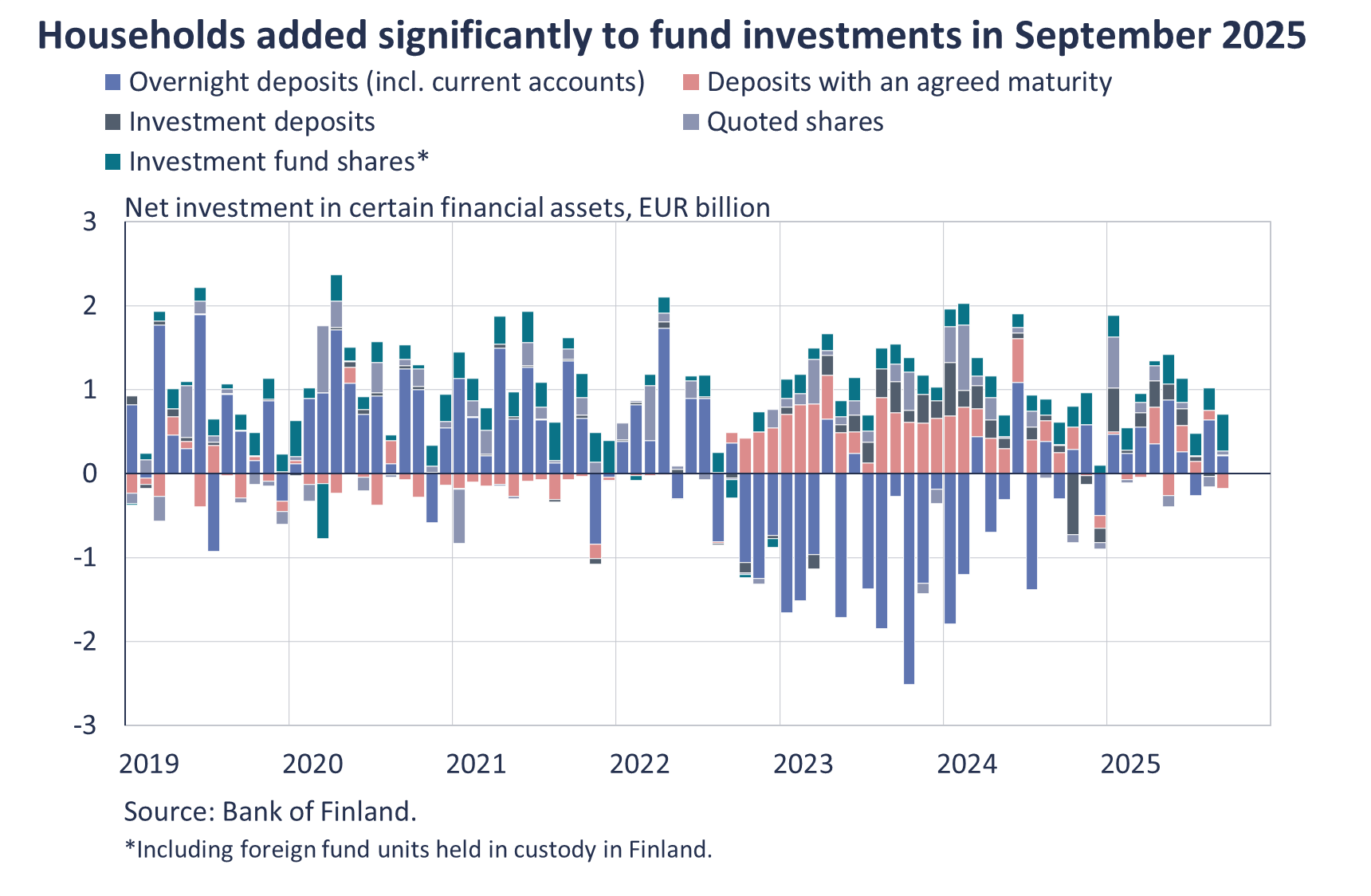

Households added significantly to investment fund holdings in September 2025

As a result of net subscriptions and positive value developments, households’ holdings in domestic investment funds reached an all-time high of EUR 41.6 billion at the end of September. Net subscriptions amounted to EUR 376 million, the highest monthly volume in the history of these statistics (since 2009).

In September 2025, Finnish households made more subscriptions than redemptions in Finnish investment funds[1]. Net subscriptions amounted to EUR 376 million, the highest monthly volume in the history of these statistics (since 2009). In January–September 2025, subscriptions were 19% higher than in the corresponding period of the previous year.

In September, the largest net investments (EUR 199 million) were in equity funds, followed by bond funds (EUR 110 million). In addition to new investments, the value of households’ domestic investment fund holdings appreciated by EUR 478 million in September. The largest value increases in September occurred in equity funds (EUR 290 million) and mixed funds (EUR 106 million).

As a result of net subscriptions and positive value developments, households’ holdings in domestic investment funds reached an all-time high of EUR 41.6 billion at the end of September. The majority of these holdings were in equity funds (44%), bond funds (28%) and mixed funds (19%).

In September 2025, Finnish households also made net subscriptions of EUR 62 million to foreign investment funds[2], bringing their total net subscriptions to investment funds to EUR 438 million for the month. At the end of September, households’ holdings in foreign investment funds also reached an all-time high of EUR 9.9 billion. The majority (77%) of households’ holdings in foreign investment funds were in equity funds. In addition, households hold significant amounts in domestic and foreign investment funds through unit-linked insurance policies.[3]

During 2025, domestic equities held by Finnish households have outperformed foreign equities

At the end of September 2025, households’ holdings of quoted shares[4] totalled EUR 54.8 billion, representing an increase of 9% year-on-year. During September 2025, households made net investments of EUR 47 million[5] in quoted shares. In addition, the value of these equity holdings increased by EUR 512 million in September.

In recent years, the share of foreign shares in households’ portfolios of quoted shares has increased. At the end of September 2025, their share was 15%, compared with 12% at the same time two years earlier.

In 2025, the return[6] on domestic equities held by households has been +22%, in contrast with foreign equities’ +5% return. Over the longer term, however, foreign shares have outperformed domestic ones. For example, from the start of 2023, the return on households’ foreign shares has been +35%, compared with +16% on domestic shares.

Finnish deposits and investments (EUR million), 2025Q3 |

||||||

| All** | Households | Employment pension schemes | ||||

| stock (flows) | change in valuation | stock (flows) | change in valuation | stock (flows) | change in valuation | |

| Finnish investments | ||||||

| Listed shares | 263 826 | 11 952 | 54 751 | 2 160 | 51 262 | 2 510 |

| (1 408) | (-64) | (1 070) | ||||

| - in domestic shares | 130 840 | 5 286 | 46 580 | 1 883 | 19 870 | 820 |

| (-665) | (-197) | (-248) | ||||

| Bonds | 237 883 | 502 | 2 376 | 38 | 29 315 | 90 |

| (-2 798) | (-45) | (-393) | ||||

| - in domestic bonds | 85 113 | 57 | 1 712 | 14 | 3 750 | 0 |

| (-6 852) | (-25) | (-62) | ||||

| Fund shares | ||||||

| Domestic investment funds | 140 991 | 4 368 | 41 590 | 1 369 | 6 040 | 170 |

| (294) | (687) | (70) | ||||

| Foreign funds | 210 840 | 5 419 | 9 872 | 467 | 155 074 | 3 389 |

| (2 580) | (277) | (1 736) | ||||

| Finnish bank deposits | ||||||

| Overnight deposits (transaction accounts) | 142 524 | -4 | 70 498 | 0 | 6 563 | 0 |

| (-1 189) | (593) | (-806) | ||||

| Other deposits | 53 199 | 1 | 44 945 | 0 | -* | -* |

| (-174) | (113) | -* | ||||

| * Confidential. | ||||||

| ** Insurance corporations' securities and mutual fund information is missing. | ||||||

Related statistical data and graphs are also available on the Bank of Finland website at: https://www.suomenpankki.fi/en/statistics.

The next news release on saving and investing will be published at 10 am on 10 February 2026.

[1] Including UCITS and non-UCITS funds registered in Finland.

[2] Investment fund units held in custody in Finland.

[3] Households’ investment fund holdings increased in 2024.

[4] Held in custody in Finland.

[5] Purchases – sales.

[6] The return is calculated based on monthly revaluation adjustments (price and currency change) of the shares and dividends received.