Growth in household deposit stock

At the end of March 2025, the stock of Finnish households’ deposits (EUR 112.1 billion) was EUR 3 billion higher than at the same time a year earlier. The average interest rates on higher-interest deposits, i.e. agreed-maturity and investment deposits, turned to a decline in the course of 2024. As the level of interest rates declined, households’ investments in higher-interest deposits have decreased.

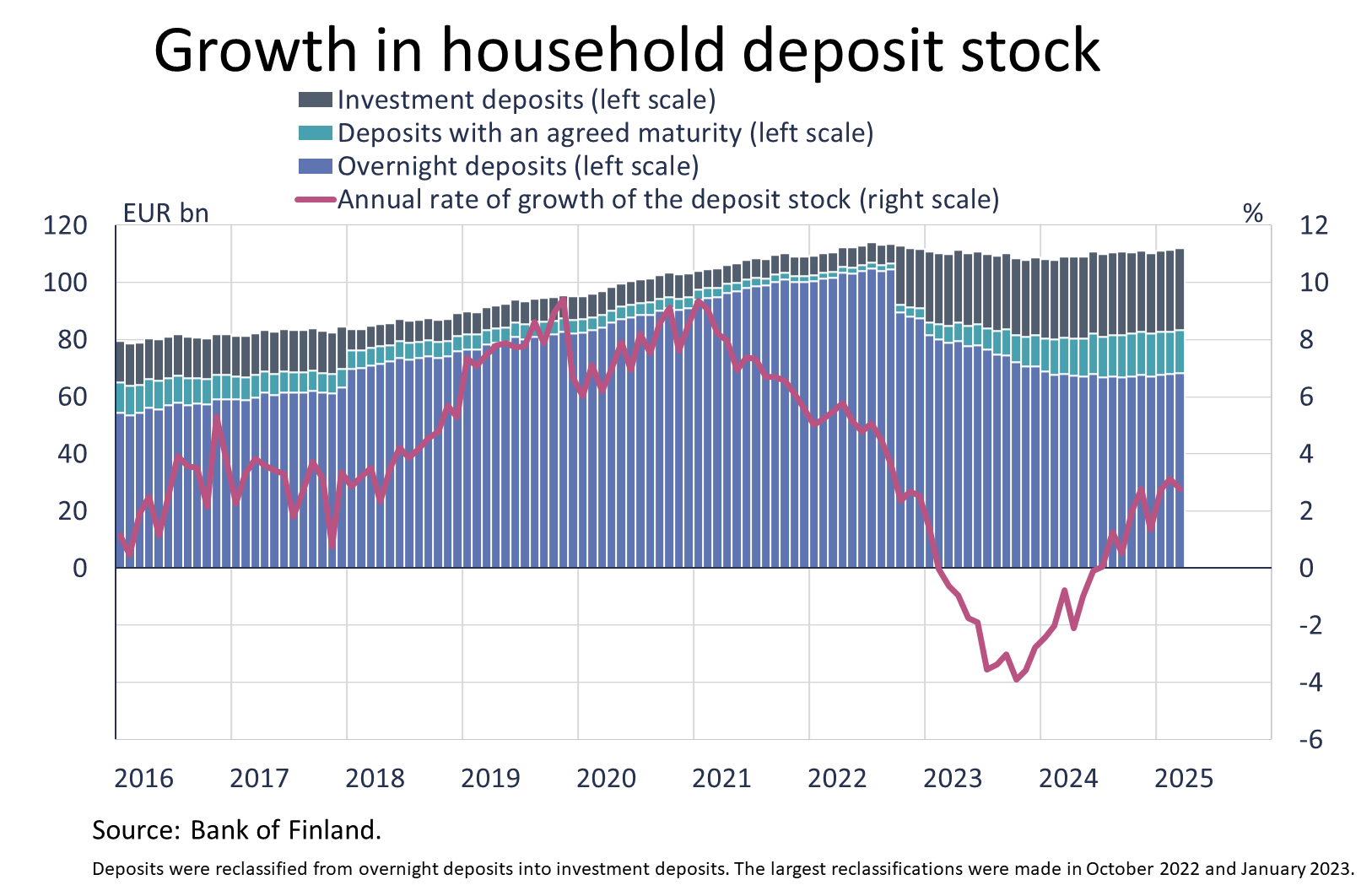

At the end of March 2025, the stock of Finnish households’ deposits (EUR 112.1 billion) was EUR 3 billion higher than at the same time a year earlier. The last time the deposit stock was higher was in 2022. In July 2022, it had reached its all-time high at almost EUR 114 billion. At the end of March 2025, EUR 68.4 billion of households’ deposits were overnight deposits[1], EUR 14.9 billion were deposits with an agreed maturity and EUR 28.8 billion were investment deposits[2].

In March 2025, the annual rate of change of the deposit stock was +2.8%, as opposed to a contraction of -0.8% in the same period a year earlier. Just a year ago, the overnight deposit stock contracted at a rate of -13.8%, but in March 2025, it showed growth of +0.6%. In 2025, the stock of overnight deposits turned to positive growth for the first time since the end of 2022. In contrast, the growth of higher-interest deposit stocks has slowed down. In March 2025, the annual rate of growth of the stock of deposits with an agreed maturity slowed down to +16.9%, as opposed to over +100% in March last year. The growth rate of the investment deposit stock also slowed down during the year from +13.1% to +1.6%.

The average interest rates on higher-interest deposits, i.e. agreed-maturity and investment deposits, turned to a decline in the course of 2024. As the level of interest rates declined[3], households’ investments in higher-interest deposits have decreased. In the first quarter of 2025, households reduced EUR 80 million from agreed-maturity deposit accounts, whereas just a year ago, these accounts saw inflows of EUR 1.8 billion over the same period. Investment deposit accounts saw inflows of EUR 740 million, as opposed to EUR 1.1 billion in the same period last year. Correspondingly, the assets on households’ overnight deposit accounts (incl. transaction accounts), grew by EUR 1.3 billion, as opposed to a decline of EUR 2.6 billion in the same period a year earlier. In total, the assets on deposit accounts grew by EUR 1.9 billion in the first quarter of 2025.

In March 2025, the average interest rate on the stock of deposits with an agreed maturity stood at 2.59%, as opposed to over 3% in March last year. The average interest on new agreements with an agreed maturity declined by over a percentage point during the year, to 2.45% in March 2025. The average interest rate on the stock of investment deposits declined by over 0.9 percentage points year-on-year, to 1.62% at the end of March 2025. In March 2025, the interest rate on overnight deposits (0.49%) was almost the same as a year earlier. At the end of March 2025, the average interest rate on the deposit stock was 1.06%.

Finnish deposits and investments (EUR million), 2025Q1 |

||||||

| All** | Households | Employment pension schemes | ||||

| stock (flows) | change in valuation | stock (flows) | change in valuation | stock (flows) | change in valuation | |

| Finnish investments | ||||||

| Listed shares | 239 865 | -954 | 49 366 | 2 163 | 45 368 | -525 |

| (3 507) | (693) | (-83) | ||||

| - in domestic shares | 118 420 | 4 867 | 42 183 | 2 423 | 17 915 | 646 |

| (535) | (366) | (190) | ||||

| Bonds | 239 902 | -343 | 2 289 | 20 | 29 005 | -350 |

| (6 455) | (-172) | (1 151) | ||||

| - in domestic bonds | 92 075 | -302 | 1 663 | 27 | 3 557 | -15 |

| (-658) | (-111) | (-302) | ||||

| Fund shares | ||||||

| Domestic investment funds | 132 479 | -2 580 | 38 173 | -839 | 5 677 | -15 |

| (1 728) | (339) | (43) | ||||

| Foreign funds | 189 123 | 393 | 8 544 | 281 | 137 629 | -2 751 |

| (1 913) | (287) | (864) | ||||

| Finnish bank deposits | ||||||

| Overnight deposits (transaction accounts) | 138 987 | -47 | 68 421 | -3 | 5 435 | -2 |

| (352) | (366) | (-985) | ||||

| Other deposits | 52 360 | -9 | 43 647 | 0 | -* | -* |

| (296) | (660) | -* | ||||

| * Confidential. | ||||||

| ** Insurance corporations' securities and mutual fund information is missing. | ||||||

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/statistics/.

The next news release on saving and investing will be published at 10 am on 7 August 2025.

[1] Overnight deposits include transaction accounts and other types of accounts from which funds may be withdrawn or transferred freely.

[2] Investment deposits are deposits redeemable at notice. They do not have a fixed maturity date (unlike deposits with an agreed maturity), but they have a notice period, during which the deposit cannot be converted into cash without consequences (unlike overnight deposits). This class also includes investment accounts without a period of notice or agreed maturity but which have restrictive drawing provisions.

[3] After interest rates rose, Finnish households shifted significant volumes of assets to higher-interest deposit accounts.