Household deposit stock at all-time high in June

At the end of June 2025, the stock of Finnish households’ deposits (EUR 114.7 billion) stood at an all-time high. Deposit interest rates have declined. At the end of June 2025, households’ holdings of quoted equities totalled EUR 52.4 billion, representing an increase of 8% year-on-year.

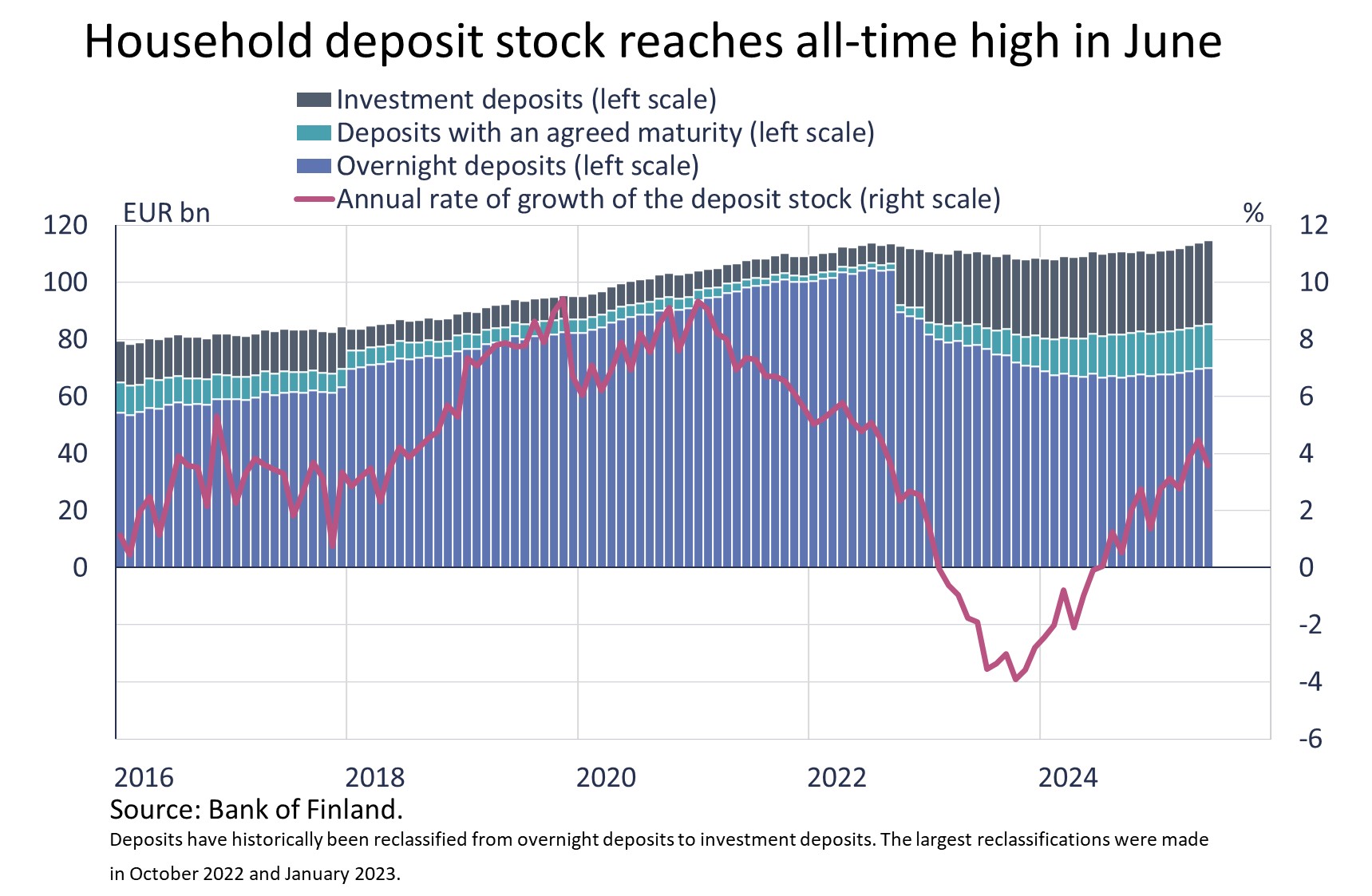

At the end of June 2025, the stock of Finnish households’ deposits (EUR 114.7 billion) stood at an all-time high. It was almost EUR 4 billion higher than at the same time a year earlier. At the end of June, EUR 69.9 billion of households’ deposits were overnight deposits[1], EUR 15.4 billion were deposits with an agreed maturity[2], and EUR 29.4 billion were investment deposits[3]. In June, the year-on-year rate of growth for overnight deposits was 2.7%, for deposits with an agreed maturity 10.1% and for investment deposits 2.5%.

Deposit interest rates have declined. At the end of June 2025, the average interest rate on deposits with an agreed maturity stood at 2.30%, compared with 3.17% in June last year. The average interest rate on new deposit agreements with an agreed maturity fell by almost 1.4 percentage points over the same period, reaching 2.18% in June 2025. The average interest rate on the stock of investment deposits decreased by over one percentage point from a year earlier, to 1.28% at the end of June 2025. In June 2025, the interest rate on overnight deposits (0.36%) was 0.11 percentage points lower than at the same time a year earlier. At the end of June, the average interest rate on the aggregate deposit stock was 0.86%.

Households increased investments in equities and funds

At the end of June 2025, households’ holdings of quoted equities[4] totalled EUR 52.4 billion, representing an increase of 8% year-on-year. In the second quarter of 2025, households invested a further EUR 120 million in net terms[5] in listed equities. Over the same period, the value of the equity holdings increased by EUR 2.7 billion. The all-time high value of equity holdings to date was in August 2021, at EUR 56.1 billion.

In the second quarter of 2025, households made more subscriptions to Finnish investment funds[6] than redemptions from them. In net terms, the new investments amounted to EUR 400 million.

In addition to new investments, the value of domestic investment fund holdings appreciated by EUR 960 million in the second quarter of 2025.

At the end of June, households’ investments in domestic investment funds totalled EUR 39.5 billion, just below the record high level of February 2025 (EUR 39.7 billion). Most of the fund investments were in equity funds (43%), bond funds (28%) and mixed funds (19%).

In the second quarter of 2025, Finnish households also invested a further EUR 300 million in net terms in foreign investment funds[7]. At the end of June, households held foreign investment fund units worth EUR 9.1 billion.

| Finnish deposits and investments (EUR million), 2025Q2 | ||||||

| All** | Households | Employment pension schemes | ||||

| stock (flows) | change in valuation | stock (flows) | change in valuation | stock (flows) | change in valuation | |

| Finnish investments | ||||||

| Listed shares | 249 980 | 10 533 | 52 352 | 2 716 | 47 568 | 1 631 |

| (-345) | (122) | (608) | ||||

| - in domestic shares | 126 250 | 7 597 | 44 894 | 2 506 | 19 298 | 1 192 |

| (230) | (1) | (192) | ||||

| Bonds | 240 191 | -780 | 2 382 | 47 | 29 610 | -518 |

| (1 185) | (48) | (1 121) | ||||

| - in domestic bonds | 91 912 | 598 | 1 723 | 18 | 3 814 | 21 |

| (-687) | (42) | (235) | ||||

| Fund shares | ||||||

| Domestic investment funds | 136 324 | 3 027 | 39 533 | 962 | 5 668 | 103 |

| (819) | (397) | (-112) | ||||

| Foreign funds | 191 735 | -2 591 | 9 110 | 268 | 138 860 | -3 419 |

| (1 709) | (302) | (1 152) | ||||

| Finnish bank deposits | ||||||

| Overnight deposits (transaction accounts) | 143 718 | -232 | 69 905 | -13 | 7 370 | -18 |

| (4 963) | (1 497) | (1 952) | ||||

| Other deposits | 53 372 | -24 | 44 832 | -2 | -* | -* |

| (1 036) | (1 187) | -* | ||||

| * Confidential. | ||||||

| ** Insurance corporations' securities and mutual fund information is missing. | ||||||

Related statistical data and graphs are also available on the Bank of Finland website: suomenpankki.fi/en/statistics.

The next news release on saving and investing will be published at 10 am on 10 November 2025.

[1] Overnight deposits include transaction accounts and other types of accounts from which funds may be withdrawn or transferred freely.

[2] Deposits with an agreed maturity include savings deposits for first home purchase (ASP deposits).

[3] Investment deposits are deposits redeemable at notice. They do not have a fixed maturity date (unlike deposits with an agreed maturity), but they have a notice period during which the deposit cannot be converted into cash without consequences (unlike overnight deposits). This class also includes investment accounts that do not have a period of notice or agreed maturity but have restrictive drawing provisions.

[4] Held in custody in Finland.

[5] Purchases – sales.

[6] Including UCITS and non-UCITS investment funds registered in Finland.

[7] Investment fund units held in custody in Finland.