Euribor rates have increased their popularity as reference rates for new housing loans throughout the early part of the year. In March 2012, as much as 84% of new housing loans were linked to a Euribor rate. As in the previous months, 11% of new housing-loan drawdowns were linked to a fixed rate and almost 6% to banks' own reference rates. In December 2011, as much as 12% of new housing loans were still linked to prime rates. The fall in Euribor rates and their increased popularity has also induced a drop in average interest rates on new housing loans in the early part of the year. In March 2012, the average interest rate on new housing-loan drawdowns was 2.23%.

Loans

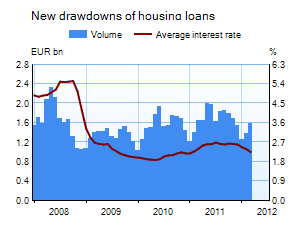

Households' new drawdowns of housing loans amounted to EUR 1.6 bn in March 2012, which is almost as much as a year earlier. The average interest rate on new housing-loan drawdowns fell by 0.14 percentage point from February, to 2.23%. At end-March the stock of euro-denominated housing loans amounted to EUR 82.5 bn and carried an average interest rate of 2.34%. The annual growth rate of the housing loan stock increased from February, to 6.5% in March.

New drawdowns of loans to non-financial corporations (excluding overdrafts and credit card credit) amounted to EUR 2.0 bn in March, which is about EUR 300 m more than a year earlier. The average interest rate on new corporate loans fell to 2.19%, from 2.30% in February. At end-March the stock of euro-denominated loans to non-financial corporations amounted to EUR 61.9 bn, of which loans to housing corporations totalled EUR 14.4 bn. The annual growth rate of the corporate loan stock accelerated to 7.9%, from 7.4% in February.

Deposits

At end-March the stock of household deposits totalled EUR 82.1 bn. The average interest rate on the stock was 1.02%. Households concluded new agreements on deposits with an agreed maturity in the amount of EUR 2.3 bn. The average interest rate on these fell to 1.82%, from 1.89% in February.

In the first quarter of 2012 households concluded 2,475 new long-term savings contracts. At end-March the total number of long-term savings contracts was 20,885. In January-March households deposited EUR 5.1 m in long-term savings accounts. At end-March long-term savings accounts amounted to EUR 31.9 m..

Notes:

MFIs comprise all monetary financial institutions operating in Finland.

Loans and deposits comprise all euro-denominated loans and deposits vis-à-vis the euro area as a whole, with countries other than Finland accounting for a very small share of total volumes.

Key figures of Finnish MFIs' loans and deposits, preliminary data

| January, EUR million |

February, EUR million |

March, EUR million |

March, 12-month change1, % |

March, | |

| Loans to households2, stock | 109.726 | 109.984 | 110.468 | 5.4 | 2.70 |

| - of which housing loans | 81.884 | 82.119 | 82.546 | 6.5 | 2.34 |

| Loans to non-financial corporations2, stock | 60.997 | 61.647 | 61.927 | 7.9 | 2.52 |

| Deposits by households2, stock | 81.894 | 81.636 | 82.066 | 5.0 |

1.02 |

| Households' new drawdowns of housing loans | 1.252 | 1.370 | 1.586 | – | 2.23 |

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Households also include non-profit institutions serving households; non-financial corporations also include housing corporations.

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Analytical accounts of the banking sector (MFIs) in Finland

For further information, please contact Jussi Pajunen, tel. +358 10 831 2343, email: jussi.pajunen(at)bof.fi

The next news release will be published at 1 pm on 31 May 2012.