Electronic payment instruments

To put it simply, payment is the transfer of money from one party to another, and it is a key factor in all economic activity. The digitalisation of the economy also affects the development of payment. As a result of the increase in e-commerce and developments in mobile technology, the range of payment applications has expanded significantly in recent years. This trend is likely to continue.

Despite the flood of new payment applications for customers, payment is still based largely on the use of conventional electronic payment instruments, particularly payment by card. Credit transfer and card payment are the preferred electronic payment instruments in Finland. Less common payment instruments are direct debit and cheques. The use of various payment instruments is shown in payments statistics.

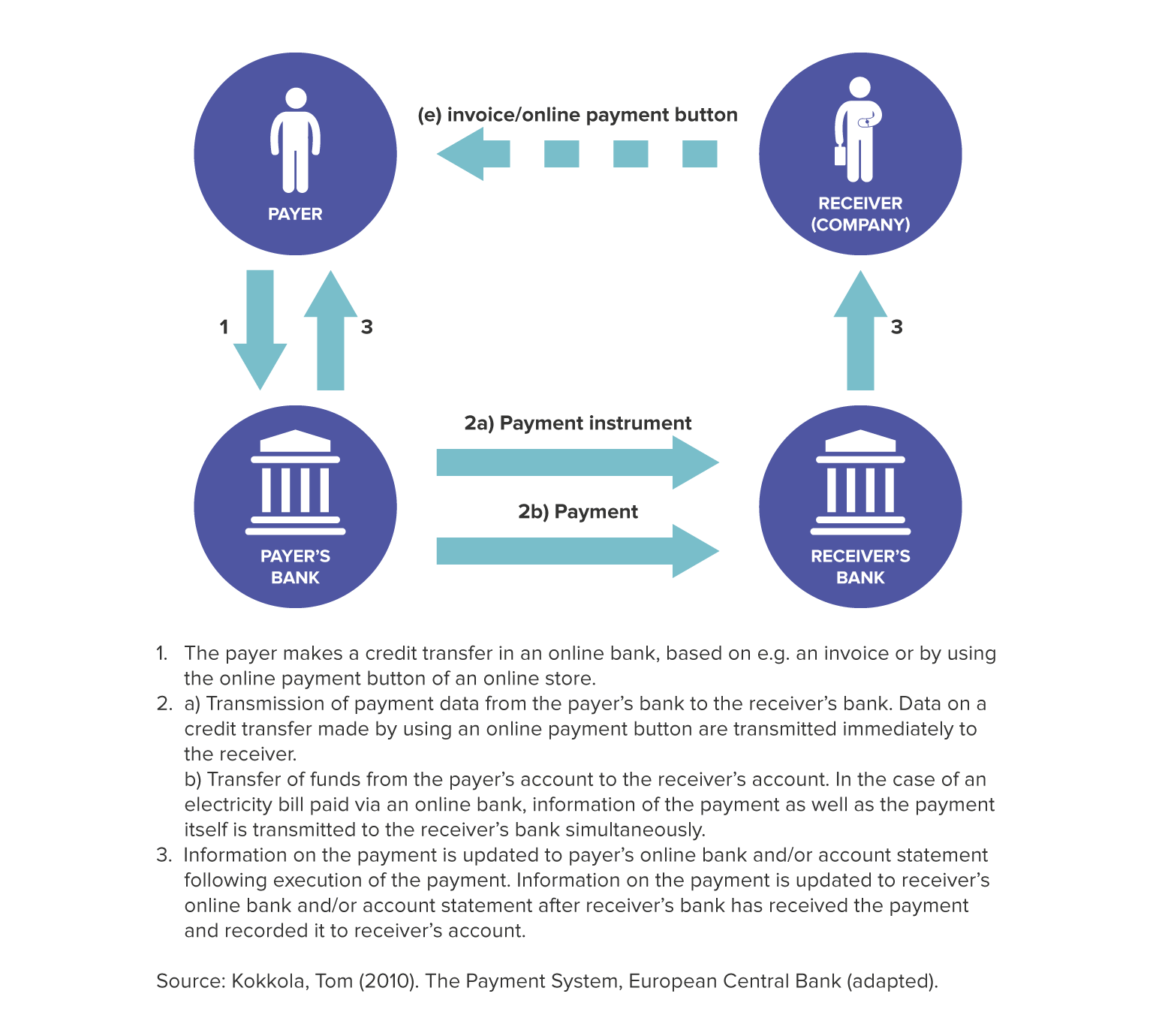

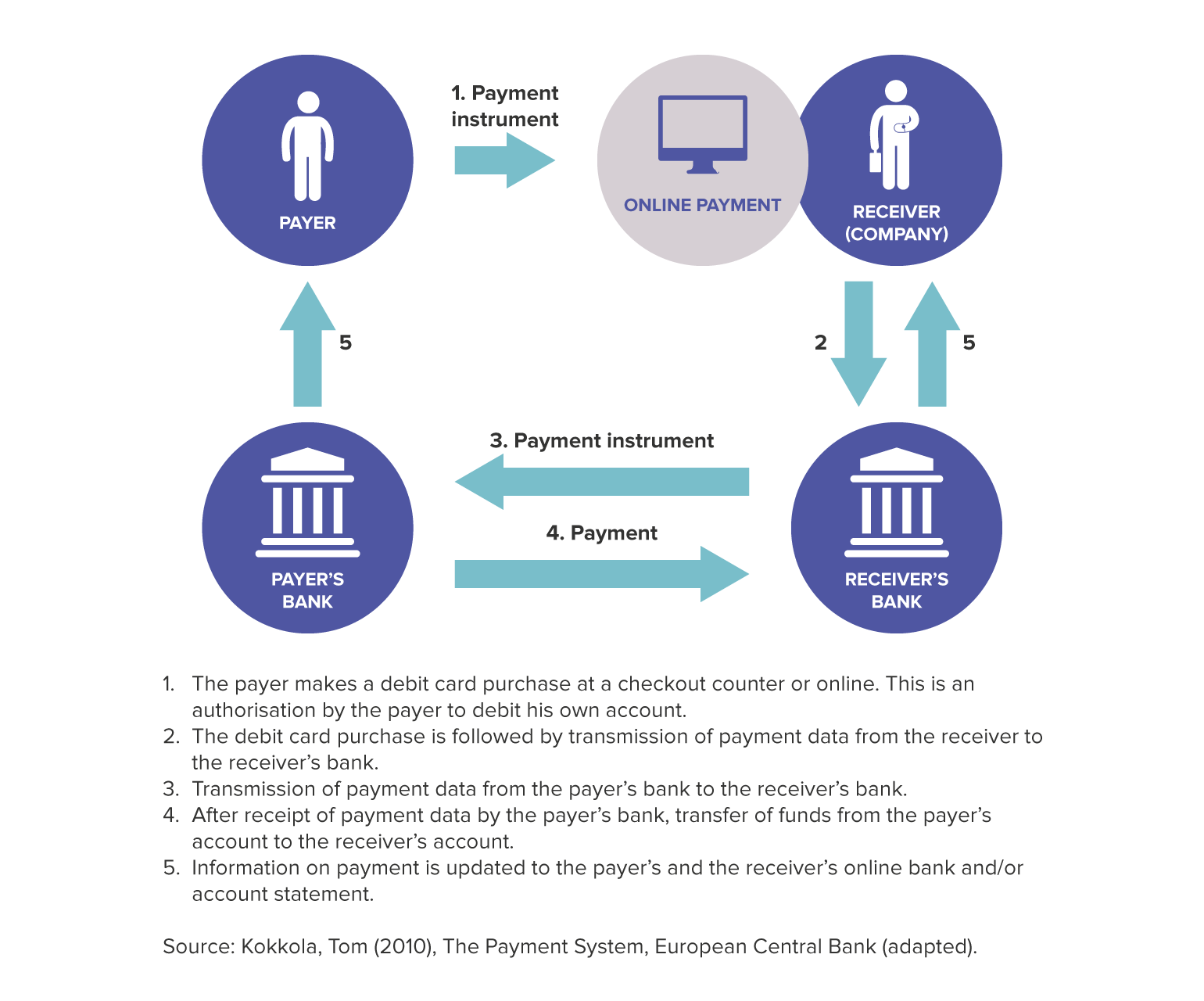

Payment instruments differ from each other in terms of operating principles and they are mainly either credit- or debit-based. In the case of a credit-based payment instrument, the payer himself or herself initiates the payment transaction by, for example making a credit transfer in his or her online bank, for the payment an electricity bill. In the case of a debit-based payment instrument, the payment transaction is initiated by the payee. For example, in card payments, the card data entered in an online shop authorise the payee's bank to transfer to the payer's bank a request to debit the account.

Credit-based payment instrument (e.g. credit transfer)

Debit-based payment instrument (e.g. payment card)

Finland is part of the Single Euro Payments Area (SEPA). In the SEPA, there is no distinction between cross-border and domestic payments, and these payments are subject to the same technical and business requirements. In Finland, SEPA Credit Transfer (SCT) replaced the national credit transfer by the end of October 2011. National direct debits, in turn, were in Finland replaced mainly by changing over to the use of the e-invoice by the end of January 2014, instead of migration to SEPA Direct Debit (SDD). In the euro area countries, the end-date for migration to SEPA instruments was 1 August 2014.

Payment infrastructures

After receiving a payment instruction, banks have several ways of transferring the payment from the payer's bank to the payee's bank. If the payer's and the payee's accounts are with the same bank, the payment is transferred as the bank's internal transaction. If the payer's and the payee's accounts are with different banks, the payment is transferred either via the correspondent banking network or payment systems.

In correspondent banking, payments are executed mostly based on bilateral agreements and arrangements between banks, via the banks' accounts. Nowadays, the majority of electronic payments between banks are, however, transferred via payment systems, where the final settlement takes place in central bank money, between the banks' accounts held with the central bank.

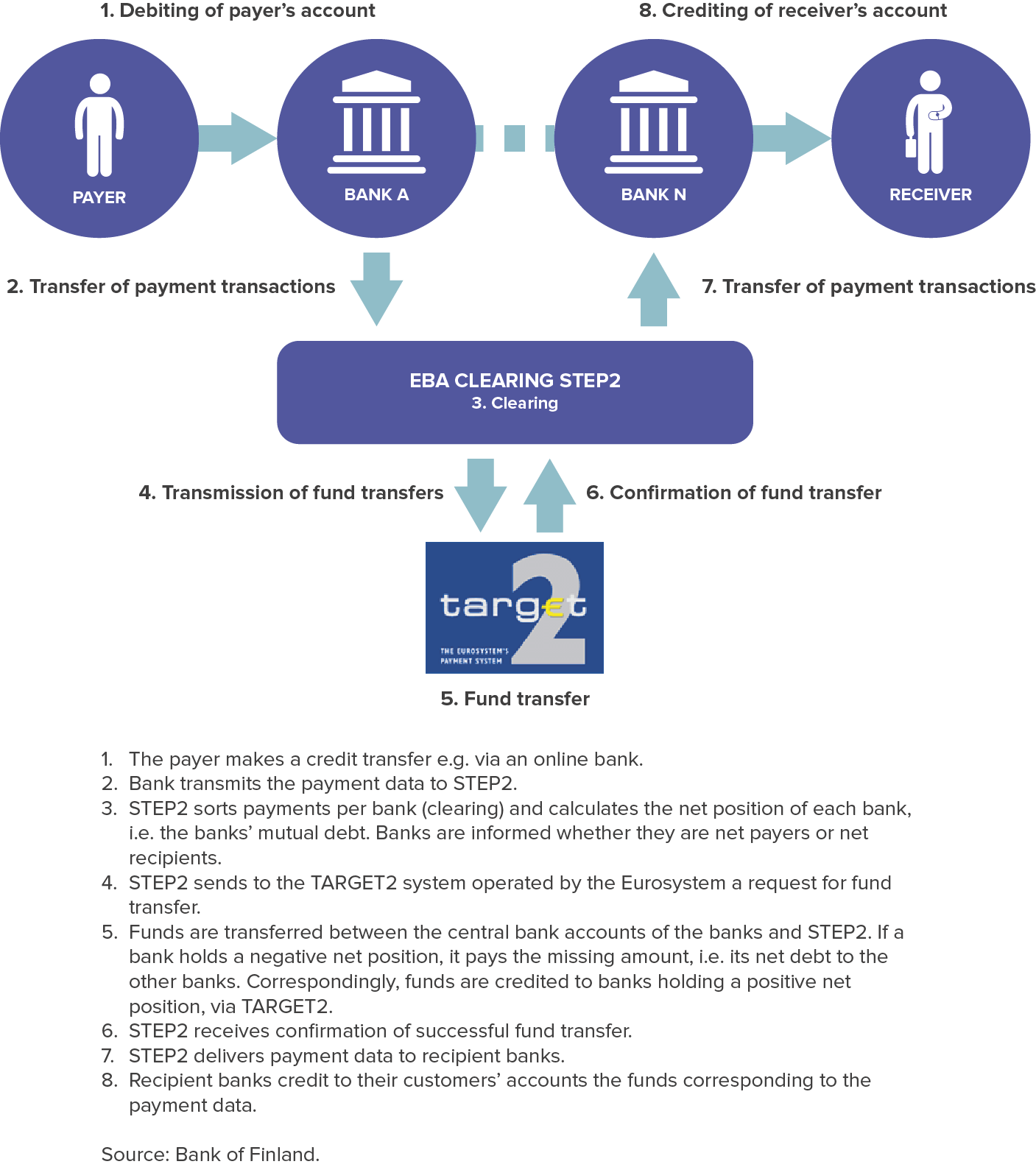

Payment systems – payment infrastructures – refer to multilateral arrangements and systems that are used for transferring electronic payments between payer and payee. For Finland, the most significant system related to retail payments is the pan-European STEP2 system, managed by EBA Clearing and used by banks operating in Finland for the processing of credit transfers and direct debits throughout the euro area. STEP2 sorts the payments received from banks per recipient bank and calculates, based on outgoing and incoming payments, a net credit or debit position for each bank. This process is referred to as clearing. After clearing, settlement is effected in TARGET2, in the participant banks' accounts.

TARGET2 (Trans-European Automated Real-time Gross settlement Express Transfer system) is a settlement system operated by the Eurosystem. Following the transfer of funds in TARGET2, banks receive information on the individual payments and record the payments to their customers' accounts. The clearing and settlement of Finnish credit transfers take place, as a rule, after midnight for payments executed on the previous day (T+1).

Transmission of SEPA credit transfers via STEP2

The other payment systems used by Finnish banks are POPS, EURO1 and CLS. POPS is the domestic banks’ online payment system for interbank express transfers and cheques. EURO1 is a large-value payment system operated by EBA Clearing. It processes domestic and cross-border transactions in euros, both customer payments and interbank payments. EURO1 is a multilateral net settlement system in which the funds for the settlement of payments are transferred via TARGET2 once a day in the afternoon. CLS (Continuous Linked Settlement) is a global multilateral netting system for foreign exchange transactions, operating on the payment-versus-payment (PvP) principle. The system is operated by CLS Bank. All these systems use TARGET2 for the settlement of euro-denominated payments.

Bank of Finland’s guiding principles on electronic payments

Read more about the guiding principles in the speech by Board Member Tuomas Välimäki: Guiding principles on electronic payments, opening remarks at Payments Forum, 25 May 2022 (in Finnish).

The development of payments in Finland is discussed in detail in a Bank of Finland publication on the Bank of Finland's role in the development of payments from national systems to pan-European systems Suomen Pankin rooli maksuliikkeen kehityksessä: kansallisista järjestelmistä yhteiseurooppalaisiin järjestelmiin.

The operation of payment and settlement systems in the euro area is described in the book The Payment System – Payments, Securities and Derivatives, and the Role of the Eurosystem.