Introduction

The Bank of Finland is Finland’s monetary authority and national central bank. Its tasks include the management of its own financial assets, such as the foreign reserves as well as the management of the Bank´s share of the ECB's foreign reserves. Through its investment activities, the Bank of Finland secures the value of its financial assets and its ability to support the liquidity of the banking system, whenever necessary. The Bank of Finland invests and manages its financial assets in accordance with central bank objectives and taking into account the risks and responsibility aspects related to investment activities. Responsible investment generally means the appropriate recognition of environmental, social and corporate governance issues in investment activities.

These priciples applies to the Bank of Finland’s own financial assets, the management principles for which the Bank decides for itself. The principles do not, therefore, apply to, for example, the ECB's asset purchase programmes,management of the ECB's foreign reserves or holdings of special drawing rights (SDRs) allocated by the International Monetary Fund (IMF).

Responsible investment at the Bank of Finland

The foundations of our sustainability lie in our core activities. Our mission is based on building economic stability and, therewith, promoting the wellbeing of the population. Climate risk management is a key focus area in our responsibility programme, introduced in 2019. We also contribute to climate action through responsible investment. By signing the UN-backed Principles for Responsible Investment (PRI) in December 2019, we have committed ourselves to incorporating environmental, social and corporate governance issues into our investment decisions and ownership policies and practices. To us, signing these principles means that sustainability is a key criterion in our investment activities; we actively develop our responsible investment practices and report annually on our progress. Responsible investment does not weaken the risk-return ratio of our investment portfolio.

Responsible investment

In addition to maintaining responsible practices in our own investment activities, we endeavour to promote responsible investment by playing an active role in various networks and by participating in public discussions.

In our activities and reporting, we adhere to a selection of international recommendations, within the limits of our tasks as a central bank. We report annually on responsible investments concerning our financial reserves, not only in our annual report but also in accordance with the PRI reporting framework. Our reports will also draw on the recommendations issued by the NGFS (Central Banks and Supervisors Network for Greening the Financial System) and the TCFD (Task-Force for Climate-Related Financial Disclosure).

The Bank of Finland’s approaches to responsible investment

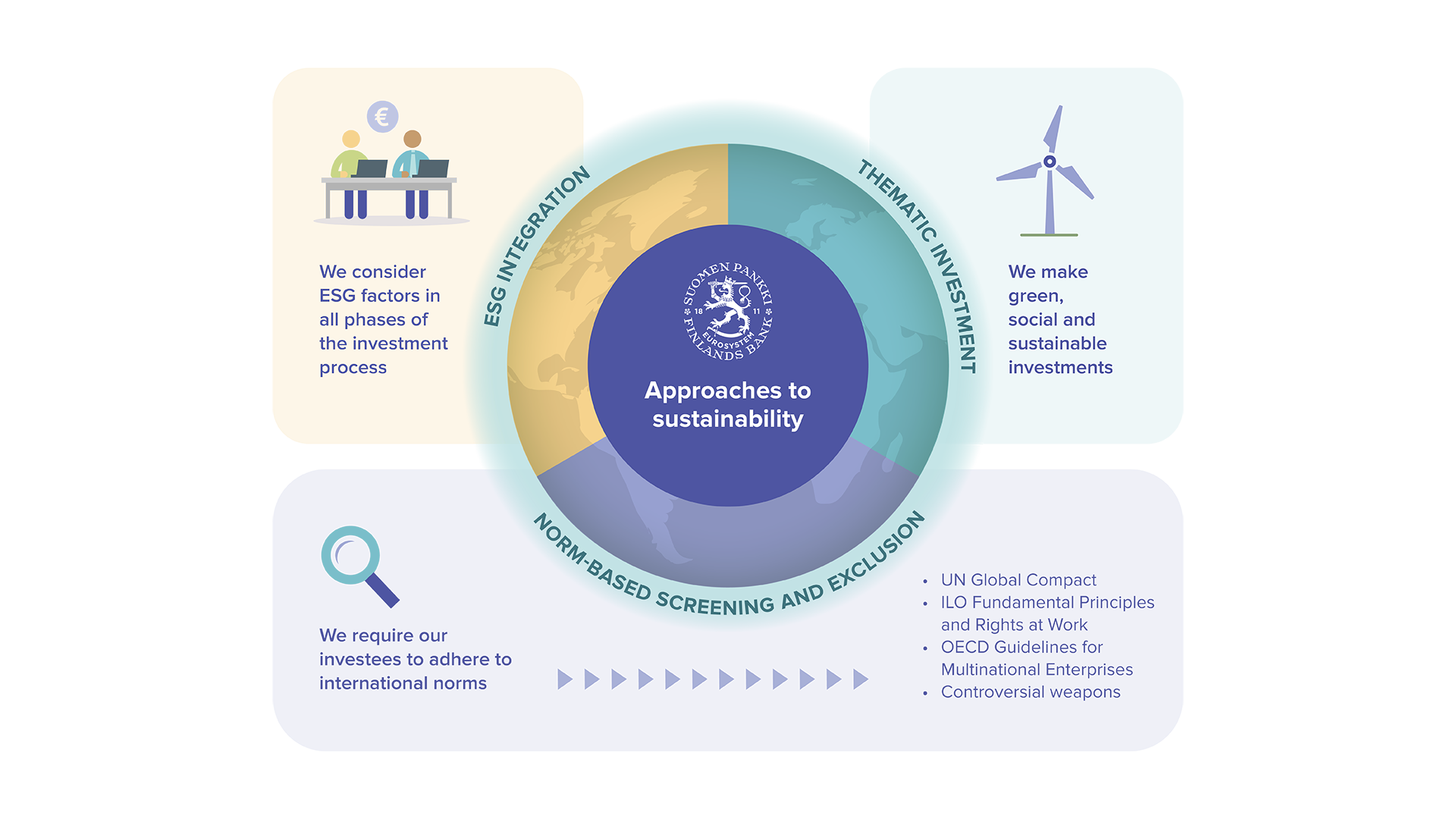

From the various approaches to responsible investment, investors can choose those most suited to their own investment strategies. We have chosen ESG integration, norm-based screening and thematic investments as components in our responsible investment activities. We are not currently investing directly in equities, and therefore our emphasis on active ownership, voting and engagement, in particular,relates to integrating responsible investment practices when we select and monitor asset managers.

Approaches to sustainability

ESG integration

ESG integration means including responsibility criteria alongside the traditional financial factors in investment decisions. Our portfolio managers consider ESG factors and employ both external and internal resources when assessing the sustainability of investments and potential investments. In indirect investments, our emphasis is on assessing asset managers from the perspective of responsible investment practices. Active ownership is assessed on a fund-by-fund basis. Individual investees may be brought up in meetings with asset managers, if necessary. The Bank of Finland’s own questionnaire or a questionnaire already widely used in the sector is sent to asset managers each year. This serves to monitor the sustainability aspects in the funds the Bank of Finland invests in and asset managers’ general measures to develop their responsible investment policies.

ESG integration also includes the identification of opportunities and risks associated with climate change and impact analysis. Climate change has become one of the main issues to be considered in recent years. The Bank of Finland’s sustainability programme published in December 2019, also focuses in the next few years on three areas: the promotion of sustainable growth and wellbeing, making an impact using information and cooperation, and the management of climate risks. The aim is to provide comprehensive climate data both for portfolio managers and for impact reporting during 2021.

Norm-based screening and exclusion

In addition to adherence to regulations, the minimum requirement for our direct investments is that investees comply with internationally accepted standards, or ‘norms’. In this context, these are, for example, the United Nations Global Compact principles, the International Labour Organisation’s fundamental principles and rights at work and the OECD Guidelines for Multinational Enterprises. We do not make direct investments in companies that manufacture prohibited/controversial weapons as defined in international treaties.

Our portfolio managers use external service providers’ analyses to screen direct investments, asset managers and counterparties. Although norm-based screening does not extend to external asset managers’ portfolios, we carry out such screening of asset management companies and counterparties whenever possible. Norm-based screening is also one part of the selection of external asset managers.

If we are holding a company among our direct investments that does not meet our responsibility criteria based on norm-based screening, we will refrain from new investments in said company. If a company in our portfolio has initiated active corrective measures, we can maintain our investment in the company. A divestment process will be initiated if the company has not commenced corrective action. Further investments may be made once confirmation has been obtained that the company has taken corrective action and is no longer in breach of the standards. Decisions on issuer exclusion based on responsibility criteria are taken by the Bank of Finland’s internal working group on responsible investment.

Thematic investment

In addition to the aforementioned approaches, we make fixed-income investments in green, social and sustainability bonds and bonds issued by development banks. For an investment to be included in the thematic investment category, it must fulfil third-party assessment criteria.