Geopolitical uncertainties are increasing the likelihood of cyber risks and other external influencing in the financial sector. Preparedness in the financial sector and among the authorities is at a good level, however. Household preparedness is also of considerable importance to society, and especially to household members themselves. That’s why each of us ought to make sure we are prepared.

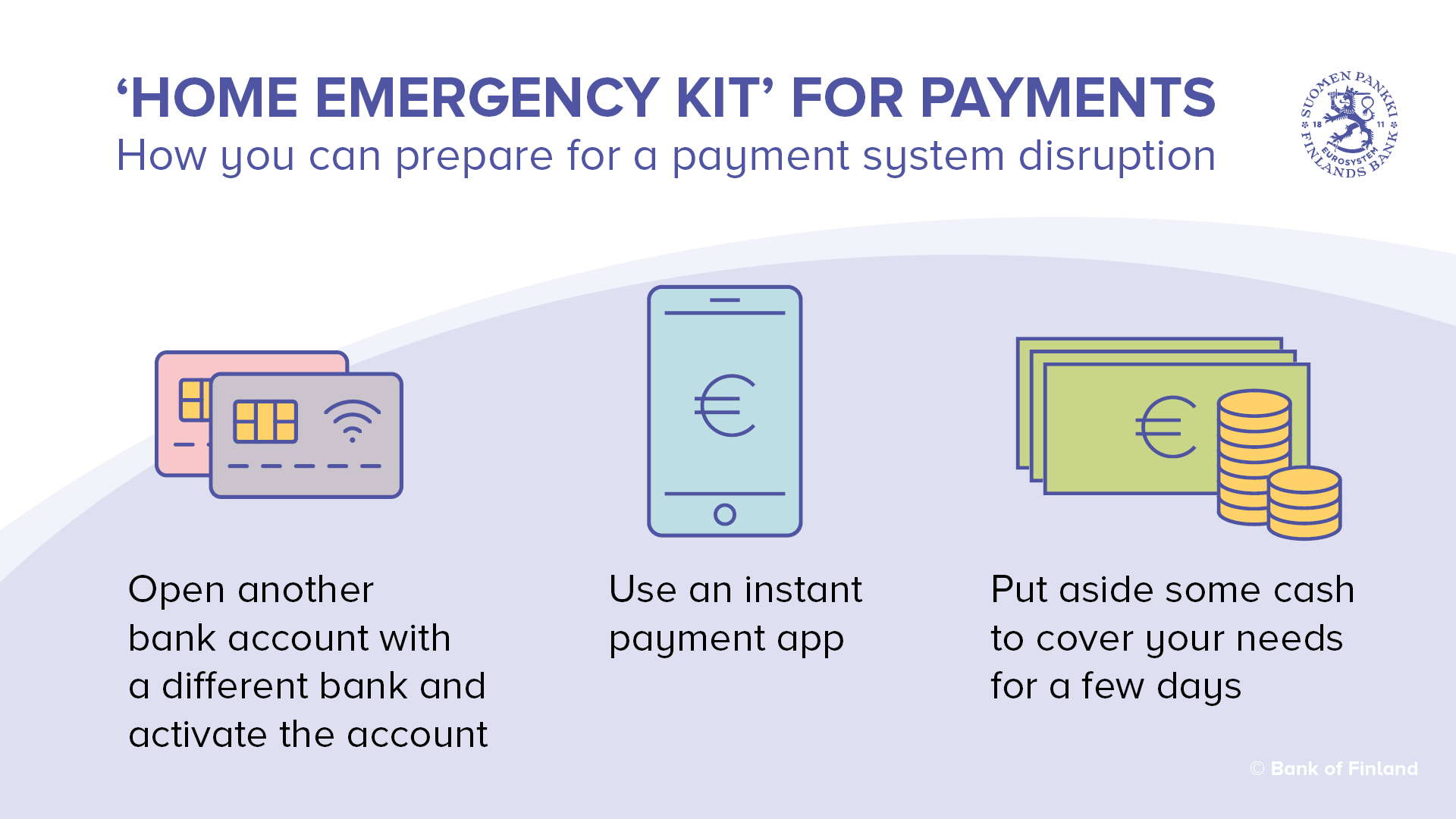

Open another account with a different bank and activate the account

It would be useful if households were to have bank accounts and payment cards in two different banks in case the services of one bank become unavailable for a period of time. It is also worth activating the online and mobile banking services for these accounts. Make sure that your personal details and contact information are up to date.

Online banking codes are used not only for payments but also for online identification needs in many different services where reliable identification is required. For identification purposes, it is worth considering whether you should acquire online banking codes from another bank or perhaps a mobile ID from a telecommunications operator.

Use an instant payment app

To improve the certainty of being able to manage your everyday money matters in all situations, you could start using mobile apps for making payments. An instant payment app based on the Finnish Siirto system, for example, would be a good addition to your range of payment methods. Siirto transmits payments in real time between accounts in the participating banks. Ask your bank about the service.

Keep cash for several days’ needs

A small amount of cash is good to have at home as part of a normal level of preparedness. The recommendation is to have enough for three days. Take a moment to think about how much your household would need as a minimum over such a 72-hour period if you cannot use payment cards. It is not advisable, however, to keep large amounts of cash at home.