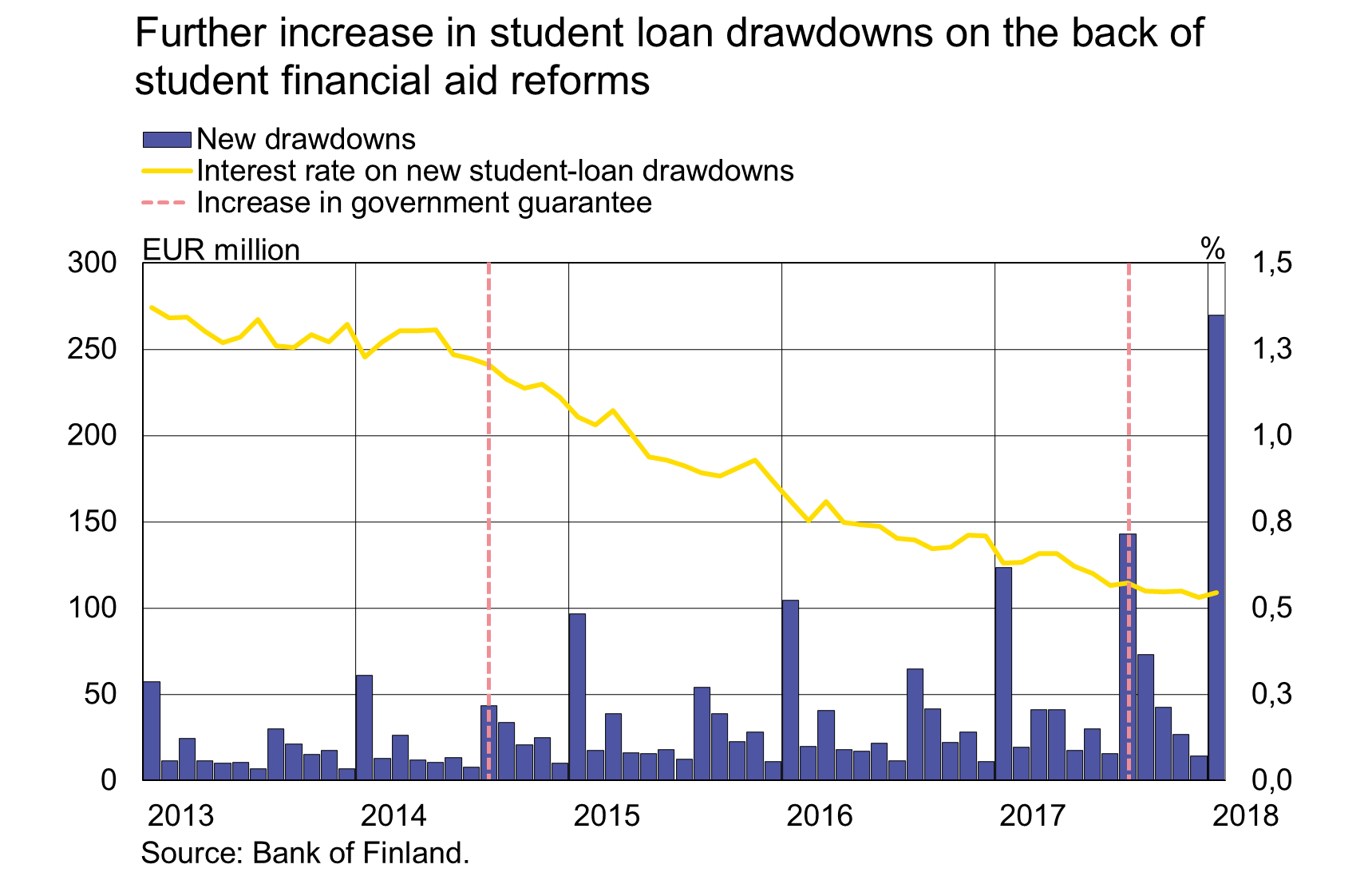

The reforms to financial aid for students, which entered into force in 2017, have boosted drawdowns of student loans to record high levels. Student loan drawdowns increased markedly already in August 2017, when students could take out the loan amount for the autumn semester. The pace of increase picked up significantly in January 2018, when the loan amount for the spring semester became available for drawdown. In January 2018, drawdowns of student loans totalled almost EUR 270 million, which is more than twice the amount taken out a year earlier.

The stock of student loans has grown by EUR 490 million since the student financial aid reforms of August 2017, and the annual growth rate of the stock has accelerated to almost 23% during the same period. In January 2018, the student loan stock also exceeded the level of EUR 3 bn. Even though the student loan stock is growing rapidly at present, the pace of growth may ease in the future due to the student loan compensation system, under which Kela (the Social Insurance Institution of Finland) may pay back part of the student loan.

Loans

In January 2018, households drew down new housing loans to the value of EUR 1.3 bn. The average interest rate on new housing-loan drawdowns was 0.94% and the imputed margin was 0.92%. At the end of January 2018, the stock of euro-denominated housing loans amounted to EUR 95.9 bn and the annual growth rate of the stock was 2.09%. Household credit at the end of January comprised EUR 15.2 bn in consumer credit and EUR 16.9 bn in other loans.

New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted to EUR 1.8 bn in January. The average interest rate on new corporate-loan drawdowns rose from December, to 2.02%. The stock of euro-denominated loans to non-financial corporations at the end of January was EUR 79.2 bn, of which loans to housing corporations accounted for EUR 28.6 bn.

Deposits

At the end of January, the stock of household deposits totalled EUR 87.0 bn, and the average interest rate on the deposits was 0.14%. Overnight deposits accounted for EUR 65.5 bn and deposits with agreed maturity for EUR 6.5 bn of the deposit stock. In January, households concluded EUR 0.4 bn of new agreements on deposits with agreed maturity, at an average interest rate of 0.35%.

Key figures of Finnish MFIs' loans and deposits, preliminary data

| November, EUR million | December, EUR million | January, EUR million | January, 12-month change1, % | Average interest rate, % | |

| Loans to households2, stock | 128,106 | 128,131 | 128,021 | 2,6 | 1,51 |

| - of which housing loans | 96,034 | 96,129 | 95,921 | 2,1 | 1,01 |

| Loans to non-financial corporations2, stock | 78,787 | 79,326 | 79,177 | 4,2 | 1,40 |

| Deposits by households2, stock | 85,892 | 87,886 | 87,008 | 3,0 | 0,14 |

| Households' new drawdowns of housing loans | 1,588 | 1,249 | 1,325 | 0,94 |

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Households also include non-profit institutions serving households; non-financial corporations also include housing corporations

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Imputed interest rate margins on loans from MFIs

For further information, please contact:

Johanna Honkanen, tel. +358 9 183 2992, email: johanna.honkanen(at)bof.fi.

The next news release will be published at 1 pm on 3 April 2018.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.