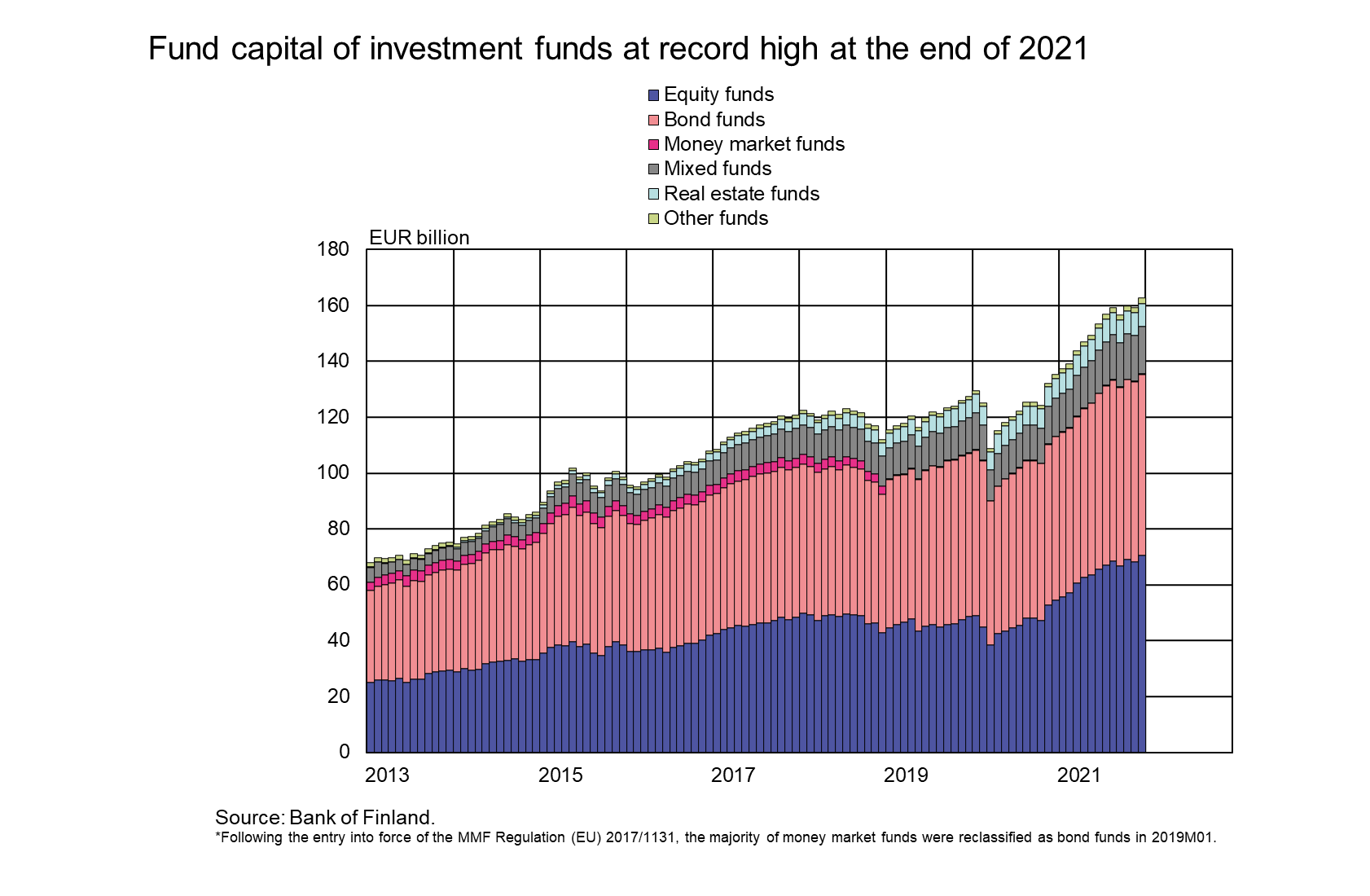

At the end of 2021, the fund capital of Finnish investment funds[1] stood at EUR 162.7 billion, EUR 27 billion higher than at the end of 2020. The record growth was mainly due to the appreciation of equities held by the investment funds, but the funds also had a significant amount of new subscriptions. In 2021, the aggregate investment fund capital appreciated by EUR 17 billion[2], while new subscriptions amounted to EUR 10.3 billion.

Bond funds have been the largest type of funds for a long time in terms of capital, but they were surpassed by equity funds in 2021 due to the strong appreciation of equities. At the end of December 2021, the fund capital of equity funds amounted to EUR 70.6 billion, compared to EUR 64.8 billion in bond funds. Equity and bond funds together account for over 83% of investment funds’ total fund capital. The next largest fund types are mixed funds and real estate funds.

In 2021, bond funds were clearly the most popular fund investments. During the year, new subscriptions in bond funds amounted to EUR 26.2 billion and redemptions to EUR 20.6 billion. Hence, net subscriptions in bond funds were EUR 5.7 billion. At the same time, equity funds also had more subscriptions than redemptions: EUR 2.1 billion in net terms. Net subscriptions in mixed funds amounted to EUR 1.4 billion, and in real estate funds to EUR 890 million.

In 2021, the largest net subscriptions (EUR 3.5 billion) were made by households. 78% of the households’ investments were made by Finnish households and 22% by Swedish. The next largest subscriptions (EUR 2.2 billion) were made by non-financial corporations, whereof Finnish companies accounted for 94%.

Majority of funds’ investments were targeted abroad

At the end of December 2021, out of Finnish investment funds’ aggregate investments of EUR 166.4 billion, 31% was allocated to Finland and 69% to the rest of the world. Changes in these proportions were very minor in 2021. The majority (42%) of domestic investments were inter-fund investments. The largest foreign investments were allocated to listed equities (46%) and bonds (32%). 43% of the foreign equity investments were made in US equities. The majority of foreign bonds held by the investment funds were issued by non-financial corporations, banks and governments. As a whole, the largest foreign investments were made in the United States (EUR 27.5 billion), Sweden (EUR 15.3 billion) and Luxembourg (EUR 14.7 billion).

Finnish households are the largest owner of investment funds

At the end of December 2021, Finnish households had direct holdings of EUR 34.7 billion in Finnish investment funds, which is more than ever before. It is estimated[1] that almost the same amount of Finnish households’ assets are channelled into domestic investment funds through unit-linked policies with insurance corporations. In the Bank of Finland’s investment fund statistics, these are shown as insurance corporations’ investments. When fund units owned through unit-linked insurance policies are included, Finnish households own more than 40% of domestic investment funds’ fund capital.

Finnish deposits and investments (EUR million), 2021Q4 |

||||||

| All | Households | Employment pension schemes | ||||

| stock (flows) | change in valuation | stock (flows) | change in valuation | stock (flows) | change in valuation | |

| Finnish investments | ||||||

| Listed shares | 254 013 | 11 249 | 55 222 | 2 060 | 40 961 | 2 577 |

| (-8 909) | (334) | (92) | ||||

| - in domestic shares | 164 362 | 4 067 | 49 246 | 1 677 | 20 865 | 910 |

| (-1 585) | (185) | (-191) | ||||

| Bonds | 243 724 | -78 | 1 453 | 19 | 31 367 | 763 |

| (1 609) | (-123) | (-1 621) | ||||

| - in domestic bonds | 112 977 | -448 | 807 | 14 | 3 854 | -31 |

| (4 113) | (-89) | (- 176) | ||||

| Fund shares | ||||||

| Domestic investment funds | 124 386 | 3 819 | 34 652 | 1 272 | 5 854 | 157 |

| (237) | (741) | (-171) | ||||

| Foreign funds | 183 368 | 5 745 | 5 392 | 290 | 123 025 | 3 739 |

| (1 586 ) | (289) | (-495) | ||||

| Finnish bank deposits | ||||||

| Overnight deposits (transaction accounts) | 188 755 | 56 | 100 074 | 8 | 8 359 | 3 |

| (4 449) | (-224) | (-279) | ||||

| Other deposits | 11 696 | 1 | 8 932 | 0 | -* | -* |

| (-382) | (-276) | -* | ||||

*confidential

For further information, please contact:

Ville Tolkki, tel. +358 9 183 2420, email: ville.tolkki(at)bof.fi,

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/saving-and-investing/.

The next news release on saving and investing will be published at 10 am on 12 May 2022.

[1] Including UCITS and non-UCITS investment funds registered in Finland.

[2] Net subscriptions.

[3] In addition to the investment fund statistics, the estimate draws on the Bank of Finland’s insurance corporation statistics and Finance Finland's statistics on insurance savings under life insurance.