Loans

Loans

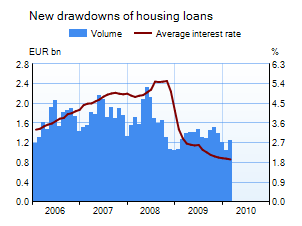

In February 2011, households drew down housing loans to a total value of EUR 1.4 billion, ie EUR 0.2 billion more than in January and EUR 0.1 billion more than in February 2010. The average interest rate on new housing loans rose by 0.09 percentage point to 2.26%. The stock of euro-denominated MFI housing loans to households grew by EUR 0.3 million, to EUR 77.2 billion at the end of February. The annual growth rate of the stock of housing loans rose to 6.9 % in February (6.8% in January). The average interest rate on the stock of housing loans rose on January by 0.03 percentage point, to 2.09% in February.

In February, companies agreed on new loans amounting to EUR 6.0 billion, up EUR 0.6 billion on January. The average interest rate on new business in corporate loans decreased by 0.07 percentage point to 2.51% The stock of euro-denominated corporate loans grew by EUR 0.4 billion to EUR 57.5 billion at the end of February. The annual growth rate of the corporate loan stock rose to 4.5% in February, from 4.3% in January. The average interest rate on the corporate loan stock increased by 0.02 percentage point to 2.49%.

Deposits

The stock of household deposits remained virtually unchanged in February. The outstanding stock of deposits with an agreed maturity grew somewhat, while the stock of overnight depsits decreased. At the end of February, total outstanding deposits stood at EUR 77.4 billion with an average interest rate of 0.89%. The average interest rate on new deposits with an agreed maturity rose by 0.05 percentage point to 1.91%.

Notes:

MFIs comprise all monetary financial institutions operating in Finland.

Loans and deposits comprise all euro-denominated loans and deposits vis-à-vis the euro area as a whole, with countries other than Finland accounting for a very small share of total volumes.

Key figures of Finnish MFIs' loans and deposits, preliminary data

| December, EUR million |

January, EUR million |

EUR million |

February, 12-month change1, %

|

Average interest rate, % | |

| Loans to households2, stock | 104.273 | 104.383 | 104.625 | 6.1 | 2.48 |

| - of which housing loans | 76.747 | 76.885 | 77.159 | 6.9 | 2.09 |

| Loans to non-financial corporations2, stock | 56.471 | 57.112 | 57.482 | 4.5 | 2.49 |

| Deposits by households2, stock | 77.764 | 77.447 | 77.360 | 4.2 |

0.89 |

| Households' new drawdowns of housing loans | 1.433 | 1.204 | 1.375 | – | 2.26 |

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Households also include non-profit institutions serving households; non-financial corporations also include housing corporations.

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Analytical accounts of the banking sector (MFIs) in Finland

More information:

Elina Salminen, tel. +358 10 831 2343, email: elina.salminen(at)bof.fi

Kimmo Koskinen, tel. +358 10 831 2546, email: kimmo.koskinen(at)bof.fi

Olli Alanko, tel. +358 10 831 2456, email: olli.alanko(at)bof.fi

Hanna Häkkinen, tel. 358 10 831 2552, email: hanna.hakkinen(at)bof.fi

The next news release will be published at 4 pm on Friday 29 April 2011.