Loans

Loans

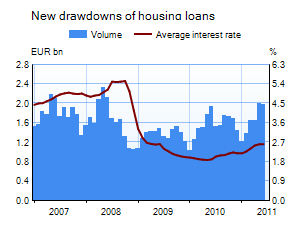

Households’ new drawdowns of housing loans amounted to EUR 2.0 bn in June 2011, which is as much as in May and EUR 0.1 bn more than a year ago in June. The average interest rate on new housing loan drawdowns remained almost unchanged on May, at 2.60%. The stock of euro-denominated MFI housing loans to households grew by EUR 0.6 bn on May, to EUR 79.1 bn at end-June. The annual growth rate of the stock of housing loans remained virtually unchanged in June, declining 0.3 percentage point to 6.6%. The average interest rate on the stock of housing loans increased by 0.07 percentage point on May, to 2.36% at end-June. The popularity of housing loans tied to banks’ own reference rates continued to increase moderately in June. Of the new drawdowns of housing loans in June, 11% were tied to prime rates and 83% were tied to Euribor rates.

New loan agreements with non-financial corporations in June totalled EUR 8.0 bn, which is EUR 0.9 bn more than in May. The average interest rate on new loan agreements increased to 2.78% in June, from 2.64% in May. The stock of euro-denominated loans to non-financial corporations increased by EUR 0.3 bn, to EUR 58.7 bn at end-June. The annual growth rate of the stock of loans to non-financial corporations remained unchanged at 4.0%, and the average interest rate on the stock increased by 0.08 percentage point to 2.78%.

Deposits

Household deposits increased by EUR 0.8 bn in June. Both total overnight deposits and total deposits with agreed maturity grew by EUR 0.4 bn in June. The month-end total of household deposits was EUR 80.1 bn, and the average interest rate was 0.97%. Households’ new agreements on deposits with agreed maturity totalled EUR 2.4 bn. The average interest rate on new deposits with agreed maturity rose in June by 0.08 percentage point to 2.30%.

In April–June 2011, households' new long-term savings agreements totalled 2,129, and by the end of June, households had made a total of 14,123 long-term savings agreements. At the end of June, households’ long-term savings accounts amounted to EUR 16.7 million. The majority of the savings (54%) are invested in fund shares.

Notes:

MFIs comprise all monetary financial institutions operating in Finland.

Loans and deposits comprise all euro-denominated loans and deposits vis-à-vis the euro area as a whole, with countries other than Finland accounting for a very small share of total volumes.

Key figures of Finnish MFIs' loans and deposits, preliminary data

| April, EUR million |

May, EUR million |

EUR million |

June, 12-month change1, % |

Average interest rate, % | |

| Loans to households2, stock | 105.421 | 106.058 | 106.731 | 5.7 | 2.74 |

| - of which housing loans | 77.976 | 78.495 | 79.102 | 6.6 | 2.36 |

| Loans to non-financial corporations2, stock | 57.970 | 58.362 | 58.687 | 4.0 | 2.78 |

| Deposits by households2, stock | 79.527 | 79.323 | 80.113 | 5.1 |

0.97 |

| Households' new drawdowns of housing loans | 1.634 | 1.999 | 1.959 | – | 2.60 |

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Households also include non-profit institutions serving households; non-financial corporations also include housing corporations.

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Analytical accounts of the banking sector (MFIs) in Finland

More information:

Kimmo Koskinen, tel. +358 10 831 2546, email: kimmo.koskinen(at)bof.fi

Jussi Pajunen, tel. +358 10 831 2343, email: jussi.pajunen(at)bof.fi

The next news release on money and banking statistics will be published on 31 August 2011, at 1 pm.