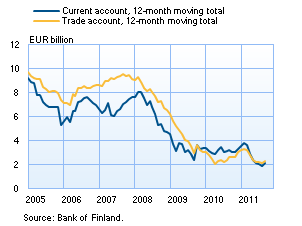

Current account posted a deficit January –SeptemberThe current account for the third quarter of 2011 showed a surplus of EUR 0.8 billion, which is nearly the same as for the year earlier period. However, for the period from the beginning of the year, from January to September, the current account has posted a deficit of EUR 0.9 billion, compared to the year earlier corresponding period when it was in surplus at EUR 0.3 billion. The current account for the September showed a surplus of EUR 0.5 billion, which is more than for any of the preceding months in 2011. |

|

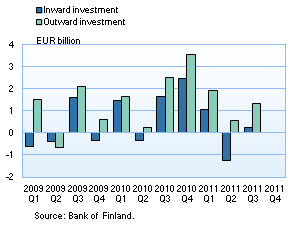

Direct investment export of capital increasedIn the period January - September 2011 there was a net outflow of EUR 3.8 billion in direct investment abroad by Finnish investors and there was a direct inward investment of EUR 0.03 billion by foreign investors in Finland. There was a net outflow of EUR 3.8 billion in direct investment capital which was EUR 2.2 billion more than a year earlier. Reviewed by quarter export of capital grew in each of the three quarters. |

|

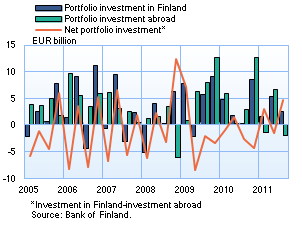

Inward portfolio investment exceeded export of capitalPortfolio investment was inward on net, for January – September in the amount of EUR 6.1 billion. Foreign investors purchased EUR 9.4 billion in Finnish securities while Finnish investors increased their investments in foreign securities by EUR 3.3 billion. Capital movements were at their briskest in the second quarter when there was a net outflow of EUR 6.7 billion and net inflow of EUR 5.3 billion. Import of capital in the January-September period mainly comprised of investment in securities issued by Finnish MFIs of which there was a net outflow totalling EUR 8.2 billion. Of these securities bonds issued by banks caused net outward direct investment totalling EUR 5.1 bn, and from other MFIs totalling EUR 3.5 bn. There was an outflow of Finnish government bonds of EUR 7.7 billion, however short-term government bonds were repurchased and redeemed totalling EUR 4.5 billion. EUR 1.2 billion in Finnish companies' shares were repurchased from abroad. The majority of the outward capital exports from Finland are invested in foreign government bonds, which in the January - September period acquired to the net sum of EUR 5.3 billion. EUR 1.3 billion was invested in fund units of mutual funds registered outside Finland. Investment in foreign shares decreased by EUR 3.3 billion and in foreign bonds by EUR 1.1 billion. The largest assets, when broken down by investor sector, were invested in MFIs, totalling EUR 8.3 billion. Of which banks accounted for over EUR 6.4 billion. Mutual funds registered in Finland reduced their foreign securities-based liabilities by EUR 3.0 billion and the Finnish State by EUR 2.2 billion. |

|

Finland's external assets still exceed liabilitiesThe Finnish international investment position at the end of September 2011 was a positive EUR 28 bn. Gross assets were at EUR 623 billion and gross liabilities EUR 596 billion. The external liabilities of non-financial corporations, monetary financial institutions (MFIs), central government and local government exceeded their external assets. In contrast, the external assets of other financial institutions, employment pension funds and households exceeded their external liabilities. The Finnish portfolio liabilities at the end of September were a negative EUR 12 bn. Other investments (loans, deposits and trade credits) - were negative EUR 16 billion. Meanwhile the direct investment position was a positive EUR 41 billion. Finland's major investor sectors' claims on the so-called GIIPS1 at the end of September were EUR 19 billion. The GIIPS countries' share of these sectors from all investor stock was approximately 4 %. Finland's net international investment position (= gross liabilities – gross assets) excluding equity items was positive, in the amount of EUR 45 bn. 1 Greece, Ireland, Italy, Portugal and Spain. |

| Year 2010, EUR million |

August 2011, EUR million |

September 2011, EUR million |

12 month moving sum, EUR million | |

| Current account | 3,302 | 97 | 455 | 2,114 |

| Goods | 2,999 | -26 | 280 | 2,312 |

| Services | 138 | -27 | -34 | -274 |

| Income | 1,831 | 300 | 358 | 1,389 |

| Current transfers | -1,667 | -150 | -150 | -1,313 |

| Capital account | 160 | 13 | 13 | 160 |

| Financial account | -1,440 | -1,821 | -672 | -2,221 |

| Direct investment | -2,711 | -411 | 600 | -4,876 |

| Portfolio investment | -6,304 | 5,205 | -952 | 1,860 |

| Other investment | 6,276 | -6,860 | -677 | -40 |

| Reserve assets | 1,661 | 83 | 6 | -88 |

| Financial derivatives | -362 | 162 | 352 | 923 |

| Errors and omissions | -2,021 | 1,710 | 203 | -52 |

More information Anne Turkkila tel. +358 10 831 2175, and Maria Huhtaniska-Montiel tel. +358 10 831 2534, email firstname.lastname(at)bof.fi

The next balance of payments bulletin will be published at 10.00 am on 15 December 2011.