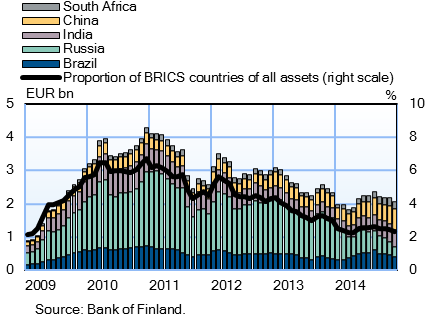

The outlook for the Russian economy was in 2014 clearly reflected in the investments by investment funds registered in Finland. During the year, investment funds' assets in Russia decreased by nearly 77 %, i.e., by EUR 0.9 bn. Of this decrease, EUR 0.6 bn was due to investment sales and other liquidations, and EUR 0.3 bn reflected depreciation of investments. Finnish investment funds withdrew capital from Russia particularly in the first quarter (EUR 0.4 bn) and fourth quarter (EUR 0.1 bn) of the year. The direct impact of the weakening of the rouble on the value of the investment stock remained small because on average over 95 % of Finnish investment funds' investments in Russia are dollar-denominated. Even though Finnish investment funds' withdrawals from Russia increased in 2014 compared to the previous years, many of the funds had reduced their investments in Russia already earlier. The investment stock peaked in February 2011 when EUR 2.3 bn (3.6%) of Finnish investment funds' capital was invested in Russia. By the end of 2014, the investment stock had contracted to EUR 288 million (0.3 %). Excluding Russia, Finnish investment funds’ investments in all the other BRICS countries increased in 2014 by over 60 %, to EUR 1.8 bn. |

Finnish investment funds'

|

Growth in fund capital slowed due to fund transfers to Sweden Fund capital grew by EUR 0.9 bn in the fourth quarter of 2014, and at the end of the year it totalled EUR 89.3 bn. Growth slowed significantly in the quarter; in the previous three quarters, the stock had increased by EUR 3.1 bn on average. Net investments were a negative EUR 0.35 bn in the fourth quarter. This was particularly due to fund merger arrangements in the latter part of the year, in which assets managed by funds registered in Finland were transferred to Sweden. At the same time, positive revaluation changes increased aggregate fund capital by EUR 1.2 bn. An examination by fund types shows that in the fourth quarter, the majority of net subscriptions, i.e., ca EUR 1.5 bn, were in bond funds. In contrast, net subscriptions in equity funds were a negative EUR 1.1 bn in the fourth quarter. This is largely explained by the fund mergers, but even without them, net subscriptions in equity funds would have been negative. |

Key statistical data on investment funds registered in Finland, preliminary data |

For further information, please contact:

Topias Leino, tel. +358 10 831 2315, email: topias.leino(at)bof.fi The next investment fund news release will be published on 30 April 2015 at 1 pm. |