|

The outcome of the UK referendum in favour of leaving the European Union was the major event of the second quarter of 2016 as regards investment funds registered in Finland. The funds not only held direct UK assets, but markets worldwide reacted to the result of the referendum, which in turn affected the value of the funds. In particular, the value of the funds was affected by the sharp fall in share prices as soon as the result became clear and by the decline of the pound. |

|

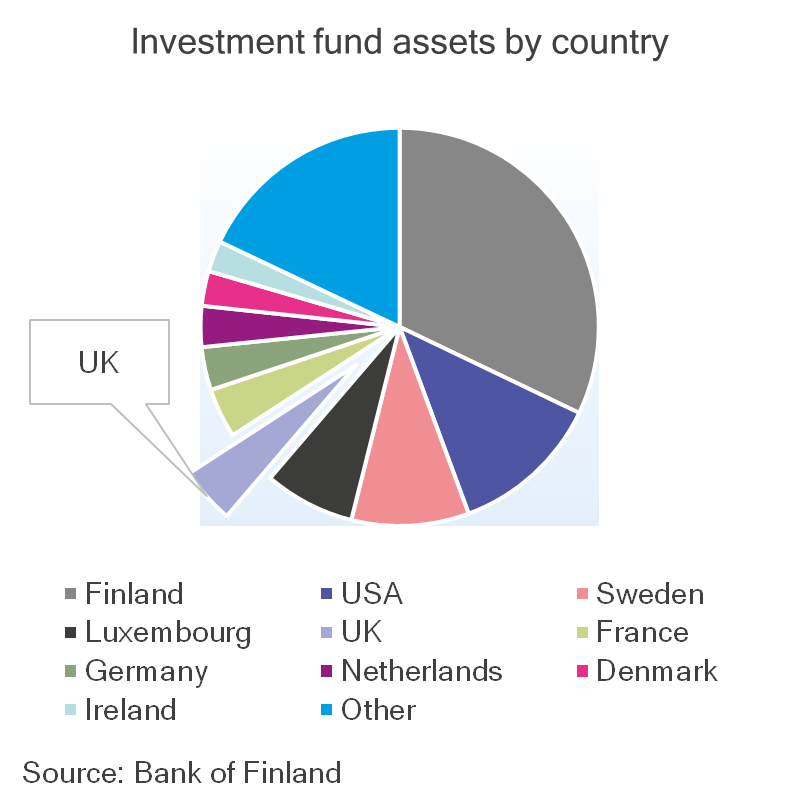

At the end of June 2016, about half (224 funds) of the investment funds registered in Finland held UK assets. The total value of the assets was EUR 4.7 bn, which, however, represents a fairly small (4.6%) portion of the total assets held by these investment funds. Britain is the fifth most popular target country for investments by investment funds registered in Finland, and especially equity and bond funds have invested in Britain. The values of equity fund investments in particular fell in June (EUR -0.7 bn), and at the same time assets of these funds were also redeemed (to a net value of EUR -0.7 bn). This was significant for the overall developments (EUR -0.8 bn) in the aggregated assets of the investment funds, although the positive development of bond funds mitigated the contraction of assets. |

|

|

Some of the real-estate funds operating in Britain suspended or limited their fund unit redemptions, when a considerably larger-than-normal portion of investors at the same time sought to redeem fund units in the wake of the EU referendum. Investment funds registered in Finland do not have direct assets1 in funds that have suspended trading, as mentioned above.

1 Some of the fund investments are in other investment funds. There is no direct statistical information available on the investment vehicles of such target funds, and as a result detailed analysis of fund investments is difficult. |

|

For further information, please contact The next investment fund news release will be published at 1 pm on 31 October 2016. |