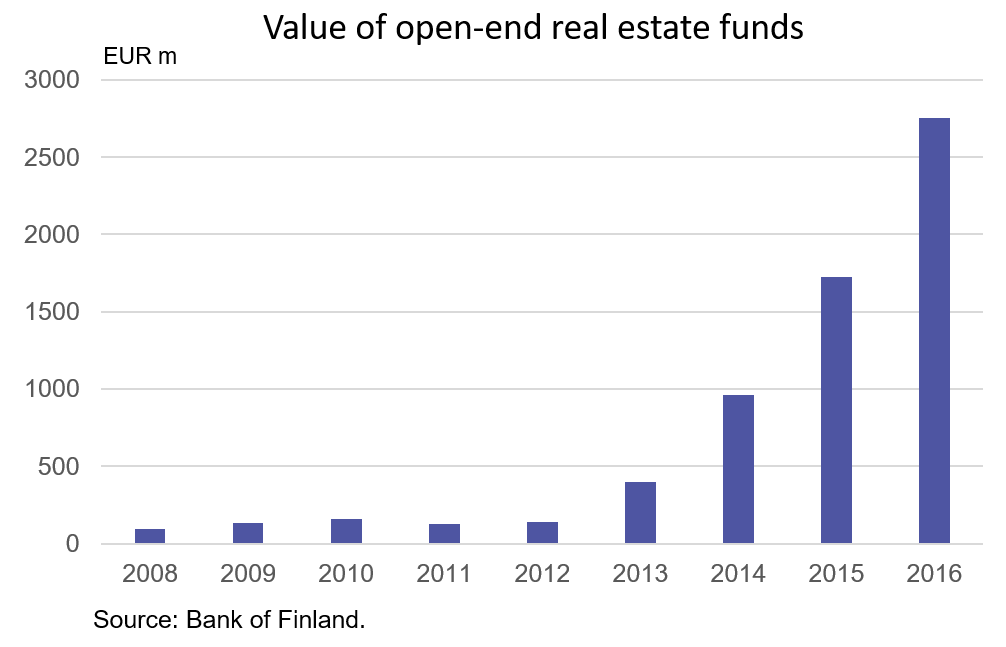

The fund capital of publicly-traded open-end real estate funds in Finland grew from just under EUR 100 million at the end of 2008 to about EUR 3 bn at the end of March 2017. The value of investments has almost tripled over the past two years. In euro terms, the strongest growth was witnessed in 2016, when the value of open-end real estate funds grew by about EUR 1 bn. Growth stemmed mainly from net subscriptions, and the impact of valuation changes was small.

In the first quarter of 2017, however, growth in open-end real estate funds slowed. In February–March, net subscriptions turned negative, in the amount of EUR 100 million, i.e. withdrawals from the funds exceeded new investments. Net subscriptions to open-end real estate funds were last negative in August 2012.

The largest investments in open-end real estate funds were by households. At end-March 2017 their share of fund capital was about 45% (EUR 1.2 bn). Households were followed by non-financial corporations (EUR 0.5 bn) and insurance corporations (EUR 0.4 bn).

In addition to open-end real estate funds, so-called closed-end real estate funds have also grown markedly in recent years. At end-2016, the value of assets managed by these funds totalled about EUR 3 bn, which was roughly equal to the value of assets managed by open-end real estate funds.

The largest investors in closed-end real estate funds are general government entities (EUR 0.8 bn), insurance corporations (EUR 0.7 bn) and non-financial corporations and housing corporations (EUR 0.4 bn).

About 90% of the assets of open-end and closed-end real estate funds are invested in Finland.

Real estate funds more indebted than other funds

Finnish real estate funds have also used relatively high leverage to finance their investments.

At end-2016, debt items comprised about 3% of Finnish investment funds’ total liabilities, while the corresponding figure for open-end real estate funds was 19% and for closed-end real estate funds 39%. Measured by this indicator, real estate funds are clearly the most indebted fund type in Finland.

The majority of real estate funds’ debt capital is from banks and insurance corporations.

Key statistical data on investment funds registered in Finland, preliminary data

- Breakdown of investment funds’ fund-share liability by sector of holder

- Securities-based assets of investment funds by area

- Securities-based assets of investment funds by instrument, area and sector

For further information, please contact:

Anne Turkkila, tel. +358 9 183 2175, email: anne.turkkila@bof.fi

Topias Leino, tel. +358 9 183 2315, email: topias.leino@bof.fi

The next investment fund news release will be published at 1 pm on 1 August 2017.