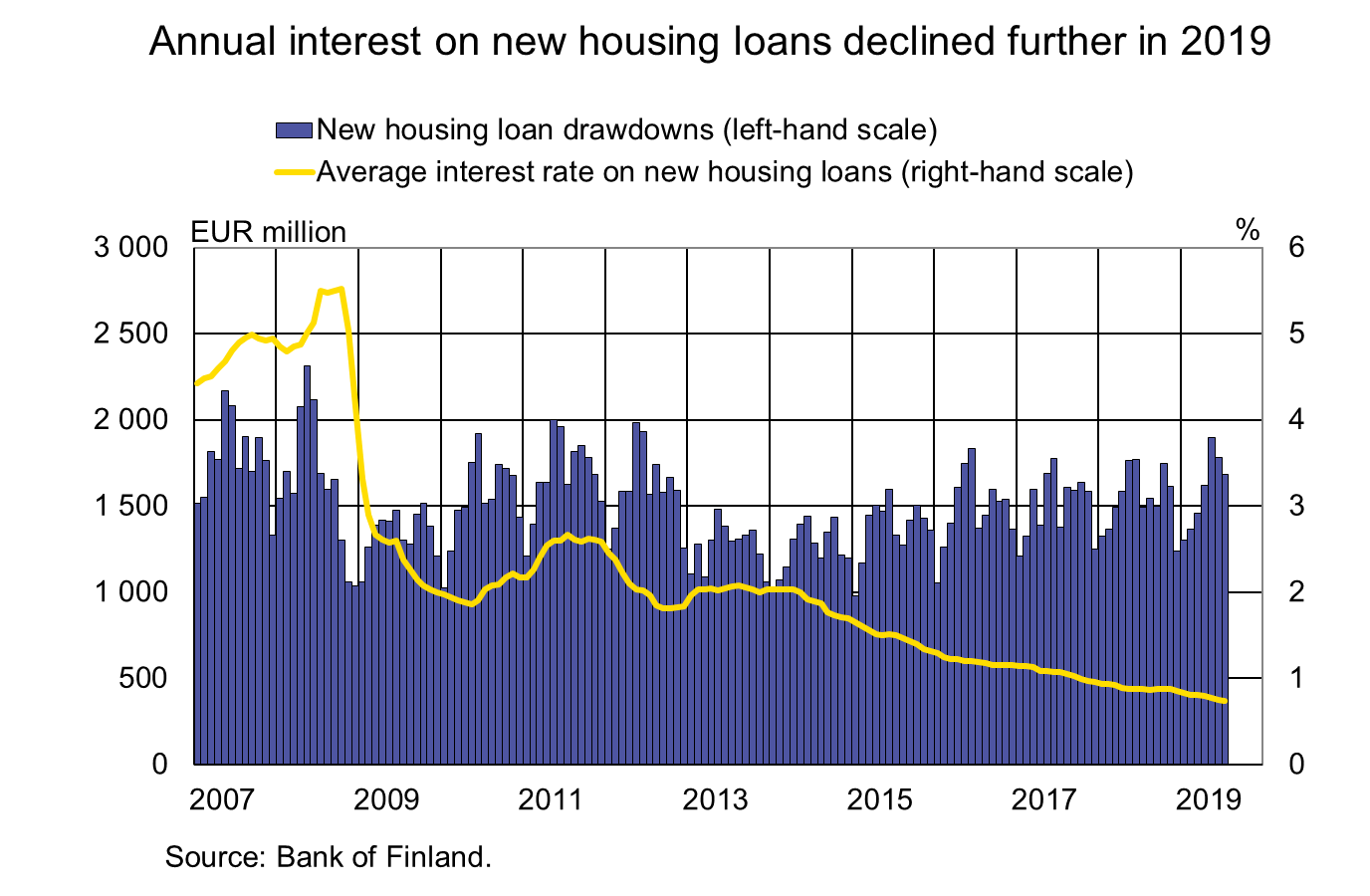

In July 2019, new housing loan drawdowns amounted to EUR 1.7 bn, or EUR 200 million more than a year earlier. The last time drawdowns of housing loans in July exceeded this total was in 2007–2008, when drawdowns of housing loans peaked. In May–July 2019 housing loan drawdowns were 7% above the corresponding period a year earlier. As a result of the increased amount of drawdowns, the stock of housing loans exceeded EUR 99 bn in July, and annual growth in the loan stock was 2.1%.

The average interest on new housing loans has declined further in 2019. The agreed annual interest rate on new housing loans in July was 0.74%, against 0.87% in December 2018. The decline in the agreed annual interest rate is explained by a narrowing of the interest rate margin. In July, the average interest rate margin on new housing loans was an estimated 0.53–0.63%.1

Recent years have seen a lengthening in amortization periods for housing loans. In July, the average amortization period on new housing loans taken out – 20 years 7 months – was half a year longer than in July a year earlier, and one year longer than in July 2017. Of new housing loans taken out in July, over 60% had an amortization period of 20–26 years. The share of all loans with longer amortization periods (over 29 years) has also grown: of new housing loans in July, 6% had an amortization period of over 29 years.

Loans

Of all household loans outstanding at the end of July, consumer credit amounted to EUR 16.2 bn, while other loans totalled EUR 17.4 bn. New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) in July amounted to EUR 2.4 bn. The average interest rate on new corporate loan drawdowns rose from June, to 2.2%. At the end of July, the stock of euro-denominated loans to non-financial corporations stood at EUR 88.3 bn, of which loans to housing corporations accounted for EUR 33.7 bn.

Deposits

The combined stock of deposits by Finnish households at the end of July totalled EUR 93.0 bn, and the average interest rate on these deposits was 0.11%. Of the total, overnight deposits accounted for EUR 79.8 bn, while deposits with agreed maturity accounted for EUR 5.1 bn. In July, households concluded EUR 0.6 bn of new agreements on deposits with agreed maturity, at an average interest rate of 0.23%.

1 The assessment has been adjusted to take into account the effects of the costs of interest-rate hedging on the average interest rate margin published on the Bank of Finland website. https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/older-news/2016/kotitalous_ja_yrityslainojen_laskennalliset_korkomarginaalit_suomessa_chrt_en/

Key figures of Finnish MFIs' loans and deposits, preliminary data

| May, EUR million | June, EUR million | July, EUR million | July, 12-month change1, % | Average interest rate, % | |

| Loans to households2, stock | 131,870 | 132,436 | 132,662 | 2,5 | 1,47 |

| - of which housing loans | 98,479 | 98,921 | 99,038 | 2,1 | 0,95 |

| Loans to non-financial corporations2, stock | 87,365 | 88,046 | 88,286 | 6,9 | 1,36 |

| Deposits by households2, stock | 96,704 | 98,017 | 97,390 | 7,6 | 0,11 |

| Households' new drawdowns of housing loans | 1,899 | 1,784 | 1,681 | 0,74 |

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Households also include non-profit institutions serving households; non-financial corporations also include housing corporations

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Imputed interest rate margins on loans from MFIs

For further information, please contact:

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi,

Ville Tolkki, tel. +358 9 183 2420, email: ville.tolkki(at)bof.fi.

The next news release will be published at 1 p.m. on 30 September 2019.

Related statistical data and graphs are also available on the Bank of Finland website at: https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.