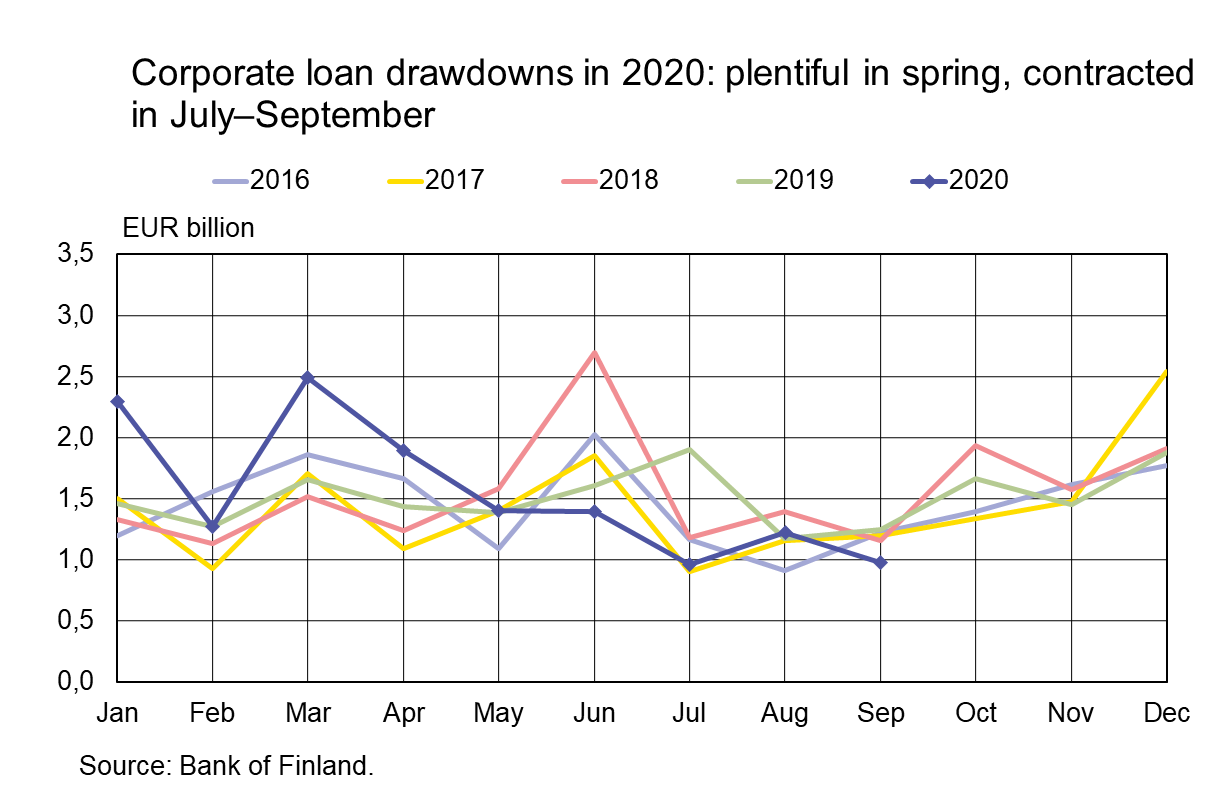

After a brisk acceleration in the early part of 2020, growth in the stock of corporate loans slowed during the summer. With the exception of housing corporations, Finnish non-financial corporations drew down exceptionally few loans[1] (to a value of EUR 973 million) in September 2020. For the July–September quarter there were less new corporate loan drawdowns than in any equivalent quarter in the 2010s.

Very few companies drew down large loans of over EUR 1 million. Of the new corporate loans drawn down in September, only half (to a total value of EUR 489 million) were for over EUR 1 million. The share of large loans has varied considerably since 2010, between 46% and 86% annually. In September, the average interest rate on the totality of new corporate loans was 2.95%, and on large corporate loans, 2.21%.

The pace of corporate loan drawdowns has changed a great deal since the first half of the year, during which non-financial corporations drew down new loans to a total value of EUR 10.8 billion. The last time the first half of the year exceeded this total was in 2014. In May, the stock of corporate loans[2] exceeded EUR 60 billion, totalling EUR 60.2 billion at the end of September.

Uncertainty and precautionary behaviour have been reflected in a rapid growth in deposits by non-financial corporations. There has been a particularly marked flow of cash into overnight deposits. The stock of overnight deposits (EUR 41.6 billion) has grown during the current year by EUR 6.0 billion, and the pace of annual growth has increased rapidly, to stand at 26.5% in September. The average interest rate paid on overnight deposits dipped below zero in March and stood at -0.04% in September.

Loans

Household drawdowns of new housing loans in September totalled EUR 1.9 billion, EUR 170 million more than in the same period a year earlier. At the end of September, the euro-denominated stock of housing loans stood at EUR 102.5 billion, representing annual growth of 2.9%. Out of all household loans at the end of September, consumer credit totalled EUR 16.7 billion, while other loans amounted to EUR 18.3 billion.

New housing corporation loans (excl. overdrafts and card debt) were drawn down to a value of EUR 367 million in September. The average interest on new housing corporation loan drawdowns was up from August and stood at 1.20%. The stock of loans to housing corporations stood at EUR 36.8 billion at the end of September.

Deposits

The stock of Finnish households’ deposits at the end of September amounted to EUR 102.6 billion, at an average interest rate of 0.07%. Overnight deposits accounted for EUR 90.0 billion, and fixed-term deposits for EUR 4.2 billion of the total. Households agreed new fixed-term deposits to a total of EUR 0.1 billion, with an average interest rate of 0.20%.

Key figures of Finnish MFIs' loans and deposits, preliminary data |

|||||

| July, EUR million | August, EUR million | September, EUR million | September, 12-month change1, % | Average interest rate, % | |

| Loans to households2, stock | 136,586 | 137,055 | 137,502 | 3,1 | 1,40 |

| - of which housing loans | 101,757 | 102,074 | 102,462 | 2,9 | 0,86 |

| Loans to non-financial corporations2, stock | 97,037 | 97,412 | 97,194 | 9,1 | 1,31 |

| Deposits by households2, stock | 105,290 | 105,707 | 106,885 | 8,4 | 0,07 |

| Households' new drawdowns of housing loans | 1,703 | 1,653 | 1,883 | 0,72 | |

* Includes euro-denominated loans and deposits to euro area.

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Households also include non-profit institutions serving households; non-financial corporations also include housing corporations

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Imputed interest rate margins on loans from MFIs

For further information please contact

Ville Tolkki, tel. +358 (0)9 183 2420, email: ville.tolkki(at)bof.fi,

Markus Aaltonen, tel. +358 (0)9 183 2395, email: markus.aaltonen(at)bof.fi.

The next monetary and banking statistics release will be published on 30 November 2020 at 13:00.

The statistical figures and graphics this release is based on can be viewed on the Bank of Finland website at https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.

[1] Excluding overdrafts and card debt.

[2] Loans to Finnish non-financial corporations (S.111) excl. housing corporations.