In the last quarter of 2021, households drew down a total of EUR 90 million of loans other than vehicle loans[1] from other financial institutions[2], whereof consumer credit accounted for 86%. The average interest rate on these new drawdowns was 8.0%. A fifth of the drawdowns was made from consumer credit and small loan companies, and the average interest rate on these loans was over 16%.

The stock of loans granted to Finnish households by consumer credit and small loan companies, also known as payday lenders, continued to decrease in the fourth quarter of 2021. At the end of December 2021, the stock stood at slightly over EUR 200 million, as opposed to EUR 220 million at the end of September 2021. The stock of payday lenders’ consumer credit has contracted significantly since 2018, when payday lenders had an estimated EUR 700 million of loan receivables from households. In September 2019, a 20%-interest rate cap on consumer credit entered into force, after which some of the companies granting small loans have discontinued either the extension of new loans or their activities altogether. The contraction of the loan stock also reflects the sales of loans off balance sheets. At the end of December 2021, the average interest rate on consumer credit extended by consumer credit and small loan companies stood at 39%[3].

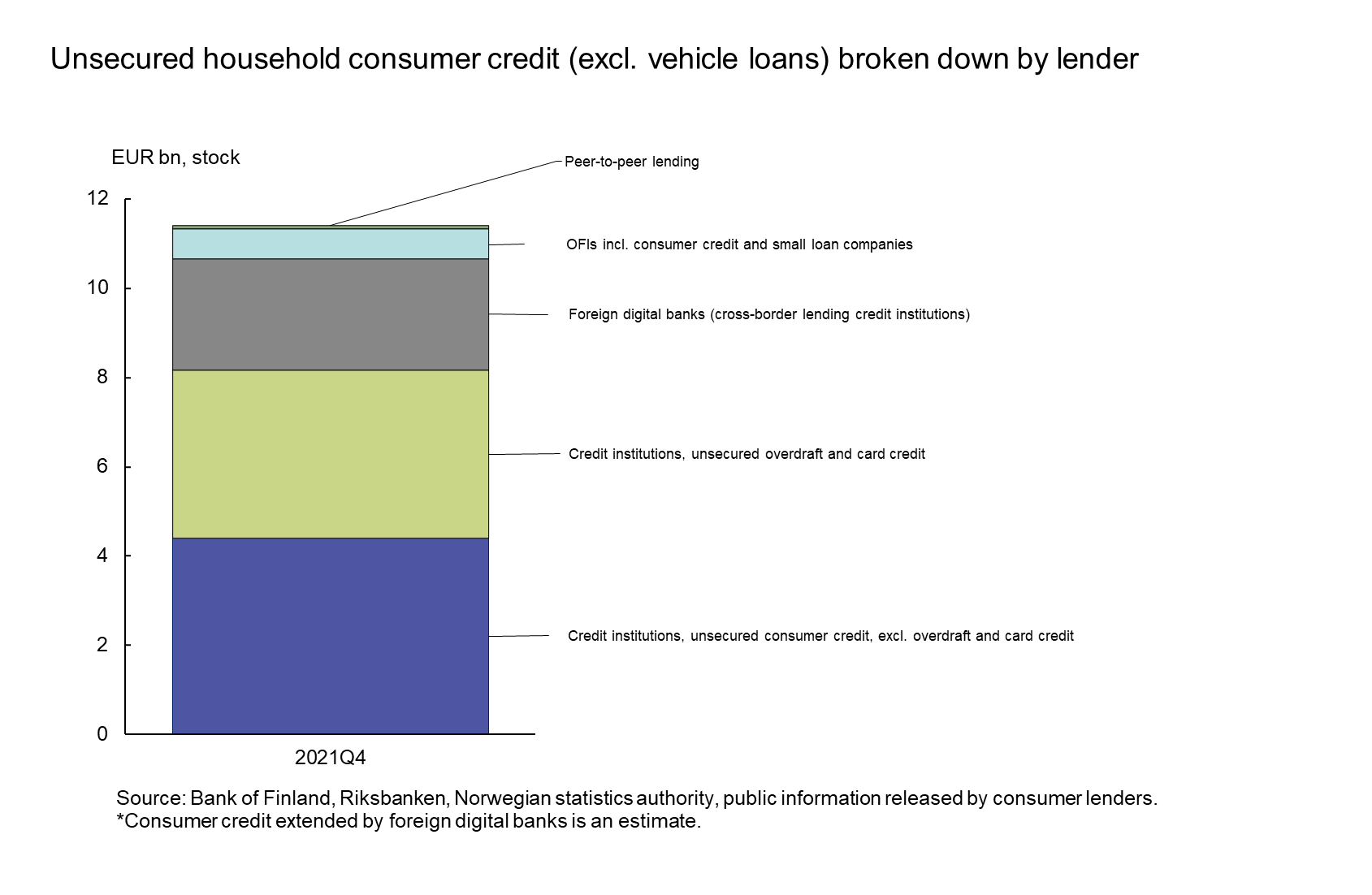

OFIs have a low share of unsecured consumer credit

At the end of 2021, the stock of loans granted by other financial institutions[1] to Finnish households stood at EUR 5.0 billion, 3% more than a year earlier. Almost all of these loans were consumer credits. The average interest rate on the stock of consumer credit declined from September, to stand at 4.3% at the end of December 2021. The average interest rate on the stock of consumer credit is slightly lower than the average interest rate on consumer credit granted by credit institutions (4.7%). The low average OFI interest rate is explained by the high proportion (87%) of vehicle loans out of all consumer credit. However, there are major differences in the interest rates on consumer credit across different market participants and operating models.

At the end of 2021, OFIs accounted for 20% of all household consumer credit (EUR 24.2 billion). Nearly half of household consumer credit was unsecured[2]. In unsecured consumer credit, OFIs are estimated to have a significantly lower share (6%) than in the total stock of consumer credit.

Almost a third of household consumer credit has been used to purchase vehicles. A significant part (56%) of the vehicle finance was granted by OFIs[1]. At the end of December 2021, the total stock of vehicle loans granted by OFIs and credit institutions to households amounted to EUR 7.5 billion.

THE STOCK OF LOANS GRANTED BY OFIS TO FINNISH NON-FINANCIAL CORPORATIONS AND HOUSEHOLDS, 2021Q4:

|

|

Non-financial corporation loans (EUR million) |

Household loans (EUR million) |

|

Secured |

1 545 |

4 237 |

|

Unsecured |

3 673 |

736 |

|

Total |

5 218 |

4 973 |

For further information, please contact:

Markus Aaltonen, tel. +358 9 831 2395, email: markus.aaltonen(at)bof.fi,

Jaakko Suni, tel. +358 10 831 2402, email: jaakko.suni (at)bof.fi

The next Other financial institutions release will be published in autumn 2022.

Name & Shame process:

Financial corporations intentionally dropping out of the OFI statistics for the period 2021Q4:

Aasa Oy (2021Q02-2021Q04)

Aputoiminimet / Bifirma / Auxiliary company name:

Aasa Rahoitus

AA-Yleislaina OÜ, Suomen sivuliike (2021Q02-2021Q04)

Creditstar Finland Oy (2021Q4)

Nordfin Capital Oy (2021Q4)

VFS Finland Ab (2020Q04-2021Q04)

Aputoiminimet / Bifirma / Auxiliary company name:

Volvo Kuorma-autorahoitus / Volvo Lastvagnsfinans / Volvo Truck Finance

Volvo Rahoitus / Volvo Finans / Volvo Finance

Volvo Rahoitus Suomi / Volvo Finans Finland / Volvo Finance Finland

[1] Excl. overdrafts and credit card credit.

[2] Excl. pawnshops.

[3] Consumer credit agreements concluded before September 2019 are governed by previous interest rate cap regulation, providing that the effective interest rate on consumer credit under EUR 2,000 may not exceed the reference interest rate under the Interest Act by more than 50 percentage points. This interest rate cap did not apply to credits larger than EUR 2,000.

[4] Entities belonging to the OFI sector and granting household loans include for example, vehicle loan companies, consumer credit and small loan companies, banks’ finance companies and pawnshops.

[5] Excl. vehicle loans.

[6] However, a significant proportion of vehicle lenders actually belong to foreign banking groups, but these are recorded outside the credit institution sector in domestic financial statistics, since these institutions do not have a credit institution’s authorisation in Finland.