A total of over three billion payments were made from Finnish bank accounts in 2019. Of this, approximately 65% was accounted for by card payments and approximately 35% by credit transfers; only 0.04% was accounted for by other payments[1]. In value terms, however, most of the money moved in credit transfers: in 2019, credit transfers amounted to EUR 2,748 billion, while EUR 54 billion was paid using cards. In 2019, the number of card payments grew by more than 6% from the previous year, and the use of the contactless payment function of cards, in particular, showed a significant increase following the raising of the upper limit of contactless payments to EUR 50[2] in April 2019. The number of credit transfers made from Finnish accounts increased, in turn, by nearly 9% from 2018. As electronic payments continued to become more common, the use of cash declined further, which was reflected in, e.g. a decrease in the total value of cash withdrawals. During 2019, Finns withdrew cash to an estimated value of EUR 13.2 billion, which is 9% less than in the previous year.

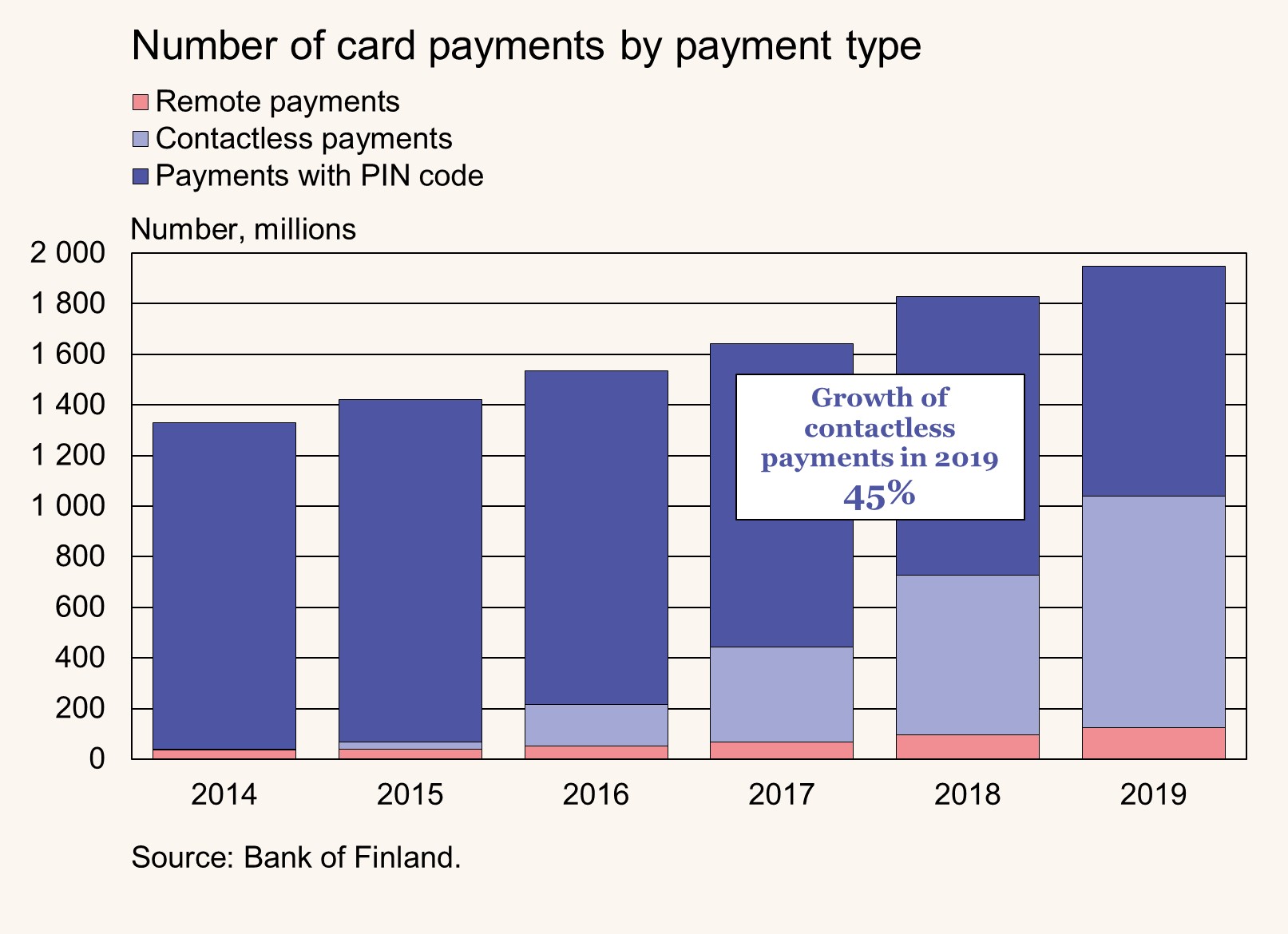

Contactless payments exceeded card payments with a PIN code

In 2019, Finnish cards were used to make payments nearly two billion times, of which 94% were made at physical point of sale and 6% as remote payments online. During 2019, for the first time, more contactless payments were made than card payments with a PIN code: 913 million contactless payments were made, while there were 908 million payments made with a PIN code (Figure 1). Use of the contactless payment function of cards grew by 45% from the previous year. In addition, the value of purchases made by contactless payments nearly doubled from 2018, exceeding EUR 10 billion in 2019 (accounting for 20% of the total value of card payments). At the end of 2019, approximately 90% of payment cards were equipped with the contactless payment function.

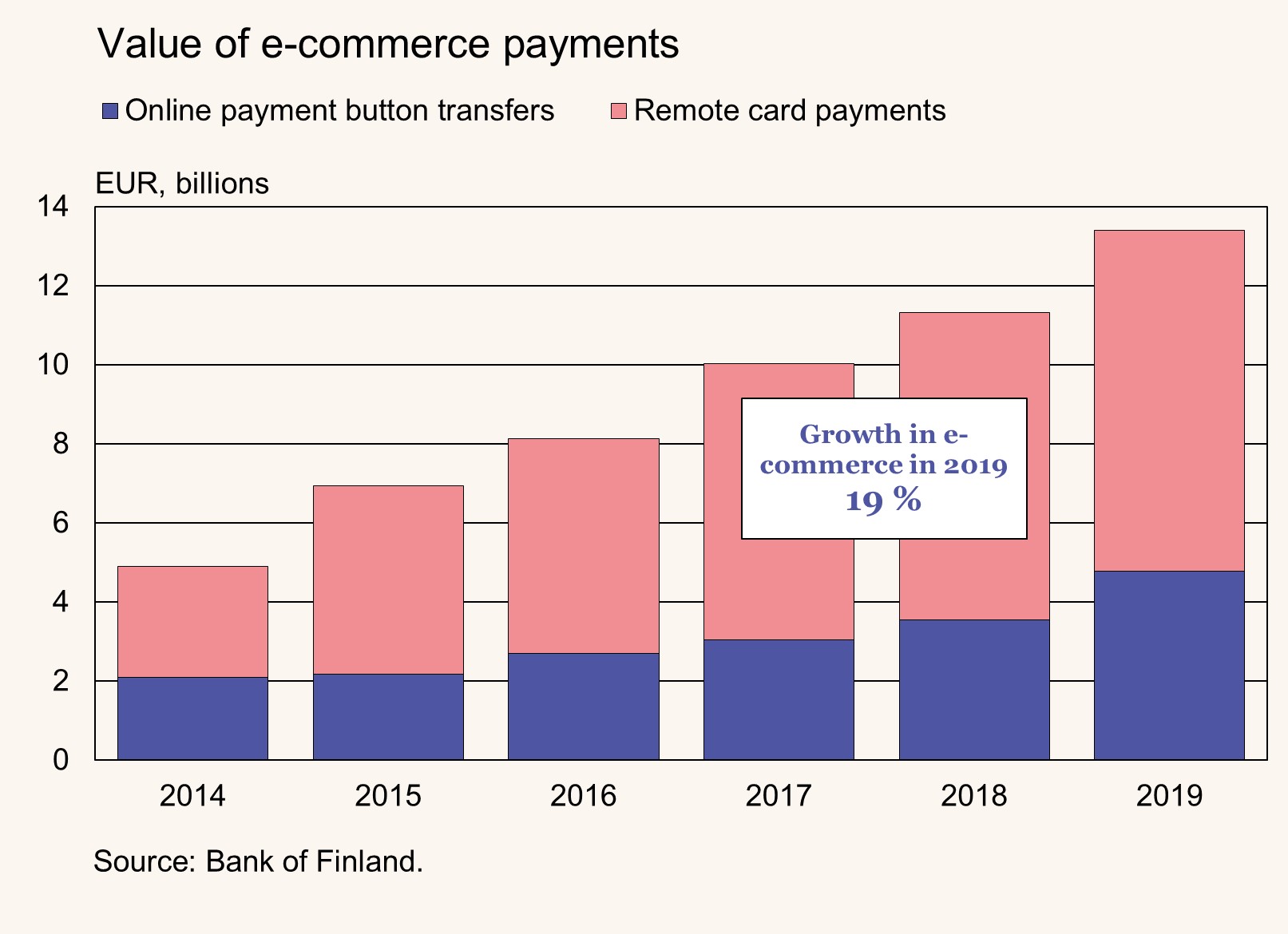

Total value of e-commerce payments grew by nearly a fifth [3]

In addition to contactless card payments, remote card payments also increased significantly. Remote card payments refer to card payments initiated using a computer or mobile device[4]. Their value grew by more than a third from the previous year to EUR 4.8 billion in 2019. Most online purchases, however, are still paid for with the online payment buttons provided by banks, i.e. by credit transfers authenticated with online banking IDs. Payments initiated with online payment buttons amounted to EUR 8.6 billion in

2019, which is 11% more than in the previous year. Based on these, the total value of payments made in e-commerce rose to EUR 13.4 billion in 2019, an increase of nearly 19% from 2018 (Figure 2). Of this, remote card payments accounted for approximately 36% and payments made by online payment button for approximately 64%[5]. The proportion of payments made by online payment button declined, however, by 5 percentage points from the previous year.

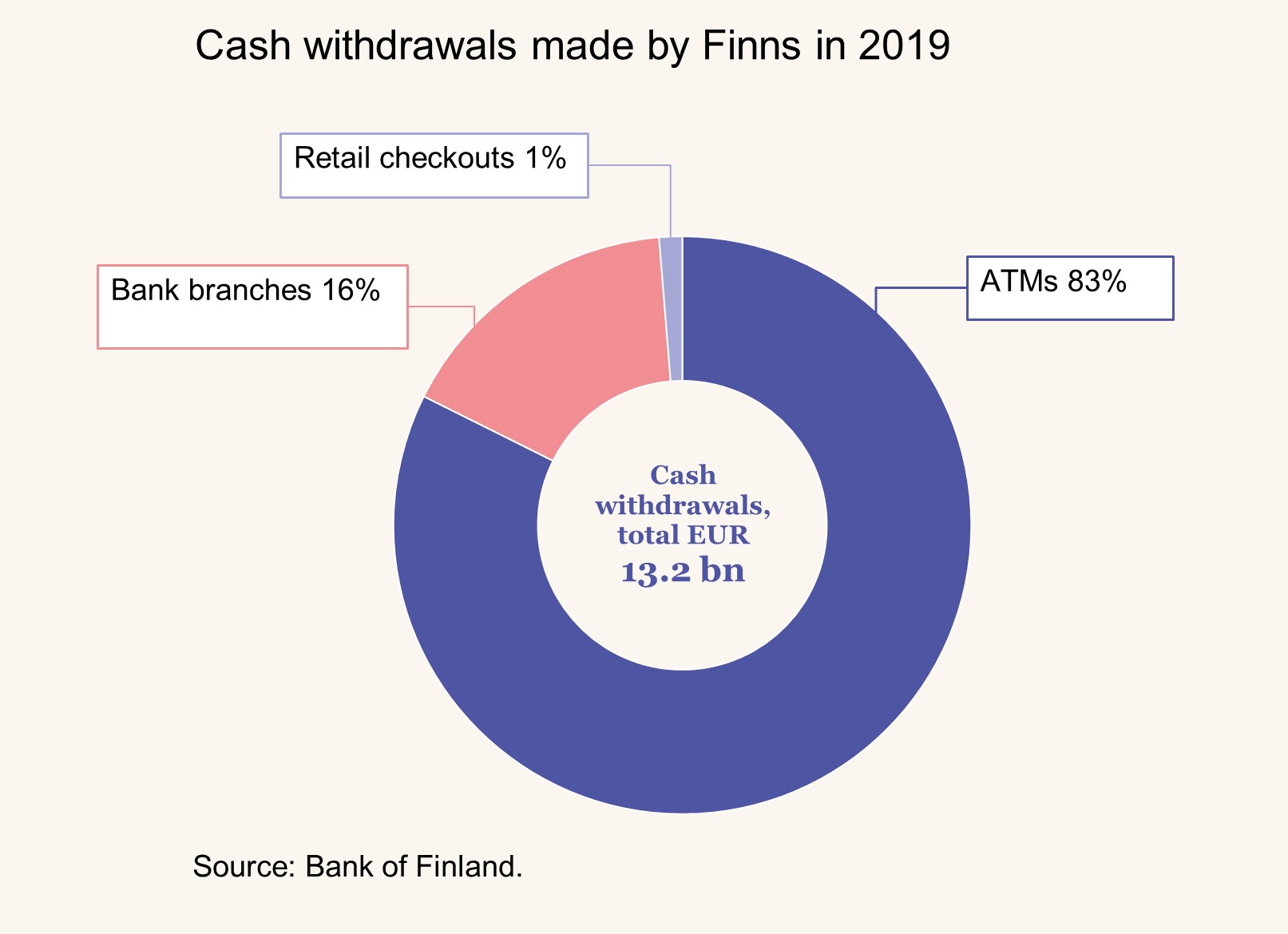

Finns withdrew over EUR 13 billion in cash

In 2019, an estimated EUR 13.2 billion in cash was withdrawn, i.e. an average of approximately EUR 2,400 per Finn. This is nearly 9% less than in the previous year. Most cash was withdrawn at ATMs: a total of EUR 10.9 billion in cash was withdrawn using cards issued in Finland, which accounted for 83% of all cash withdrawals (Figure 3). In addition, EUR 2.1 billion in cash was withdrawn at bank branches[6] and EUR 0.2 billion at retail checkouts in 2019. According to the Bank of Finland’s consumer survey, approximately 7% of Finns used cash as their primary means of payment for buying daily consumer goods in 2019, and approximately 9% stated that they used both cash and a card.

As electronic payment methods and online purchases have become more common, cash withdrawals and, at the same time, use of cash have declined steadily in recent years. Next year’s payment statistics will show whether the coronavirus pandemic has contributed to strengthening this phenomenon. Cash is still used rather often, however, and for some consumers it is the only possible payment option, so the disappearance of cash is not yet in sight.

For further information, please contact:

Meri Sintonen, tel. +358 9 183 2247, meri.sintonen(at)bof.fi

Jenna Björklund, tel. +358 9 183 2547, jenna.bjorklund(at)bof.fi

[1] Other payments consist of direct debits, money orders/money transfers, cheques and e-money transactions.

[2] EUR 50 is the maximum amount currently approved by the European Banking Authority for a single contactless payment made using a card.

[3] Statistics on e-commerce payments include payments initiated with cards and online payment buttons. The figures do not include e-commerce related purchases paid with, for example, invoices, instalments or credit agreements.

[4] Remote card payments include mobile payments other than those initiated with NFC technology, which are classified as contactless payments. Payment applications implemented with NFC technology include e.g. Apple Pay, Google Pay and the Finnish Pivo application.

[5] Remote card payments also include mobile payments not related to e-commerce, such as person-to-person payments. In reality, the value of e-commerce payments accounted for by card payments is therefore slightly lower than presented and, correspondingly, the share of payments made by online payment button is slightly higher than presented.

[6] Based on Bank of Finland calculations.