The fund capital of investment funds registered in Finland grew by a total of EUR 12.9 bn in 2017. EUR 7.6 bn of this growth stemmed from new investments, while EUR 5.2 bn reflected valuation changes. When flows between Finnish funds are not taken into account, the annual investment flows for 2017 were the largest seen in the history of investment fund statistics.

Finnish investors accounted for EUR 3.3 bn, and foreign investors for EUR 4.3 bn of net investments in Finnish investment funds. Especially in the early part of the year, foreign investments in Finnish funds were boosted by inward flows from Sweden.

Finnish investments in foreign funds also increased strongly in 2017, amounting to EUR 8.2 bn. The most prominent investor groups were employment pension schemes (EUR 4.7 bn), investment funds that rechannelled invested assets into foreign investment funds (EUR 2.7 bn) and insurance corporations (EUR 0.8 bn).

Finnish investors' holdings in foreign funds larger than in domestic funds

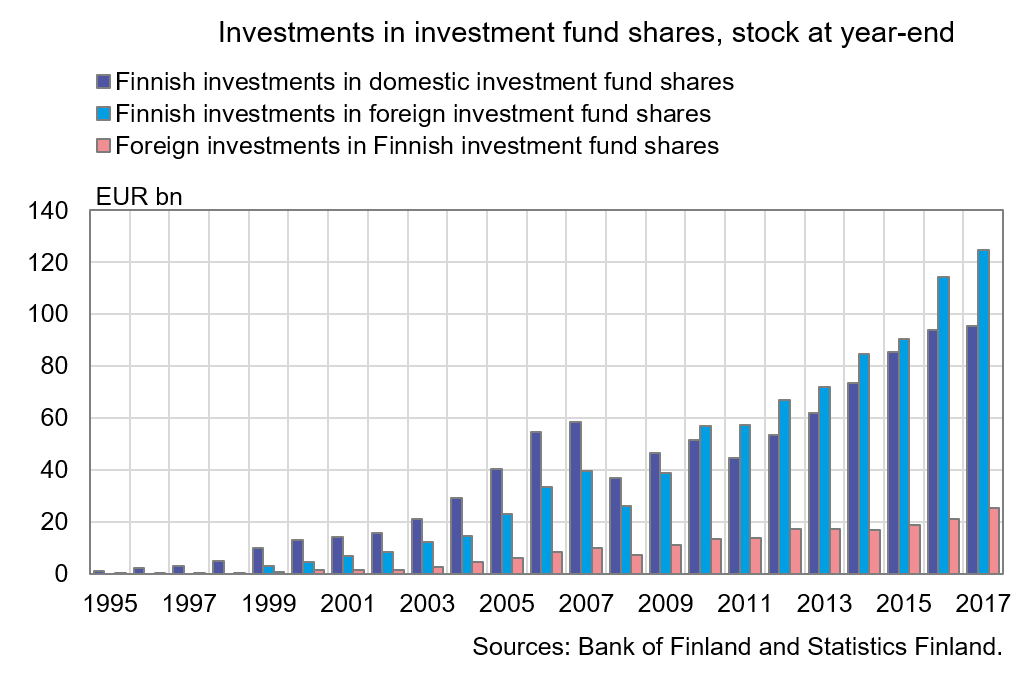

At the end of 2017, Finnish holdings of domestic investment fund shares totalled EUR 96 bn (excluding inter-fund investments, EUR 78 bn). Finnish holdings of foreign investment fund shares totalled EUR 125 bn (excluding inter-fund investments, EUR 110 bn).

Finnish investments in both domestic and foreign funds have increased strongly in recent years. In the 2010s alone, the stock of Finnish investments in domestic funds has about doubled and investments in foreign funds have about tripled.1

With respect to domestic funds, households are in practice the most notable investor group. At the end of 2017, households' direct holdings of Finnish investment fund assets totalled EUR 30 bn (Finnish households: EUR 22 bn). An even larger portion of household assets are channelled into investment funds via insurance corporations' unit-linked insurance products. According to the Bank of Finland estimate, these investments amounted to at least EUR 30 bn at the end of 2017.

The largest investments from Finland in foreign investment funds were by institutional investors. By far the largest foreign holdings at the end of 2017 were those of employment pension schemes (EUR 89 bn), followed by investment funds (EUR 15 bn) and insurance corporations (EUR 11 bn).

Fund investments strongly channelled into Nordic non-financial corporations

Of net investments made in Finnish investment funds in 2017, EUR 4.8 bn was channelled into Nordic investment vehicles; 75% of this was invested in Finland.

New inflows to bond funds totalled EUR 2.4 bn in net terms. These were mainly directed at bonds issued by non-financial corporations and banks, of which most were Nordic. Only EUR 0.1 bn in net terms was channelled into government bonds.

Equity funds registered a net inflow of about EUR 3 bn in new investments. Besides investments in Finland, investment funds particularly increased their equity holdings in non-financial corporations in the United Kingdom, Sweden, Japan and the euro area. Investments in US and Russian equities, meanwhile, were reduced.

1 Sources: the Bank of Finland's investment fund statistics and securities holding statistics and Statistics Finland's annual financial accounts for 1995–2016.

Key statistical data on investment funds registered in Finland, preliminary data

- Breakdown of investment funds’ fund-share liability by sector of holder

- Securities-based assets of investment funds by area

- Securities-based assets of investment funds by instrument, area and sector

For further information, please contact:

Topias Leino, tel. +358 9 183 2315, email: topias.leino(at)bof.fi,

Anne Turkkila, tel. +358 9 183 2175, email: anne.turkkila(at)bof.fi

The next investment fund news release will be published at 1 pm on 5 May 2018