Loans

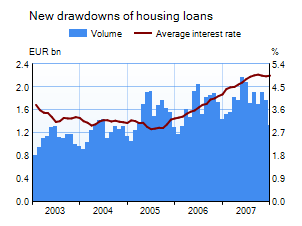

New drawdowns of housing loans by households in December amounted to only EUR 1.3 billion, down EUR 0.4 billion from November and down EUR 0.1 billion from a year earlier. December and January have traditionally been the months in which new housing loans are taken out less than in other months. The average interest rate on new drawdowns of housing loans in December was 4.94%. The average interest rate rose slightly from November, caused by the general increase in market interest rates as a result of the international financial market volatility. The most commonly used reference rate for new housing loan agreements in December was the prime rate, to which 51% of all new business on housing loans was linked. Consequently, in December, prime rates gained popularity, crowding out Euribor rates, the most widely applied reference rates for housing loans in the last few years.

The stock of housing loans extended to households by MFIs amounted to EUR 62.2 billion at the end of December, with an average interest rate of 4.99%. The housing loan stock continued to expand, even if the annual rate of growth continued to fall slightly. In December, the annual rate of growth in the stock of housing loans stood at 12.4%.

The stock of loans to non-financial corporations amounted to EUR 48.4 billion, with an average interest rate of 5.19%. The annual rate of growth in the loan stock fell to 12.9% in December, from the peak of 14.1% in November.

Deposits

The stock of household deposits was EUR 65.3 billion in December, up year-on-year by more than 12.

The stock of household deposits was still boosted by deposits with an agreed maturity of up to two years, which continued to grow rapidly for the fifth consecutive month. The increase in December was as much as EUR 1.2 billion, almost EUR 0.5 billion more than in November. At the end of December, the stock of deposits with an agreed maturity of up to two years amounted to EUR 19.8 billion. The average interest rate on these deposits was 4.29%, 0.11 percentage points higher than in November.

Notes:

MFIs comprise all monetary financial institutions operating in Finland.

Loans and deposits comprise all euro-denominated loans and deposits vis-à-vis the euro area as a whole, with countries other than Finland accounting for a very small share of total volumes.

More information:

Elisabeth Hintikka tel. +358 10 831 2322

email firstname.surname@bof.fi