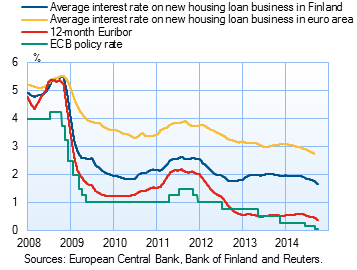

Housing loans are usually tied to Euribor rates in Finland. In September 2014, about 93% of new housing loan agreements were tied to Euribors. The most widely used reference rate is the 12-month Euribor. Due to the popularity and low level of Euribor rates, interest rates on housing loans are lower in Finland than in the euro area on average. In September, the average interest rate on new housing loan agreements was 1.66% in Finland, compared to 2.7% in the euro area. In a number of countries – e.g. Germany and France – the majority of housing loans are tied to fixed rates. Fixed-rate loans are typically more expensive than loans with variable rates. Following the decline in market rates, the average interest rates on new housing loan agreements fell slightly during summer 2014. The imputed housing loan margin has remained around 1.5% in recent months, and in September it was 1.49%. |

|

In September 2014, households’ new drawdowns of housing loans amounted to EUR 1.3 bn. The average interest rate on new housing-loan drawdowns was 1.77%, down by 0.10 percentage point on August. The stock of euro-denominated housing loans totalled EUR 89.4 bn at the end of September, and the annual growth rate of the stock was 1.7%. At the end of September, household credit comprised EUR 13.5 bn in consumer credit and EUR 15.5 bn in other loans. New drawndowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted in September to EUR 2.4 bn, which is EUR 0.4 bn more than in September 2013. The average interest rate on new corporate-loan drawdowns fell from August, to 2.07% in September. At the end of September, the stock of euro-denominated loans to non-financial corporations was EUR 67.4 bn, of which loans to housing corporations accounted for EUR 20.6 bn. | ||||||||||||||||||||||||||||||||||||||||||

Deposits At the end of September, the stock of household deposits totalled EUR 80.9 bn. The average interest rate on the stock was 0.40%. Overnight deposits accounted for EUR 53.4 bn and deposits with agreed maturity EUR 13.9 bn of the total deposit stock. In September, households concluded EUR 0.8 bn of new agreements on deposits with agreed maturity. The average interest rate on these was 1.10%. Notes: | ||||||||||||||||||||||||||||||||||||||||||

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes. | ||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||

For further information, please contact: The next news release will be published on 28 November 2014 at 1.00 pm. |