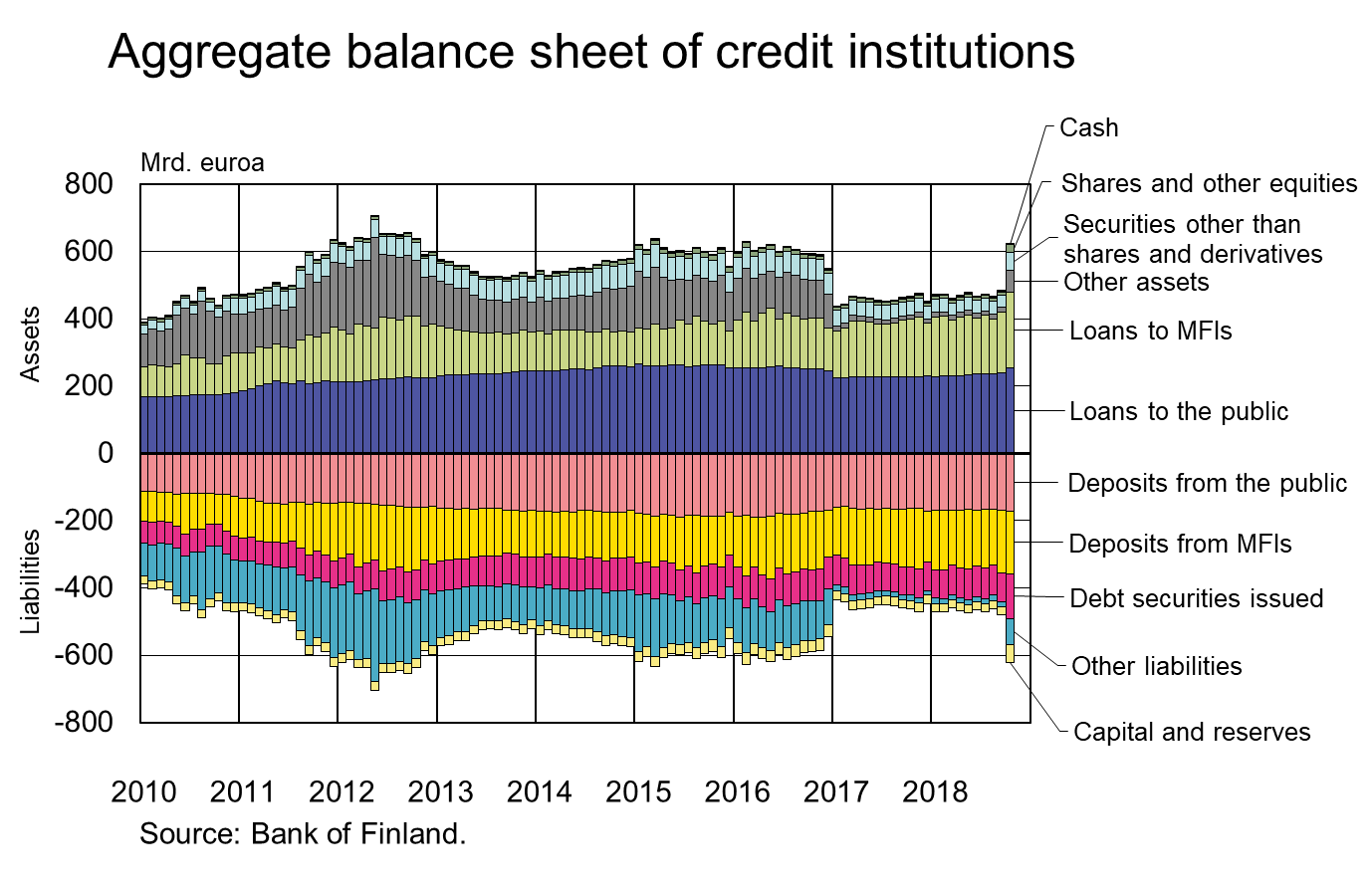

At the end of October 2018, the aggregate balance sheet of credit institution operating in Finland totalled EUR 622 bn, which is EUR 140 bn more than in September 2018. The growth reflects the transfer of Nordea’s headquarters from Sweden to Finland on 1 October. In this context, Nordea Bank AB (publ), Finnish Branch, was closed down and its assets and liabilities were transferred to the balance sheet of Nordea Bank Abp, established for the purposes of Nordea’s redomiciliation. At the same time, Nordea Group’s Markets activities were transferred back to Finland. The Markets activities were transferred from Finland to Sweden in January 2017, and as a result, the aggregate balance sheet had contracted significantly. The Markets activities include trading in derivatives, securities and repos.

The increase in the aggregate balance sheet of credit institutions in October stemmed mainly from the transfer of Nordea’s Markets activities to Finland but was partly also due to transfers in other balance sheet items in connection with Nordea’s redomiciliation. On the liabilities side of the aggregate balance sheet, the volume of debt securities issued grew by EUR 46 bn and capital by EUR 28 bn. On the assets side, inter-MFI loans increased by EUR 44 bn and credit institutions’ securities holdings by EUR 28 bn. Derivatives, which are recorded in the statistics under other liabilities and assets, grew by EUR 42 bn in October 2018.

Loans

Households’ new drawdowns of housing loans in October 2018 amounted to EUR 1.7 bn, which is EUR 100 million more than a year earlier. The average interest rate on new housing-loan drawdowns was 0.87% and the imputed margin was 0.85%. At the end of October, the stock of euro-denominated housing loans totalled EUR 97.6 bn and the annual growth rate of the stock was 1.8%. The housing loan stock has last grown at a slower pace in April 2015. Household credit at end-October comprised EUR 15.9 bn in consumer credit and EUR 17.2 bn in other loans.

New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted to EUR 2.6 bn in October. The average interest rate on new corporate-loan drawdowns declined from September, to 1.95%. At the end of October, the stock of euro-denominated loans to non-financial corporations was EUR 84.7 bn, of which loans to housing corporations accounted for EUR 31.2 bn.

Deposits

The stock of household deposits at end-October totalled EUR 86.9 bn and the average interest rate on the deposits was 0.12%. Overnight deposits accounted for EUR 73.7 bn and deposits with agreed maturity for EUR 5.5 bn of the deposit stock. In October, households concluded EUR 0.3 bn of new agreements on deposits with agreed maturity, at an average interest rate of 0.28%.

| Key figures of Finnish MFIs' loans and deposits, preliminary data | |||||

| August, EUR million | September, EUR million | October, EUR million | October, 12-month change¹, % | Average interest rate, % | |

| Loans to households2, stock | 130,014 | 130,502 | 130,645 | 2,3 | 1,48 |

| - of which housing loans | 97,187 | 97,444 | 97,575 | 1,8 | 0,98 |

| Loans to non-financial corporations2, stock | 83,316 | 84,015 | 84,669 | 6,8 | 1,37 |

| Deposits by households2, stock | 90,765 | 91,547 | 90,875 | 5,1 | 0,12 |

| Households' new drawdowns of housing loans | 1,546 | 1,497 | 1,749 | 0,87 | |

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Households also include non-profit institutions serving households; non-financial corporations also include housing corporations

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Imputed interest rate margins on loans from MFIs

For further information, please contact:

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi

Meri Sintonen, tel. +358 9 183 2247, email: meri.sintonen(at)bof.fi.

The next news release will be published at 1 pm on 4 January 2019.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.