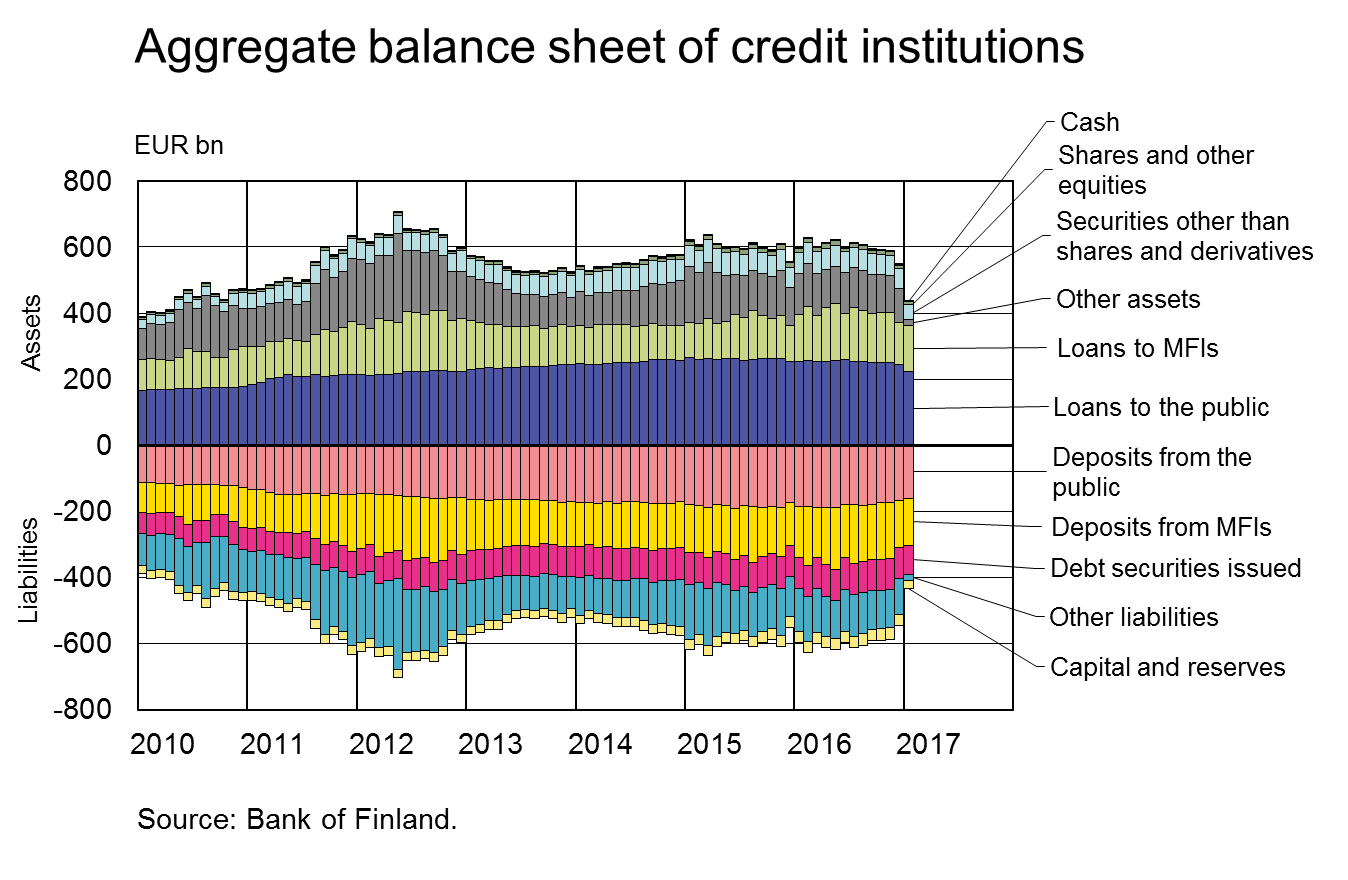

The aggregate balance sheet of credit institutions operating in Finland totalled EUR 435 bn in January 2017. This is EUR 111 bn less than in December 2016 and EUR 152 bn less than in November 2016. The reduction of the balance sheet reflects a change in Nordea Group's legal structure in January 2017, when also the Finnish subsidiary, Nordea Bank Finland Plc, merged with the Swedish parent company, Nordea Bank AB (publ). At the same time, Nordea Group's Markets activities concentrated in Finland were moved to the Swedish parent company. The Markets activities include derivatives, securities and repo trading. All balance sheet items other than Markets activities of the merged Nordea Bank Finland Plc were transferred to the balance sheet of Nordea Bank AB (publ), Finnish Branch.

The contraction of credit institutions' aggregate balance sheet was due mainly to the transfer of Nordea's Markets activities to Sweden. In particular, derivatives included in other assets and liabilities decreased. The derivatives assets and liabilities of credit institutions declined in January 2017 by a total of about EUR 70 bn from December 2016.

Loans

Households drew down EUR 1.2 bn worth of new housing loans in January 2017. The average interest rate on new housing-loan drawdowns was 1.15% and the imputed margin 1.11%. The stock of euro-denominated housing loans totalled EUR 94 bn at the end of January 2017, and the annual growth rate of the stock was 2.2%. At the end of January, household credit comprised EUR 14.6 bn in consumer credit and EUR 16.4 bn in other loans.

New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted to EUR 2 bn in January. The average interest rate on new corporate-loan drawdowns rose from December, to 2.14%. At the end of January, the stock of euro-denominated loans to non-financial corporations was EUR 76.1 bn, of which loans to housing corporations accounted for EUR 26 bn.

Deposits

At the end of January, the stock of household deposits totalled EUR 84.5 bn, and the average interest rate on the deposits was 0.18%. Overnight deposits accounted for EUR 61.7 bn and deposits with agreed maturity for EUR 8.2 bn of the total deposit stock. In January, households concluded EUR 0.6 bn of new agreements on deposits with agreed maturity, at an average interest rate of 0.47%.

Key figures of Finnish MFIs' loans and deposits, preliminary data

| November, EUR million | December, EUR million | January, EUR million | January, 12-month change1, % | Average interest rate, % | |

| Loans to households2, stock | 124,763 | 124,931 | 124,963 | 2,5 | 1,55 |

| - of which housing loans | 93,914 | 94,056 | 93,998 | 2,2 | 1,07 |

| Loans to non-financial corporations2, stock | 75,767 | 76,026 | 76,114 | 5,0 | 1,45 |

| Deposits by households2, stock | 85,332 | 85,092 | 84,477 | 2,7 | 0,18 |

| Households' new drawdowns of housing loans | 1,539 | 1,364 | 1,212 | 1,15 |

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Households also include non-profit institutions serving households; non-financial corporations also include housing corporations.

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

For further information, please contact:

Markus Aaltonen, tel. +358 10 831 2395, e-mail: markus.aaltonen@bof.fi.

Olli Tuomikoski, tel. +358 10 831 2146, e-mail: olli.tuomikoski@bof.fi.

The next news release will be published at 1 pm on 31 March 2017.