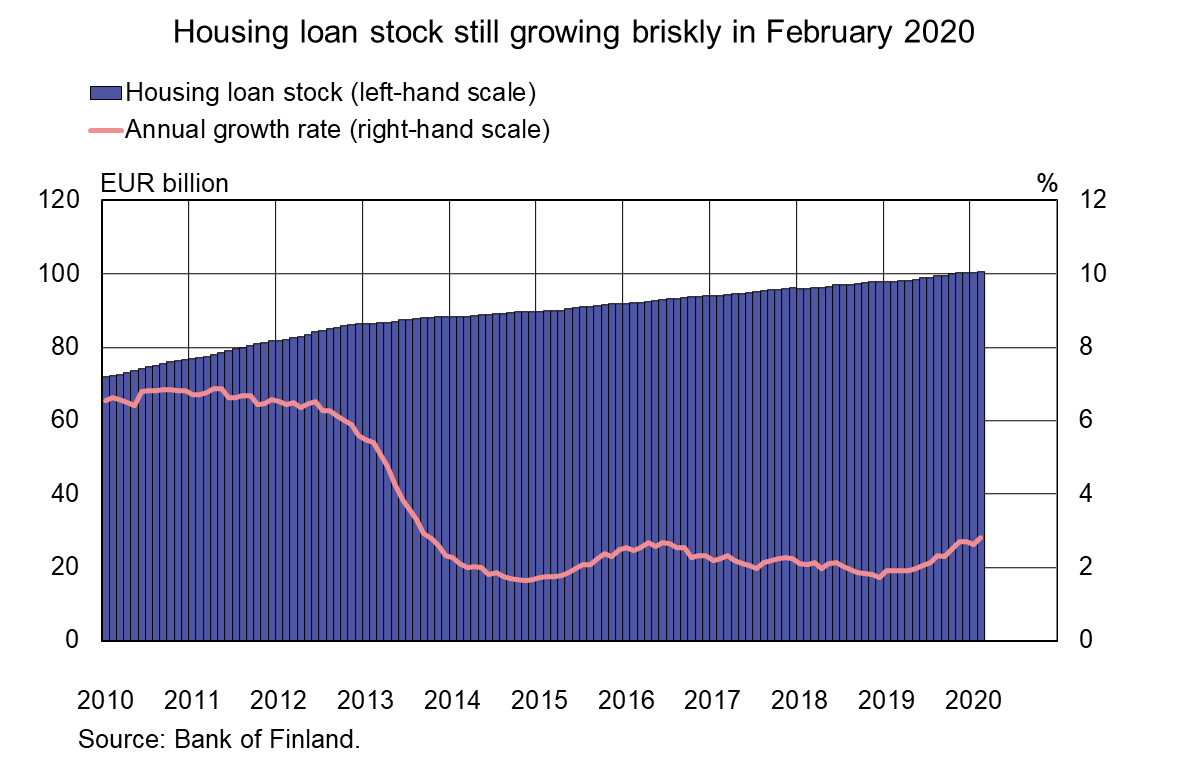

At the end of February 2020, the stock of euro-denominated housing loans granted by credit institutions totalled EUR 100.5 bn (of which loans to Finnish households EUR 99.8 bn). The average interest rate on the stock was 0.89%. The annual growth rate of the housing loan stock has long been around 2%. During the past 12 months it has picked up, and at the end of February 202o it was 2.8%. The loan stock has last grown faster than this in September 2013.

Households’ drawdowns of new housing loans in February 2020 amounted to EUR 1.6 bn. February is usually a quiet month for new housing-loan drawdowns. This year, however, it was exceptionally lively compared with the same month in the previous years. The average interest rate on new housing-loan drawdowns declined from January, to 0.71%.

The average repayment period of housing loans lengthened slightly in February 2020, reaching 20 years and 8 months. At present, the most typical repayment period for new housing loans in Finland is 24–26 years. These loans account for almost half of all new housing loans. Housing loans with the longest repayment periods – loans exceeding 29 years – are granted less frequently. In February 2020, their share was 7.0%.

On 12 March 2020, the Government announced its recommendations related to the coronavirus pandemic. This was also reflected in consumer behaviour in Finland. Statistics Finland collects data on consumer confidence. According to Statistics Finland, consumer confidence was still unchanged in February 2020, but weakened in March[1]. The balance figure was -4.5 in February, but fell to -7.1 in March. The changes may be reflected in borrowing decisions in the coming months.

Loans

At the end of February 2020, household credit comprised EUR 16.7 bn in consumer credit and EUR 17.7 bn in other loans. Drawdowns of new loans by non-financial corporations (excl. overdrafts and credit card credit) amounted in February to EUR 1.6 bn. The average interest rate on new corporate-loan drawdowns rose from January, to 2.3%. At the end of February, the stock of euro-denominated loans to non-financial corporations totalled EUR 92.4 bn, of which loans to housing corporations accounted for EUR 35.5 bn.

Deposits

At the end of February 2020, the stock of deposits of Finnish households totalled EUR 96.1 bn and the average interest rate on the deposits was 0.10%. Overnight deposits accounted for EUR 83.3 bn and deposits with an agreed maturity for EUR 4.6 bn of the deposit stock. In February, households concluded EUR 0.2 bn of new agreements on deposits with an agreed maturity, at an average interest rate of 0.19%.

Key figures of Finnish MFIs' loans and deposits, preliminary data |

|||||

| December, EUR million | January, EUR million | February, EUR million | February, 12-month change1, % | Average interest rate, % | |

| Loans to households2, stock | 134,414 | 134,706 | 135,011 | 3,2 | 1,43 |

| - of which housing loans | 100,354 | 100,269 | 100,541 | 2,8 | 0,89 |

| Loans to non-financial corporations2, stock | 90,977 | 91,960 | 92,392 | 8,2 | 1,32 |

| Deposits by households2, stock | 98,920 | 99,040 | 99,973 | 6,9 | 0,09 |

| Households' new drawdowns of housing loans | 1,450 | 1,361 | 1,563 | 0,71 | |

* Includes euro-denominated loans and deposits to euro area.

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Households also include non-profit institutions serving households; non-financial corporations also include housing corporations

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Imputed interest rate margins on loans from MFIs

For further information, please contact:

Ville Tolkki, tel. +358 9 183 2420, email: ville.tolkki(at)bof.fi,

Anu Karhu, tel. +358 10 831 2228, email: anu.karhu(at)bof.fi.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.

[1] Statistics Finland’s data collection for March covered the period 2 March 2020–19 March 2020.