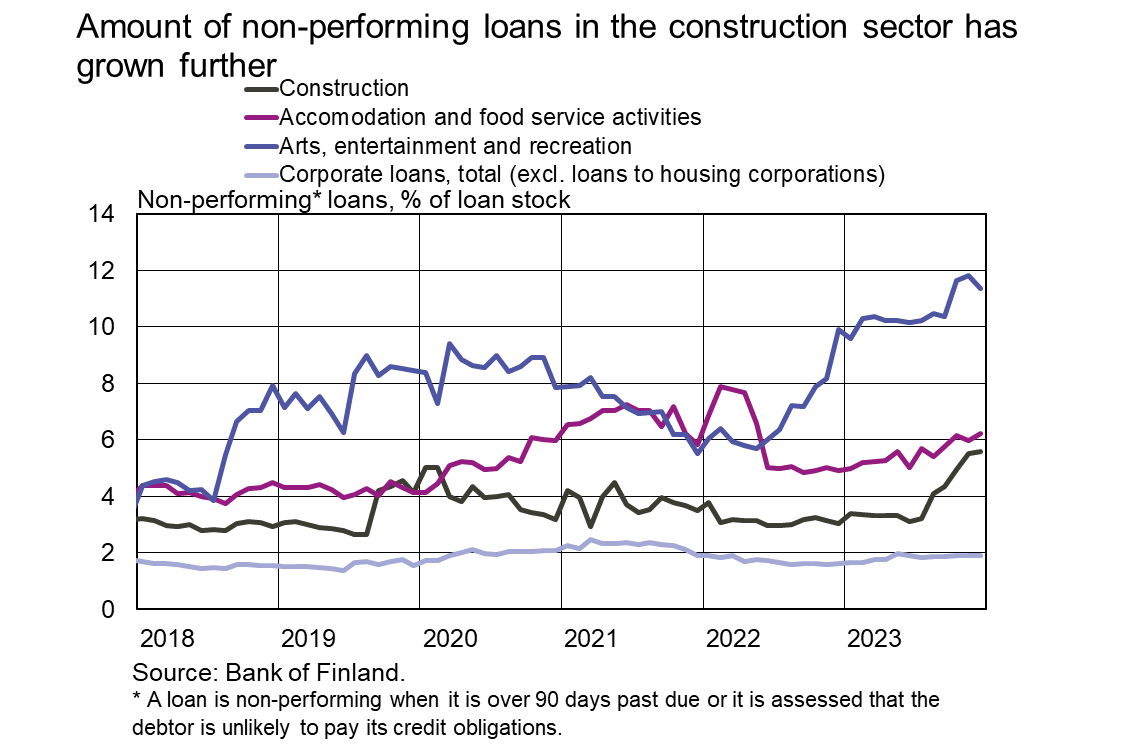

At the end of December 2023, a total of 5.6% (EUR 160 million) of the stock of loans granted by banks to Finnish companies in the construction sector were non-performing loans (NPLs)[1]. This is the highest[2] figure ever recorded. Construction sector NPLs started to increase in August 2023, and the trend continued in the autumn and early winter. Since July 2023, the share of NPLs in the stock of loans to construction sector companies (NPL ratio) has increased by 2.4 percentage points (EUR 62 million). In net terms[3], banks recognised impairments and credit losses on loans to construction sector companies to a total of EUR 100 million in 2023. This corresponds to 3,5% of the sector’s loan stock at the end of December 2023(EUR 2.9 billion).

In December 2023, only two sectors had higher NPL ratios than construction, namely arts, entertainment and recreation (11.3%) and accommodation and food service activities (6.2%). These sectors are markedly smaller in terms of loan stocks than the construction sector. At the end of December, the stocks of loans to these sectors totalled EUR 471 million and EUR 775 million, respectively. Net impairments and credit losses recognised in 2023 on loans to the arts, entertainment and recreation sector were 1.2% relative to the sector’s loan stock. For accommodation and food service activities, the percentage was 0.9%.

NPL ratios for loans to the entire non-financial corporations sector have remained low. At the end of December 2023, NPLs accounted for EUR 1.2 billion, or 1.9%, of the stock of bank loans to non-financial corporations[4] (EUR 62.0 billion). The low level of corporate sector NPLs is explained by the fact that NPL ratios have remained below 2% for sectors that are large in terms of loan stocks[5]. In 2023, net impairments recognised on the entire corporate loan stock totalled of EUR 312 million, which is 0.5% of the loan stock.

Loans

Finnish households drew down new housing loans in December 2023 to a total of EUR 1.3 billion, which is EUR 270 million more than in December a year earlier. Of the newly drawn loans, investment property loans accounted for EUR 85 million. The average interest rate on new housing loans declined from November and stood at 4.42%. At the end of December 2023, the stock of housing loans amounted to EUR 106.7 billion, and its annual growth rate was -1.6%. Investment property loans accounted for EUR 8.6 billion of the loan stock. At the end of December, the stock of loans to Finnish households included EUR 17.3 billion in consumer credit and EUR 17.5 billion in other loans.

Drawdowns of new loans by Finnish non-financial corporations in December 2023 totalled EUR 2.7 billion, of which EUR 540 million was taken out by housing corporations. The average interest rate on new drawdowns declined from November, to 5.36%. At the end of December, the stock of loans to Finnish housing corporations stood at EUR 43.8 billion.

Deposits

The stock of Finnish households’ deposits stood at EUR 108.7 billion at the end of December 2023, and the average interest rate on the deposits was 1.18%. Overnight deposits accounted for EUR 70.6 billion and deposits with agreed maturity for EUR 10.9 billion of the deposit stock. In December, Finnish households concluded EUR 1.3 billion of new agreements on deposits with agreed maturity, at an average interest rate of 3.42%.

| Loans and deposits to Finland, preliminary data* | |||||

| October, EUR million | November, EUR million | December, EUR million | December, 12-month change1, % | Average interest rate, % | |

| Loans to households, stock | 141,257 | 141,151 | 141,418 | -1.3 | 4.63 |

| - of which housing loans | 106,535 | 106,524 | 106,698 | -1.6 | 4.08 |

| - of which buy-to-let mortgages | 8,641 | 8,638 | 8,621 | 4.28 | |

| Loans to non-financial corporations2, stock | 105,873 | 106,306 | 105,794 | 1.2 | 4.77 |

| Deposits by households, stock | 108,351 | 107,987 | 108,673 | -2.8 | 1.18 |

| Households' new drawdowns of housing loans | 1,128 | 1,237 | 1,337 | 4.42 | |

| - of which buy-to-let mortgages | 100 | 95 | 85 | 4.62 | |

* Includes loans and deposits in all currencies to residents in Finland. The statistical releases of the Bank of Finland up to January 2021, as well as those of the ECB, present loans and deposits in euro to euro area residents and also include non-profit institutions serving households. For these reasons, the figures in this table differ from those in the aforementioned releases.

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Non-financial corporations also include housing corporations.

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Imputed interest rate margins on loans from MFIs

For further information, please contact:

Antti Hirvonen, tel. +358 9 183 2121, email: antti.hirvonen(at)bof.fi

Usva Topo, tel. +358 9 183 2056, email: usva.topo(at)bof.fi

The next news release on money and banking statistics will be published at 10:00 on 28 February 2024.

Related statistical data and graphs are also available on the Bank of Finland website at https://www.suomenpankki.fi/en/statistics2/.

[1] A loan is non-performing when it is more than 90 days past-due or it is assessed that the debtor is unlikely to pay its credit obligations.

[2] Data have been collected since June 2010.

[3] Includes also reversals of loan impairments, which reduce the amount of recognised impairments and loan losses. Impairments are recognised on loans based on expected credit loss models. Expected credit loss is the bank’s assessment of the amount of credit that will not be repaid by the customer. Recognised impairments and loan losses reduce the amount of non-performing loans in the loan stock.

[4] Excl. housing corporations.

[5] The sectors ‘real estate activities’, ‘electricity, gas, steam and air conditioning supply’ and ‘wholesale and retail trade; repair of motor vehicles and motorcycles’.