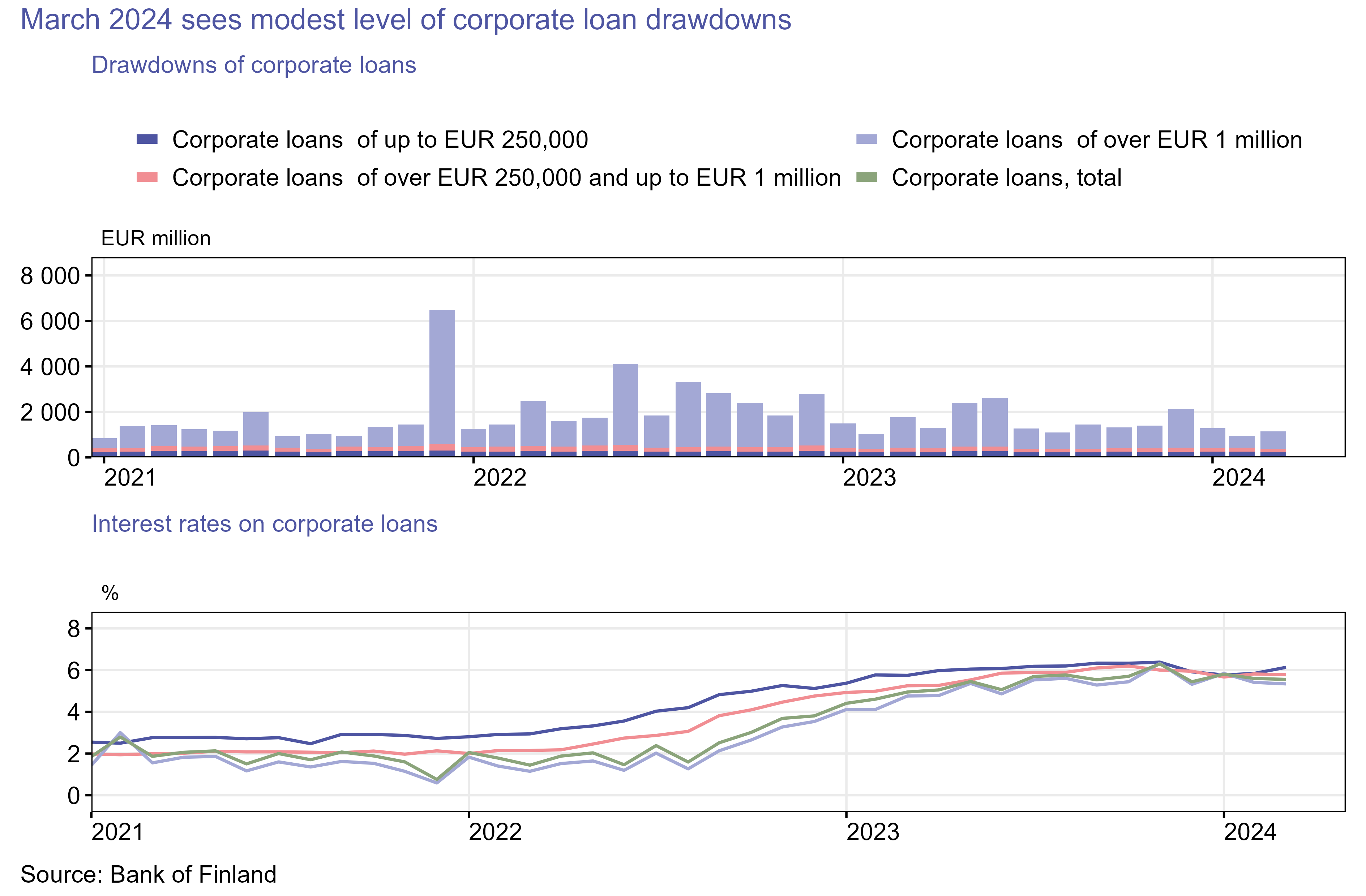

In March 2024, non-financial corporations (excl. housing corporations) drew down new loans[1] from banks operating in Finland to a total of EUR 1.1 billion – the smallest amount in March since 2011. The average interest rate on new corporate loans fell slightly from February 20204, to 5.55% in March. Nearly half of the new corporate loans were taken out by companies in the sectors with the largest amounts of outstanding loans, namely real estate and manufacturing companies. Real estate companies took out 24% of the loans, at an average interest rate of 5.01%. Manufacturing companies took out 21%, at an average interest rate of 5.86%.

The average interest rates on new loans to non-financial corporations rose in March 2024 only in the category of small loans of up to EUR 250,000. In this loan category, the average interest rose by 0.29 percentage points from February, to 6.13%. The average interest on medium-sized loans (over EUR 250,000 and up to EUR 1 million) was 5.78%, remaining almost unchanged on February. The average interest on new large corporate loans of over EUR 1 million (5.34%) also fell slightly from February. The majority (67%) of the new corporate loans drawn down in March were loans of over EUR 1 million.

Of the new corporate loans taken out in March, 40% were with a maturity of over 5 years, and the average interest rate on these loans was 5.22%. A total of 35% were with a maturity of over 1 and up to 5 years, an the average interest in this category was 5.55%. The average interest on loans with a maturity of up to 1 year was 6.20%, and these loans accounted for 25% of the new corporate loan drawdowns.

Loans

Finnish households drew down new housing loans in March 2024 to a total of EUR 1.0 billion, a decline of EUR 220 million from March a year earlier. Of the newly drawn housing loans, buy-to-let mortgages accounted for EUR 100 million. The average interest rate on new housing loans rose from February, to 4.38%. At the end of March 2024, the stock of housing loans stood at EUR 106.2 billion, and the annual growth rate of the loan stock was -1.2%. Buy-to-let mortgages accounted for EUR 8.7 billion of the housing loan stock. Of the aggregate stock of Finnish households’ loans at the end of March, consumer credit amounted to EUR 17.8 billion and other loans, EUR 17.6 billion.

Drawdowns of new loans[2] by Finnish non-financial corporations in March 2024 totalled EUR 1.6 billion, including EUR 410 million of loans to housing corporations. The average interest rate on new corporate loan drawdowns declined from February, to 5.35%. At the end of March, the stock of loans to Finnish non-financial corporations stood at EUR 107.6 billion, of which loans to housing corporations accounted for EUR 44.1 billion.

Deposits

At the end of March 2024, Finnish households’ aggregate deposit stock totalled 109.0 billion, and the average interest rate on the deposits was 1.31%. Overnight deposits accounted for EUR 68.0 billion and deposits with agreed maturity for EUR 12.7 billion of the deposit stock. In March, Finnish households made new agreements on deposits with agreed maturity in the amount of EUR 1,170 million, at an average interest rate of 3.54%.

| Loans and deposits to Finland, preliminary data | |||||

| January, EUR million | February, EUR million | March, EUR million | March, 12-month change1, % | Average interest rate, % | |

| Loans to households, stock | 141,807 | 141,631 | 141,627 | -0.8 | 4.64 |

| - of which housing loans | 106,351 | 106,204 | 106,172 | -1.2 | 4.08 |

| - of which buy-to-let mortgages | 8,627 | 8,636 | 8,651 | 4.29 | |

| Loans to non-financial corporations2, stock | 107,126 | 107,251 | 107,557 | 2.0 | 4.77 |

| Deposits by households, stock | 108,211 | 107,999 | 109,045 | -0.8 | 1.31 |

| Households' new drawdowns of housing loans | 810 | 922 | 998 | 4.38 | |

| - of which buy-to-let mortgages | 89 | 95 | 97 | 4.57 | |

* Includes loans and deposits in all currencies to residents in Finland. The statistical releases of the Bank of Finland up to January 2021, as well as those of the ECB, present loans and deposits in euro to euro area residents and also include non-profit institutions serving households. For these reasons, the figures in this table differ from those in the aforementioned releases.

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Non-financial corporations also include housing corporations.

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Imputed interest rate margins on loans from MFIs

For further information, please contact:

Tuomas Nummelin, tel. +358 9 183 2373, email: tuomas.nummelin(at)bof.fi

Usva Topo, tel. +358 9 183 2056, email: usva.topo(at)bof.fi

The next news release on money and banking statistics will be published at 10:00 on 30 May 2024.

Related statistical data and graphs are also available on the Bank of Finland website at https://www.suomenpankki.fi/en/statistics2/.

[1] Excl. overdrafts and credit card credit.

[2] Excl. overdrafts and credit card credit.