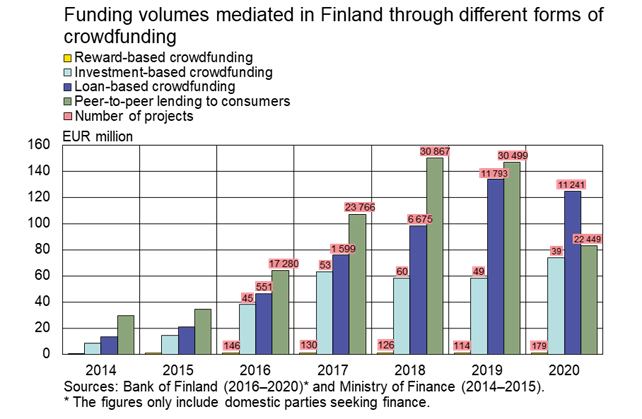

The volume of funding mediated in Finland through crowdfunding and peer-to-peer lending markets declined in 2020. Funding mediated to Finnish applicants decreased 17% from the previous year due to a reduction in P2P lending and loan-based crowdfunding. In 2020, the total volume of funding mediated through P2P lending and crowdfunding markets amounted to EUR 282 million.

Coronavirus pandemic reduced P2P lending in Finland

The Finnish peer-to-peer lending market contracted in 2020. The coronavirus pandemic and the consequent lower interest rate cap tightened the operating conditions for the P2P lending market. The number of active P2P loan companies in Finland decreased as companies reformed their

business[1] or discontinued it altogether. The volume and number of P2P loans mediated to consumer through service platforms in 2020 decreased significantly from the previous years.

In 2020, the volume of P2P loans mediated amounted to EUR 86 million, which is 46% less than in 2019. P2P loans to Finnish consumers accounted for EUR 83 million and those to foreign consumers for EUR 3 million. P2P loans mediated to foreign consumers decreased significantly from EUR 14 million in 2019.

In 2020, the number of P2P loans mediated was 18% lower than in 2019. Approximately 22,000 P2P loans were mediated to Finnish consumers in 2020. Finnish P2P loan platforms were used to mediate some 2,300 P2P loans to foreign consumers, which was almost 5,000 fewer than in 2019.

Record volume of investment-based crowdfunding mediated

In 2020, the volume of crowdfunding mediated on Finnish service platforms was 4.6% higher than in 2019. Finnish companies raised funding worth EUR 199 million through crowdfunding platforms[2] in 2020. 62% of the crowdfunding raised by companies was loan-based and 37% investment-based. The share of reward-based crowdfunding was minor.

Although crowdfunding received by companies has increased in recent years, it’s role in funding raised by Finnish companies remains small. In 2020, the volume of crowdfunding received by Finnish companies was only 1% of corporate loans drawn down from credit institutions.

Crowdfunding mediated to Finnish companies grew particularly on the back of investment-based funding[3]. In 2020, Finnish companies raised a total of EUR 74 million of investment based crowdfunding, 27% more than in 2019.[4] Investment-based crowdfunding raised by Finnish companies reached a record level in 2020.

The number of investment-based crowdfunding rounds carried out on crowdfunding platforms decreased in 2020. The number of successful investment-based crowdfunding rounds was 39, which is 10 fewer than in 2019. The average amount raised increased. On average, companies raised EUR 1.9 million through investment-based crowdfunding in 2020, which is EUR 700,000 more than in 2019.

Loan-based crowdfunding mediated to Finnish companies decreased by 7% in 2020 but retained its position as the main source of crowdfunding for companies. Loan-based crowdfunding to companies totalled EUR 124 million in 2020, which is EUR 9 million less than in 2019.

In 2020, Finnish companies carried out fewer loan-based crowdfunding rounds than in 2019. In 2020, the number of successful funding rounds was 11,200, which is 5% fewer than in 2019. The average loan received through a funding round totalled approximately EUR 11,000. The average value of a loan mediated through Finnish crowdfunding platforms has declined ever since 2017.

The volume of reward-based crowdfunding increased[5] somewhat in 2020 but remained low. In 2020, the volume of reward-based crowdfunding mediated in Finland amounted to EUR 1 million, which is 30% more than in 2019. The number of successful funding rounds through reward-based crowdfunding platforms was almost 180 in 2020. The average amount of funding received through these funding rounds decreased to just over EUR 5,700, which is 17% less than the average value of reward-based crowdfunding received last year.

Funding volumes mediated in Finland through different forms of crowdfunding*

|

|

2018, EUR million

|

2019, EUR million(12-month change) |

2020, EUR million(12-month change) |

|

Loan-based crowdfunding |

98.3 (29%) |

133.6 (36%) |

124.4 (-7%) |

|

Investment-based crowdfunding |

58.0 (-8%) |

58.3 (1%) |

73.7 (27%) |

|

Reward-based crowdfunding |

0.7 (-27%) |

0.8 (8%) |

1.0 (30%) |

|

Peer-to-peer lending to consumers |

150.1 (40%) |

146.7 (-2%) |

82.8 (-44%) |

|

Total |

307.2 (24%) |

339.4 (11%) |

282.0 (-17%) |

* The figures include domestic parties seeking funding.

For further information, please contact:

Antti Alakiuttu, tel. +358 9 183 2495, email: antti.alakiuttu(at)bof.fi,

Miska Jokinen, tel. +358 9 183 2122, email: miska.jokinen(at)bof.fi,

Maija Keskinen, tel. +358 9 183 2004, email: maija.keskinen(at)bof.fi.

[1] For example, companies started granting loans and credit from their own balance sheet. Lending by such companies is covered by the new Bank of Finland data collection and statistics on other financial institutions (OFI).

[2] Investment-, loan- and reward-based crowdfunding

[3] Direct equity investment in a non-listed company through a crowdfunding platform

[4], [5] In investment- and reward-based crowdfunding, the impact of individual large funding rounds is more significant than in debt-based crowdfunding due to the lower number of funding rounds.